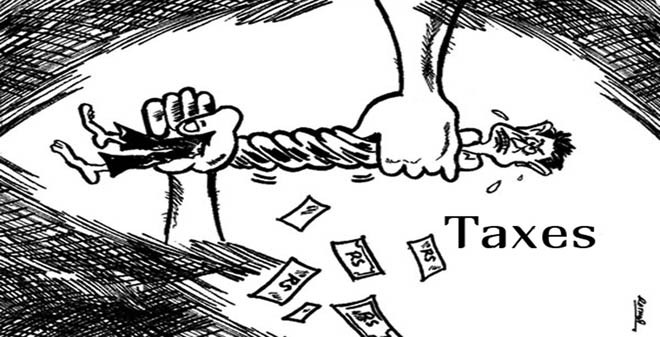

FBR needs to be replaced with a fixed rate tax regime in sales tax and income tax to increase revenue collection and relieve people of oppressive tax machinery

The past few years have witnessed the worst kind of performance by the Federal Board of Revenue (FBR) on all fronts -- revenue collection, widening of tax base, recovery of arrears, voluntary compliance, reform process etc.

What makes the situation more painful is the fact that despite the FBR’s pathetic performance for fiscal year 2013-14, Finance Minister Ishaq Dar has termed it "satisfactory" (sic) to convince the International Monetary Fund (IMF) that Pakistan deserves more lending. This is the same game that Hafeez Shaikh and Shaukat Aziz used to indulge in to hoodwink the nation that "economy is more vibrant than ever before and a new era of higher growth has just started."

The reality is just the opposite. The FBR could not tap the real tax potential of Rs8 trillion, in fact it has never been considered -- obviously to meet this level of collection requires taxing the elites and relieving the poor from unnecessary tax burden. This is not desirable by a government of businessmen, civil-military bureaucracy and corrupt politicians.

In 2013, the FBR received only 840,000 returns against 3.2 million holders of National Tax Numbers (NTNs). According to National Database and Registration Authority (NADRA) there are more than three million rich people who do not even have NTNs although they live in posh areas, have multiple bank accounts and frequently visit foreign countries.

Amongst the non-filers, there were 1050 FBR’s officials, vast majority of government servants, elected representatives and even judges and generals. It is worth mentioning that in 2009 as many as 1,282,118 people filed returns/statements. In other words, there has been annual decrease of 7 per cent in filing of returns. Yet, the FBR claims to have achieved wonders in the wake of $100 million World Bank-funded six years’ long Tax Administration Reforms Programme (TARP).

The FBR has been reporting incorrect figures of collection and income taxpayers in Pakistan. It has failed to compel people having taxable income to file returns. By July 25, 2014, the FBR claims to have issued 120,350 initial notices under section 114 of the Income Tax Ordinance 2001 to the non-filers "based on large potential fiscal liabilities and location to ensure the initiative is nationwide" and 38,413 second notices under section 122C of the Income Tax Ordinance 2001 for provisional assessments. So far, only 17,314 non-filers filed returns, and provisional assessments under section 122C were made in 28,690 cases creating tax demand of Rs11 billion. Recovery made is only of Rs306 million. Do anyone needs any further proof how inefficient and useless this organisation has become?

The FBR’s performance has been pathetically abysmal despite resorting to enormous withholding provisions and all kinds of highhandedness -- tax-to-GDP ratio has decreased from 13 per cent to 8.2 per cent in the last 10 years. It is just thriving on withholding taxes and voluntary payment -- constituting 90 per cent of total collection. The contribution of field officers [collection on demand through investigation or audit] is just 10 per cent of total collection. It proves beyond any doubt how unproductive this organisation is.

The crumbling, inefficient and corrupt tax apparatus is the root cause of the present scenario. The officials persistently squeeze and penalise existing taxpayers on the one hand but on the other, join hands with and protect the big tax evaders. For example, massive over/under invoicing is not possible without their criminal culpability. The small business houses, already heavily taxed through withholding tax mechanism, are victims of their highhandedness. It is high time that the FBR should be replaced with a National Tax Authority.

Financial wizards and tax managers sitting in the Ministry of Finance and the FBR have been persistently claiming that tax base of Pakistan is disappointingly narrow and majority of the people do not pay income tax. Actually, the reality is completely opposite. The poor people of Pakistan are one of the most heavily taxed in the entire Asian region as per official facts and figures. As far as tax base is concerned, not only total taxable population but millions of those having below taxable incomes are paying taxes at source or through voluntary filing of returns. In most of the cases, tax deducted is the full and final discharge of liability; hence taxpayers do not file statements (required under section 115(4) of the Income Tax Ordinance, 2001), which has created a wrong impression that our income tax base is narrow.

Pakistanis have been portrayed as a nation of tax cheats by local and international media. It is true that in 2013 total filers were just 840,000 but income tax payers were at least 50 million. These include mobile phone users who pay income tax at source, commercial electricity consumers and people earning interest on bank deposits who pay 10 per cent mandatory withholding tax irrespective of their quantum of income.

Out of total population of Pakistan, 43 per cent are below the age of 15 years -- an overwhelming majority of which may not have taxable income. Rural labour of 40 million earns meagre income. Thus, the total income tax paying population having taxable income of Rs400,001 can be around 20 million. The FBR is getting income tax from all these as well as from many others not earning taxable incomes. The poor are paying not only indirect taxes but also income tax at source under various provisions of the Income Tax Ordinance, 2001 -- section 148 to 156A, section 234 to 236N. Thus in reality, the poor are over-taxed and the elites enjoy tax-exemptions, perks and benefits. The poor get nothing in return.

Successive governments have failed to fulfill even their basic obligation of safeguarding life and property of people, what to talk of providing basic facilities of health, education, water and other civic amenities. It is high time to dismantle the FBR and introduce fixed rate tax regime both in sales tax and income tax -- it would not only increase collection but also relieve people of oppressive tax machinery.