The writes, lawyers and authors, are Adjunct Faculty at Lahore University of Management Sciences (LUMS).

A national consensus on fair and just tax policy is the only hope for overcoming monstrous fiscal deficit and debt burden

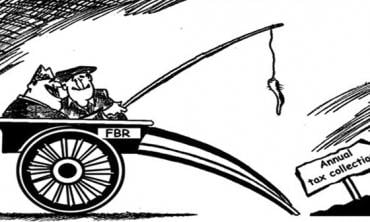

A review of the FBR’s performance during the first half of FY 2020

Do tax declarations of public officeholders and judges enjoy absolute confidentiality and secrecy?

Governments keep begging for loans and bailouts from foreign lenders and donors while billions of untaxed dollars of Pakistanis are lying abroad

The real dilemma is that ruling elites are unwilling to pay taxes on their unprecedented and exorbitant benefits, shifting burden of taxes on the...

Instead of working for enforcement of fundamental rights and paying attention to people’s problems, the government and political parties are...

With new laws in place, recovery from Swiss banks can be little easier provided the government shows sincerity in taking action against tax dodgers

FBR needs to be replaced with a fixed rate tax regime in sales tax and income tax to increase revenue collection and relieve people of oppressive...

The only way out of the prevalent fiscal mess is to accelerate growth, generate employment, enhance tax revenues and stop financing luxuries of...

Many experts, including those associated with Pakistan’s programme in the International Monetary Fund , after the failure of Federal Board of...