While our neighbouring countries -- China, India and Bangladesh -- continue to grow speedily, Pakistan’s economy has been weakening because of inept leadership, gross mismanagement, inefficiency and corruption. If foreign exchange reserves serve as an indicator about the economic health of a nation, we find China’s foreign exchange reserves standing at $3,726 billion in September 2013 and that of India at $311.858 billion in May 2014 against Pakistan’s hovering around $12 billion even after a liberal injection of Saudi gift and loans from international institutions. Even the foreign exchange reserves of Bangladesh (which emerged on the world map a little over 43 years ago and which earlier as East Pakistan was regarded as the weaker one of the Siamese twins) exceeded $20 billion in April, 2014.

Seeping into every sector of economy, the vice of corruption, in particular, has become endemic in Pakistan. It has not only tarnished the country’s image, it has also badly affected new investments. Consequently, the establishment of new industrial ventures, creation of new jobs and the country’s progress and prosperity has remained tardy over the years.

An indication of the magnitude of corruption can be vouched from a statement made by a former chairman of NAB, retired Admiral Fasih Bukhari, who stated that Pakistan lost five billion rupees a day in corruption in only three sectors of its economy at the hands of oil mafia, agriculture cartel and tax evaders. In other words, these three groups deprived the national exchequer of Rs150 billion a month and Rs1800 billion a year.

Corruption inhibits good governance, undermines economic development, stunts growth, fuels poverty and creates political instability. No nation can develop to its full capacity or realise its full potential if its social system is plagued by corruption and inefficiency. Corruption not only causes a severe drain on the national economy, it also acts as a major disincentive to serious foreign investment. Due to corruption, once a rising middle-income state -- Pakistan -- now figures amongst politically unstable poor countries.

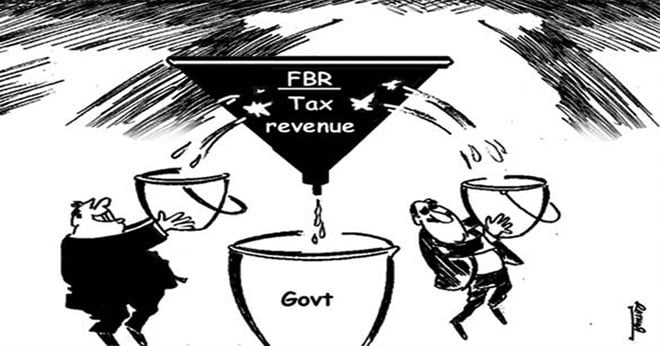

Faced with such a situation, the governments have been meeting their growing expenditure by borrowing, new taxation and deficit financing which, in turn, leads to inflation, price-hike and poverty. But, the government could easily meet its financial needs without resorting to such coercive measures if it displayed the will and determination to curb corruption, smuggling, piracy, electricity and tax theft, being the vices that constitute some of the major problems currently facing Pakistan.

At over 60 per cent of GDP, the underground economy in Pakistan inflicts heavy losses on trade, industry, citizens and the state, while it deprives the nation of badly needed revenues in hundreds of billions rupees every year. Being inimical to creativity, counterfeiting and copyright violation not only discourage new inventions and discoveries, but also production of original works, thus stifling prospects for economic development, new investments and job creation.

From street level in Peshawar district, counterfeiting has extended, at the national level, to established firms in Peshawar, Swat, Mardan, Haripur and Gadoon-Amazai in KPK; and to Chakwal, Sargodha and Bahawalnagar in Punjab; and at the international level to Afghanistan, China, Dubai and Iran. The products counterfeited ranged from small products like cigarettes, medicines, black tea, lubricants, soap, toothpaste and shaving razors, to large items like tyres and sophisticated electronics like television sets, CD players, computers, electrical goods, irons, ACs, UPS machines, juice blenders, etc. A prominent feature of the counterfeited products is the availability of exact wrappers, labels and other packing material, skilfully prepared in the tribal areas and some major urban centres.

Counterfeiting also takes place at the industry level. Among prominent products counterfeited at that level include popular cigarette brands like Gold Leaf, Gold Flake and Red & White, electric irons, non-sticking cooking pots, and cosmetics of reputed companies. For curbing smuggling and counterfeiting, experts advocate rationalisation of taxes and duties as, they insist, high rates of taxes and duties often lead to smuggling and counterfeiting of products.

The negative effect of counterfeiting and piracy on the nation and the state can be explained with the help of a study pertaining to cigarette industry. The abhorring practice deprived the government of about Rs19.6 billion in taxes and duties in the year 2012, while the legitimate cigarette industry suffered a loss of Rs6.0 billion in revenues during that year. On the other hand, the legal manufacturers of cigarettes contributed over Rs76 billion in taxes to the national kitty during the fiscal year 2012-13 and over Rs300 billion in the last five years. This industry is projected to contribute some Rs87 billion in excise duty and sales tax during the current fiscal year. Furthermore, 99.3 per cent of the total tax was actually being contributed by two big cigarette manufacturing companies while the remaining 43 registered players in the field contributed only 0.7 per cent in taxes and duties to the national kitty.

At present, there are 45 cigarette manufacturing companies registered in Pakistan, which provided employment to about 72,800 persons, while 240,000 people derived livelihood from tobacco farming. The cigarette industry also provided business opportunities to some 207,000 people, who were involved in the distribution and retail store business. By providing direct or indirect employment to some 700,000 persons, the cigarette industry was sustaining around three million people, if the average family size of an adult engaged in the tobacco industry is taken at 4.

Furthermore, it is estimated that the cigarette market in Pakistan was far bigger than the size reflected in the sale of cigarettes by the legitimate sector. It is estimated that more than 21 per cent of the cigarettes sold in Pakistan were either smuggled or counterfeited with a view to evading taxes by the unscrupulous elements, who were also involved in the cropping of low quality tobacco and making of fake and substandard cigarettes and, thus, playing havoc with the health and lives of consumers.

The sale of smuggled and counterfeited sub-standard products led to unhealthy and non-competitive practices through their sale at nominal price and offering a host of incentive schemes. The malpractices not only damaged the indigenous legitimate industry in terms of erosion of consumer confidence in genuine brands but also blocked further investments.

The supply of goods depends upon their demand. So long as the demand is there, the supply of illicit goods will proliferate. As far as cigarettes are concerned, the demand for cheap smuggled cigarettes is rising in Pakistan due to ever-increasing prices of duty-paid cigarettes, causing pressure on the pockets of consumers. Since tax-evaded cigarettes sell at artificially low prices and are easily available, the consumers seek such alternatives to avoid pressure on their pockets.

The demand for illegal cigarettes is also rising because consumers do not want to carry local packs with horrible health warnings printed on them. They prefer packs which carry no health warning at all. And there is no dearth of such smuggled cigarette packets in shops and markets across the country.

Dotted with some 144 natural passes along Pakistan-Afghanistan international border alone, plugging the porous borders is difficult and raids at retail outlets carry the risk of shutter-down strikes. The remedy, therefore, lies in identifying the main distribution networks and striking at them through tactical and calculated hits at storage points and warehouses across the country. Simultaneously, the authorities need to take steps for curtailing the demand for smuggled goods through awareness campaigns and motivating people to buy only national products while sparing no effort in smashing the network of smugglers with an iron hand.

In brief, since smuggling and counterfeiting discouraged creativity, innovation and invention and also arrested growth of national economy by inflicting heavy losses upon the corporate sector as well as the citizens and the state, it was the need of the hour to curb these vices through vigorous enforcement of law, deterrent punishment to criminals, rationalisation of duties and taxes and launching of motivational campaigns.