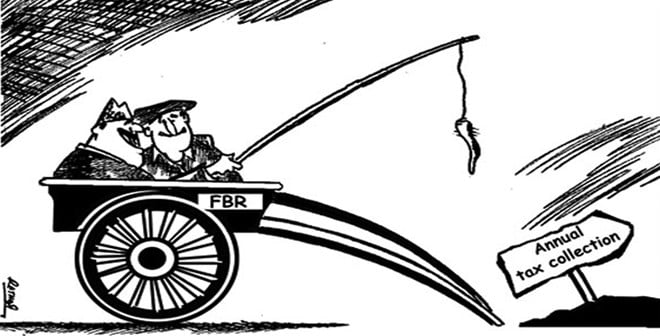

Many experts, including those associated with Pakistan’s programme in the International Monetary Fund (IMF), after the failure of Federal Board of Revenue (FBR) to meet the target of first half of the fiscal year 2013-14 by Rs85 billion, projected collection of around Rs2250-60 billion against the revenue target of Rs2475 billion. However, the bureaucrats sitting in the FBR, as usual, rejected their estimation with arrogance or ignorance. They expressed determination to bypass the target assigned to them. Later on, in a meeting with the IMF, the government admitted expected shortfall of around Rs200 billion as the FBR failed in achieving monthly targets in the first four months of second half of the fiscal year 2013-14.

The further downward revision came fait accompli when the FBR collected Rs1743 billion (after blocking refunds of billions) in the first 10 months of the fiscal year 2013-14 -- just 70 per cent of the original target of Rs2475 billion and 74 per cent of the revised target of Rs2345 billon. On April 23, 2014, the Chairman FBR admitted before the Senate’s Standing Committee on Finance & Revenue that refunds of Rs97 billion were due but not paid. He, however, refuted the figure of Rs450 billion claimed as blocked refunds without any evidence by Senator Ilyas Bilour. The admission by Chairman FBR went unnoticed even with the IMF that closely (sic) monitors our fiscal performance!

Since the FBR was to collect Rs602 billion in May and June to achieve the revised target of Rs2345 billion, which was simply impossible, the government, in order to save the skin of its favourites in the FBR, further slashed the target to Rs2275 billion. Even this proved to be "difficult"! As usual, the tax officials on the command of their bosses started asking for advances from banks, large companies, public sector enterprises (PSEs) and other taxpayers relating to next tax year to minimise the shortfall.

For extorting more funds, the FBR implemented taxation measures announced in budget, even before its approval by the Parliament, through Statutory Regulatory Orders (SROs). It issued SRO 420 to impose 17 per cent sales tax on imported leather goods and garments. Through SRO 421, the FBR increased sales tax on steel melters and re-rollers to Rs7 per electricity unit, up from Rs4. It also increased sales tax on supply of ship plates to Rs6,700 per ton from Rs5,862.

According to some insiders, who requested to be anonymous, the FBR top notches collected around Rs2266 billion by the end of fiscal year 2013-14 that included blocked refunds of Rs150 billion, if not more, and through securing advances of over Rs40 billion from various taxpayers, notably banks and PSEs. It is height of fiscal gerrymandering! It is the high time that National Assembly, Senate and Public Accounts Committee take cognizance of the matter and demand audit of the FBR’s revenue collection by an accounting firm of international standing.

The Chairman FBR in the face of growing criticism over failure to achieve original target of Rs2475 billion openly blamed it on budget-makers saying that "we proposed the figure of Rs2344 billion only". He got the target revised downward twice to Rs2275 and claimed that "any collection below Rs2344 billion was "due to a decline of 10 per cent in goods import while the appreciating rupee also hurt collection at the import stage". He revealed that "41 per cent of total revenues are received at the import stage".

The statement of the chairman confirmed the real dilemma of the country’s tax base -- the rich and mighty do not pay income tax and 90 per cent collection of the FBR comes from indirect taxes, withholding tax regime under the Income Tax Ordinance, 2001 and voluntary payments (advance tax relates to next fiscal year)!

The FBR’s stalwarts would certainly claim that tax collection of Rs2260 was a "big achievement" as compared to fiscal year 2012-13 when it failed to collect the three times downward-revised budget. The massive shortfall of Rs444 billion in 2012-13 pushed fiscal deficit to 8 per cent against the budgeted target of 4.7 per cent of GDP. The FBR collected only Rs1936 billion against the target of Rs2381 billion -- at 3 per cent, it was the lowest growth in 13 years.

In fiscal year 2011-12, there was a shortfall of Rs75 billion, even though the target was revised downward to Rs1952 billion. In 2010-11, the shortfall was Rs38 billion, but the then Chairman FBR made a false claim of collecting Rs1590.4 billion against the revised target of Rs1588 billion. The media exposed manipulation of figures and later the FBR retreated and admitted that actual collection was only Rs1550 billion. Strangely, nobody was punished even after confession of cheating and fraud in showing exaggerated collection figures.

The main reason of low revenue collection is weak fiscal management and policies of appeasement towards tax evaders. Pakistan has one of the lowest tax-to-GDP ratios in the world and there is general unwillingness to pay taxes due to poor public service delivery and because of unfairness in the tax system.

The main beneficiaries of taxpayers’ money are ruling elites -- militro-judicial-civil complex, politicians-cum-businessmen and absentee landlords. The billions are forgone as perks and benefits for the elites and the governments keep on appeasing the rich and mighty through various amnesty schemes. This dissuades the people from paying taxes as they know that their money will not be spent for public welfare -- the state has miserably failed to protect the life and property of the people and provide them basic facilities like clean drinking water, health, education, electricity, transport and housing.

The FBR’s high-ups are jubilant on collecting just one-fourth of real revenue potential of the country. In these columns, we have given concrete suggestions supported with figures on how to raise revenues to the tune of Rs8.5 trillion. For tapping our actual potential, there is an urgent need to dismantle the FBR and replace it with an efficient National Tax Authority that works autonomously with participation of all provinces. Such an organisation alone can bring undocumented economy in the tax net, bridge tax gap and distribute the incidence of various taxes judiciously amongst all the segments of society.

A close examination of the FBR’s performance would show that it has over a period of time shifted the main burden of collecting taxes to withholding agents, who are performing the essential state function of tax collectors without any reward, what to talk of getting reimbursement of exorbitant expenses incurred for performing this onerous task. It is an undeniable fact that 90 per cent of taxes are being collected through voluntary compliance and withholding tax mechanism.

It is sad to note that the present government has enormously widened the scope of collection/deduction of taxes through withholding agents through many amendments made vide Finance Act 2014. The corporate houses in general and banks in particular have virtually been converted into "FBR Collection Houses". Withholding agents incur substantial cost on complying with tax collection provisions on behalf of State (man hours, infrastructure etc). There is bar in income tax law for any collection charges for rendering these services, making it "forced labour", which is forbidden under Article 11(3) of the Constitution. In the face of these stark realities, the FBR keeps claiming that people do not pay taxes.

The truth is diametrically opposite. The rich and mighty do not pay income tax on their real incomes. The FBR itself admitted in the past that there were about 3.6 million such rich people who were not filing even tax returns!

We have millions of income tax payers -- about 50 million pre-paid mobile users alone who pay advance income tax. However, only 940,000 persons filed tax returns in 2013. This testifies to the uselessness of the FBR. It failed even to enforce law for compulsory filing of returns and wealth statements by persons having income of Rs5 million or above.

We faced international embarrassment when it came to the light that 70 per cent legislators did not file tax returns. Similar is the case with majority of government officials including about 1020 officers of the FBR.

Banks, WAPDA, PTCL and mobile companies are fully computerised. Their combined data shows that there are more than 50 million people who pay advance income tax to the government. The FBR has failed even to force majority of much-publicised high-profile 700,000 super-rich to file tax returns.

The FBR’s performance is an ugly joke with the people of this country. It collects only 10 per cent of total revenue through audit and assessments. The rest comes through withholding or voluntary payments. Taxpayers and withholding agents are victims of the highhandedness of government’s unjust tax policies. It is high time that FBR should put its own house in order and stop bluffing this nation about figures of tax collections, numbers of taxpayers and return filers to hide its own inefficiency and incompetence.