People have to brave prolonged loadshedding due to the perennial menace of power shortfall, which has been battering the domestic, industrial, agricultural and commercial sectors for the last about a decade, inflicting heavy losses on the nation and the state.

Hit by the initial shockwaves in 2004, the energy crisis has persisted till this day, rendering about 400,000 industrial workers jobless, forcing thousands of small and medium enterprises out of business and impelling scores of manufacturing units to relocate their business elsewhere.

The prime reason for the power shortfall was gross mismanagement, inefficiency, corruption and, above all, non-utilisation of more than 25 per cent of electricity generation capacity due to technical, financial and fuel-related problems.

National Power Control Cell (NPCC) and National Transmission Dispatch Company (NTDC) were involved in huge power theft, inflicting colossal loss of Rs110 billion annually on the national exchequer. The revelation was made by the Minister of State for Water and Power, Abid Sher Ali, addressing a press briefing in Islamabad on May 9, 2014. The figures of electricity generation and its distribution do not match, Abid Sher Ali said, and the past governments have for long been deceived by the top mandarins of the NTDC and NPCC. About 1,000 to 1,200MW of electricity disappears from the system daily, which NTDC and NPCC officials could not justify and prove as to where this huge quantum of electricity was going.

To keep an eye on the electricity generation and its distribution, a system comprising 500 metres was purchased for $62 million seven years ago, but it was never installed. Perhaps, the unscrupulous elements detest the system and have prevented its installation so that they could continue making fast bucks by confusing and obfuscating the nation through novel techniques and varying figures of technical data!

For instance, in a briefing to Prime Minister Nawaz Sharif on May 10, 2014, the Ministry of Water and Power stated that the power generation was recorded at 12,700MW against a total demand of 15,300MW, showing a shortfall of 2,600MW. The officials said that 3,800MW were being received from hydro resources, while 1,780MW and 7,030MW were being received from thermal resources and IPPs respectively, and that another 1,000MW of electricity would be added to the system within next 24 hours. They did not tell from where they would get these extra 1,000MWs "within next 24 hours" for addition to the system. However, just a day earlier, while briefing journalists, the Minister of State for Water and Power had stated that "when he checked the system on May 9, he found that the electricity demand was 17,438MW while generation stood at 10,183MW" on that day, showing a deficit of 7,245MW.

Meanwhile, the government-owned generating companies (GENCOS) have reportedly managed to steal furnace oil worth Rs29 billion. Some 1,920 transformers and truck-loads of cables have also been stolen. Given the situation, if the government was suffering an annual loss of Rs1,000 billion in the electricity sector, as stated by the Minister for Water and Power Khawaja Muhammad Asif, on the floor of the National Assembly on May 16, one should not be surprised. The minister said that it would not be possible to end loadshedding by 2018.

But, there is a silver lining and the situation can change if the top management of the electricity sector passes on in good hands. To reduce electricity consumption, the government decided sometime back to supply two electricity saving bulbs to each consumer. The project, entailing an expenditure of many billions of rupees, was entrusted to the government-owned electricity supply companies. At least, IESCO staff has carried out this exercise very diligently, as experienced by the author himself. This shows that the staff is good and they can deliver the goodies provided there is a change of attitude at the top.

Quoting Swiss officials, Parliamentary Secretary for Finance, Rana Muhammad Afzal Khan, stated on the floor of the National Assembly, on May 9, that about 200 billion dollars of Pakistani people are lying with Swiss banks. What is the total volume of Pakistani money stashed in overseas accounts or invested in real estate or industrial ventures abroad? It is anybody’s guess. Of course, it is the ill-gotten money that has been taken out of the country and parked in overseas banks, including in Switzerland, or invested in the real estate or industrial ventures abroad.

If the money stashed in Swiss banks alone returns to the country it could increase Pakistan’s GDP by two-thirds and enable the country to reduce its foreign debts significantly. Imagine the spurt in the national economy if all the funds held by Pakistanis abroad are repatriated and invested in the country. Of course, it could happen only when there is stability and the country starts implementing an appropriately approved long-term framework or perspective plan for economic revival in an atmosphere free from acrimony, corruption, extortion, violence, etcetera, and nobody is allowed to change the economic policies merely at whims.

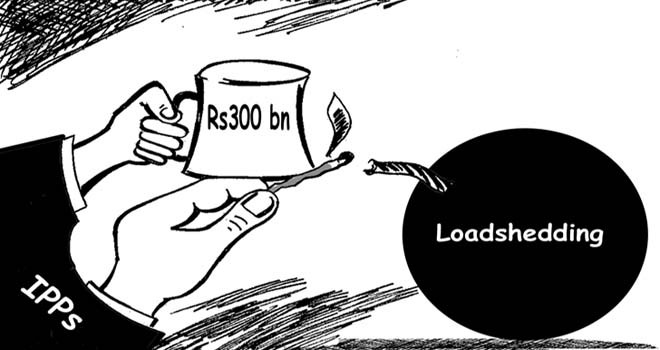

After assuming power, the present government cleared the entire backlog of power sector’s circular debt amounting to over Rs500 billion, but it has swelled to Rs340 billion over the past 340 days. The monster of circular debt will keep surfacing time and again due to corruption, massive power thefts at the production and distribution level and skewed power purchase agreements that the past governments had made with the Independent Powers Producers (IPPS). In Pakistan, the IPPS are consuming 24 kg of oil to produce 100 kWh of electricity, as per these agreements, against 14 kg of oil to produce 100 kWh that power plants take internationally.

Now, let us examine the contention of the authorities regarding circular debt. The circular debt, the authorities argue, is due to theft and line losses, which stand at 25 per cent. There are two types of line losses: technical ones because of old transformers and poor infrastructure, and non-technical losses, primarily on account of theft. Currently, the government is engaged in preventing power theft, largely at the level of consumers. Even if the government succeeds in stopping power theft by the consumers, the ‘python’ of circular debt is bound to raise its head again so long as the IPPs keep gulping oil at 71.4 per cent over and above the international standards and 1,000 to 1,200MW of electricity continues to disappear on account of theft by power mandarins at the generation and distribution level, as alleged by Abid Sher Ali.

Meanwhile, the consumers are impelled to bear the brunt in the shape of high tariff, which is highest in Pakistan when compared with other South Asian countries. With a base price of Rs14 per unit and addition of 17 per cent GST and 3.5 per cent excise duty, it becomes Rs16.95 per unit in Pakistan; while in India and Bangladesh it is merely Rs7.36 and Rs5.47 respectively. When added to the cost of production, the high tariff of electricity makes our industrial products uncompetitive in the international market.

This brings us to the conclusion that the main reasons for the high tariff in Pakistan are governance related due to the myopic vision of policy-makers, corruption, mismanagement and unavailability of the right people at the right places. Given the situation, one should not expect good results until ‘misfits’ continue to manage ventures that are essentially commercial in nature.

In the realm of politics, they say power corrupts and absolute power corrupts absolutely. However, the saying is equally applicable to the electricity sub-sector in Pakistan and also to other sectors of the country’s economy that continue to enjoy monopoly over production and distribution or have created cartels, whether overt or covert. Specifically speaking about the electricity sector, the scourge of shortfall and loadshedding will continue to persist unless this sector is privatised, splitting it into smaller units to be managed by competent hands in an atmosphere marked by competition where only the fittest and the most efficient companies survive.