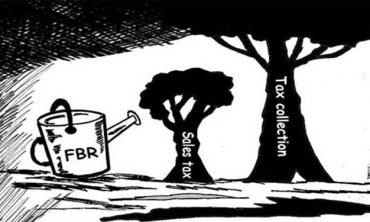

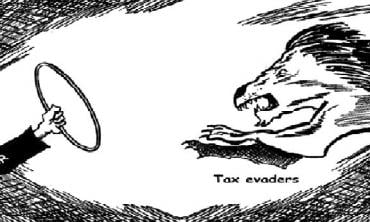

Achieving fiscal targets seems impossible unless massive sales tax evasion is stopped

Political will to enforce tax obligations and simple tax regime are imperative to get out of debt trap

Despite the fact that nearly one third of population in Pakistan lives below the poverty line and millions of mothers and children remain...

Pakistan’s obligations on external and domestic debt will increase as the government has failed to broaden the tax base and reduce expenditure

The ever-growing informal economy and unlawful money outflows are undermining economic growth

Government is relying on mini budgets as outflow of investments from Pakistan continues due to lack of security and political uncertainty

Bazar’s shutter-down threats always force tax administrators to succumb to traders’ demands on the behest of political masters

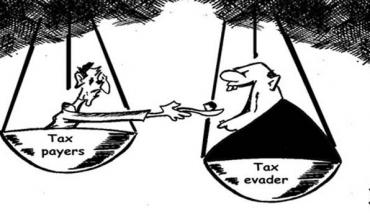

Many traders do not file their tax returns, but get religious justification for financing madrassas and militants

Levy of extra 5 per cent sales tax on petroleum products is an adverse and unwelcome act bound to burden the poor

December 27, 2014 will mark the seventh death anniversary of Benazir Bhutto. Since her assailants and conspirators behind the scheme remained...

Reduction in fiscal deficit is impossible unless the government abolishes innumerable tax exemptions and concessions available to the rich and mighty

There is a consensus that our legal system needs fundamental reforms as it is not dispensing justice. What are the problems and who will undertake...

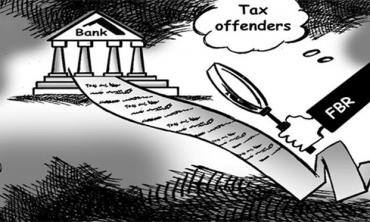

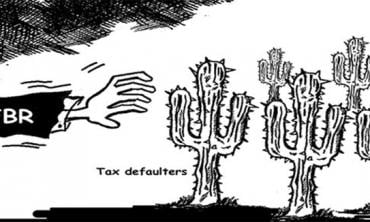

No reform agenda can succeed unless the FBR is insulated from outside pressure and an integrated Tax Intelligence System is implemented

The poor people of the country are one of the most heavily taxed in the entire Asian region

Pakistan’s obligations on external and domestic debt are rising enormously as the government has failed to broaden the tax base and reduce...

The right to taxation or exemption is exclusive domain of the Parliament and Executive should only implement the laws and refrain from legislation

Unless all political parties reform themselves and file tax returns, there is dim hope for sustainable democracy in Pakistan

There is a consensus that the Federal Board of Revenue is not only fraught with corruption but lacks professionalism and competence. The non-filing...

Majority of Pakistanis were dejected after hearing the budget speech on the evening of June 3, 2014. Not because there was no relief for the poor....

The Federal Board of Revenue has failed to achieve the real tax potential despite imposing all kinds of oppressive taxes. It is wrong to say that...