Seemingly, the Nawaz government has got behind small businesses and is encouraging young people to seize the opportunities -- by launching the brand new Prime Minister’s Youth Business Loan Scheme.

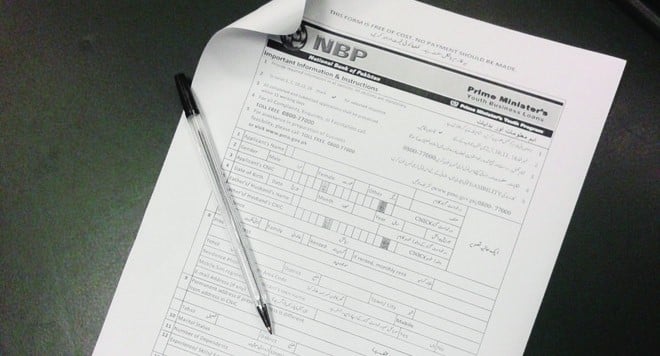

The government has allocated Rs5 billion for budget year 2013-14 to fund 100,000 loans, each worth upto Rs 2 million, to young people aged 21 to 45 years, who can show they have a robust business plan. The loans will be processed through National Bank of Pakistan (NBP) and First Women Bank (FWB). Soon, private banks will be lured to finance the scheme as well.

And, in a rather welcome gesture, half of the 100,000 loans are reserved for women borrowers.

The scheme is special to Nawaz Sharif. "It is my dream for the youth of Pakistan" he said earlier this month.

And, his daughter, Maryam Nawaz, who is chairing the scheme, exhibited as much exuberance at a meeting with regional heads of National Bank of Pakistan in Islamabad by saying that the scheme "aims at transforming micro-finance into a dynamic industry".

But, are the prospective loan seekers fired up with as much excitement for a new entrepreneurship? Judging by the number of application forms downloaded from websites, which according to Smeda has been close to 8,000,000, the response is fantastic. But, when it comes to counting the number of applications actually filed, the response is disappointingly slow.

A senior First Women Bank official, who oversees the operation of 13 branches in Lahore, says that of the 4968 application forms issued till Jan 13, only 40 have been completed and filed.

At the Gulberg branch of National Bank of Pakistan in Lahore, the response is likewise. A senior bank official says that in the first week of the scheme they issued about 2500 application forms, and "with time naturally the number reduced," he says, continuing that of the thousands of forms issued "only 18 applications have been filed, of which two are almost final."

The scheme is toughest on the guarantor’s condition -- for initially any grade-15 or above government officer with 8 or more years remaining in public service or more than one person with cumulative networth of more than 1.5 times the loan or anyone with networth more than 1.5 times the loan could give his/her guarantee. However, reacting to the sluggish response from the prospective loan seekers, the scheme relaxed this condition and allowed a blood relative or family member, having networth of 1.5 times the loan, to guarantee the loan.

"This softening of the guarantor’s condition will increase risk of default and make loan recovery more difficult for the participating banks", fears Nasir Jamal, senior journalist, Dawn. He adds, "It will also scare away private banks from the scheme due to fear of higher default unless the government agrees to pick up a major portion of their losses".

Resultantly, Jamal says, the government will have to either direct the two public banks -- NBP and FWB -- to completely finance the scheme or substantially cut the size of loans that it plans to disburse under it.

The loan will be repayable in eight years, with first year as the grace period, and the borrower will pay an 8 per cent annual interest rate, whereas the lending institutions will charge approximately 15 per cent in annual interest. The government will subsidise the loans by covering the borrowing cost for the difference between the 15 per cent rate charged by lenders and 8 per cent paid by the borrower.

A loan seeker may select a business option from one of the 55 feasibilities prepared by the Small and Medium Enterprises Development Authority (Smeda), on livestock, IT, engineering, to more women-oriented beauty parlours, boutique and day-care centres. However, those with more original business plans may also pursue National Bank or First Women Bank for funding.

These feasibilities are in essence just a way of introducing an area to loan applicants. "They will have to learn a lot more before they will be able to open up a business in any area," says economist Faisal Bari.

He, therefore, urges the banks to keep an eye on loan use, as they do with all other loans -- and "if the mainstream banks find it too hard to do it themselves, they can contract micro-credit banks to do it for them," he suggests.

The Nawaz government is showing increasing interest in small entrepreneurships. Obviously because small businesses translate into economic activity and jobs -- and both are in short supply in the country. Given our unemployment rate and lack of access to finances for small businesses, the PM initiative is on target. Doing simple math, the scheme is likely to benefit 640,000 individuals based on the average household size of 6.4 in the country. Which, by any estimate, is not a small initiative. Except, and as Faisal Bari points out, "the devil is always in the details -- if selection is not transparent, not based on merit, if workers of a party are favoured, or appear to be, if people from a province are favoured… all of these will undermine the larger objectives of generating economic activity and jobs."

Just the fact that the prime minister’s daughter Maryam Nawaz has been appointed the chairperson of the scheme suggests the possibility of loan disbursement on political basis. "It is always a good idea to choose a bipartisan, neutral person with expertise in and knowledge of finance and banking to head such initiatives because these involve public banks, and the losses suffered by the creditors on account of defaults will have to be paid with taxpayers’ money at the end of the day," says Nasir Jamal.

He thinks interference by PML-N leaders and legislators will be a major challenge -- "I doubt the government will be able to resist pressure from its MNAs and MPAs".