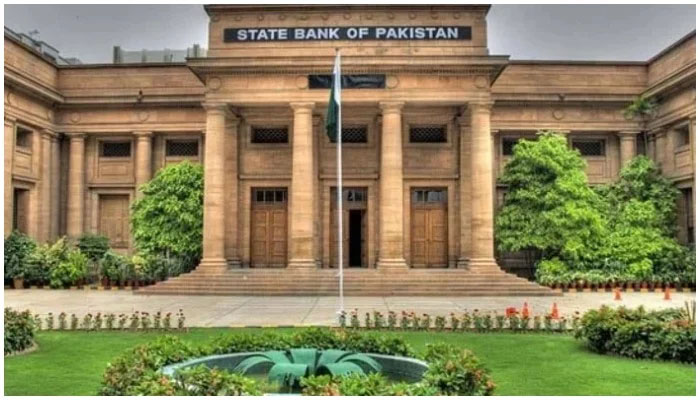

Pakistan to get $2bn from Qatar: SBP

The country will also get $1 billion in oil financing from Saudi Arabia

KARACHI: Pakistan will receive $2 billion from Qatar in bilateral support to help ease the South Asian nation’s funding crunch and the consequent risk of a default, the central bank said on Monday.

The country will also get $1 billion in oil financing from Saudi Arabia and a similar amount in investments from the UAE. All the funds are expected over twelve months, Murtaza Syed, deputy governor at the State Bank of Pakistan (SBP) said in a briefing. Prime Minister Shehbaz Sharif is visiting Qatar on August 23 (today) and 24. “An announcement of the assistance may or may not be announced during the trip,” Syed said.

The pledges come before an International Monetary Fund (IMF) board meeting on August 29 that could lead to the release of $1.2 billion in financing. Arab nations had committed to supporting Pakistan only after it secured an IMF programme, while the Washington-based lender has been seeking a commitment from Saudi Arabia.

The Pakistan rupee is the best performer globally this month and has gained 11 percent since dropping to a record low last month as worries over a possible default fade, according to data tracked by Bloomberg.

The SBP, meanwhile, left its benchmark interest rate unchanged due to easing external financing worries amid indications that the country may soon receive a bailout approval from the IMF.

Consistent with market expectations, the SBP’s Monetary Policy Committee (MPC) kept the policy rate at 15 percent as it thought it was wise to let several recent steps taken to cool the overheated economy and curb the current account deficit, such as monetary tightening, import control measures, and a robust fiscal consolidation plan, work their way through the system.

“With recent inflation developments in line with expectations, domestic demand beginning to moderate, and the external position showing some improvement, the MPC felt that it was prudent to take a pause at this stage,” the SBP said in a statement.

The policy rate has been hiked by a cumulative 800 basis points since September 2021. Last time, the SBP kept the borrowing cost steady in March 2022. “The headline inflation rose further to 24.9 percent in July, with core inflation also ticking up. This was expected given the necessary reversal of the energy subsidy package—effects of which will continue to manifest in inflation out-turns throughout the rest of the fiscal year—as well as momentum in the prices of essential food items and exchange rate weakness last month,” it added.

The trade balance fell sharply in July and the rupee reversed course during August, appreciating by around 10 percent on improved fundamentals and sentiment, it noted. The SBP said it will continue to monitor inflation outturns and global commodity prices.

“Looking ahead, the MPC intends to remain data-dependent, paying close attention to month-on-month inflation, inflation expectations, developments on the fiscal and external fronts, as well as global commodity prices and interest rate decisions by major central banks,” it said.

The SBP sees the IMF’s board approve a $1.2 billion tranche on August 29, which will help unlock funding from multilateral and bilateral lenders. In addition, Pakistan has also successfully secured an additional $4 billion from friendly countries over and above its external financing needs in FY2023. As a result, the foreign exchange reserves will be further augmented through the course of the year, helping to reduce external vulnerability.

The SBP expects the forex reserves to rise to around $16 billion this fiscal year. “To ensure this and to support the rupee going forward, it will be important to contain the current account deficit to around 3 percent of GDP by moderating domestic demand and energy imports. In addition, it will be critical to keep the IMF programme on-track by following through on the agreed fiscal tightening and structural reforms over the next 12 months,” it said.

Encouragingly, there is evidence that inflation expectations of businesses have eased significantly. Looking ahead, headline inflation is projected to peak in the first quarter before declining gradually through the rest of the fiscal year, according to the SBP.

Thereafter, inflation is expected to decline sharply and fall to the 5-7 percent target range by the end of FY2024, supported by the lagged effects of tight monetary and fiscal policies, the normalisation of global commodity prices, and beneficial base effects, it noted.

The SBP thinks this baseline outlook remains subject to uncertainty, with risks arising from the path of global commodity prices, the domestic fiscal policy stance, and the exchange rate. Pakistan’s external financing requirement (including current account deficit) will be slightly above $30 billion for FY2023 against available financing (including IMF) of around $37 billion, therefore over financed by $7 billion, said Arif Habib Limited, citing post-monetary policy analysts briefing given by the SBP Acting Governor Dr Murtaza Syed.

The breakdown of commitment of $4 billion from friendly countries includes $2 billion from Qatar, $1 billion from Saudi Arabia (deferred oil facility), and $1 billion from UAE (investment). These amounts are expected to be received over the next twelve months.

Pakistan’s short-term external debt is only six percent of its total external debt. The problem the country is having this year is the external debt repayments have bunched up, not due to any maturity problem, the SBP’s acting governor said.

Fiscal consolidation of around three percent of GDP given the election year will be challenging but this is what we have agreed with the IMF and to make this achievable, in acting governor’s view, we need to bring more people into the tax net.

-

Bad Bunny Stunned Jennifer Grey So Much She Named Dog After Him

Bad Bunny Stunned Jennifer Grey So Much She Named Dog After Him -

Kim Kardashian's Plans With Lewis Hamilton After Super Bowl Meet-up

Kim Kardashian's Plans With Lewis Hamilton After Super Bowl Meet-up -

Prince William Traumatised By ‘bizarre Image’ Uncle Andrew Has Brought For Royals

Prince William Traumatised By ‘bizarre Image’ Uncle Andrew Has Brought For Royals -

David Thewlis Gets Candid About Remus Lupin Fans In 'Harry Potter'

David Thewlis Gets Candid About Remus Lupin Fans In 'Harry Potter' -

Cardi B And Stefon Diggs Spark Breakup Rumours After Super Bowl LX

Cardi B And Stefon Diggs Spark Breakup Rumours After Super Bowl LX -

Alix Earle And Tom Brady’s Relationship Status Revealed After Cosy Super Bowl 2026 Outing

Alix Earle And Tom Brady’s Relationship Status Revealed After Cosy Super Bowl 2026 Outing -

Why King Charles Has ‘no Choice’ Over Andrew Problem

Why King Charles Has ‘no Choice’ Over Andrew Problem -

Shamed Andrew Wants ‘grand Coffin’ Despite Tainting Nation

Shamed Andrew Wants ‘grand Coffin’ Despite Tainting Nation -

Keke Palmer Reveals How Motherhood Prepared Her For 'The Burbs' Role

Keke Palmer Reveals How Motherhood Prepared Her For 'The Burbs' Role -

King Charles Charms Crowds During Lancashire Tour

King Charles Charms Crowds During Lancashire Tour -

‘Disgraced’ Andrew Still Has Power To Shake King Charles’ Reign: Expert

‘Disgraced’ Andrew Still Has Power To Shake King Charles’ Reign: Expert -

Why Prince William Ground Breaking Saudi Tour Is Important

Why Prince William Ground Breaking Saudi Tour Is Important -

AOC Blasts Jake Paul Over Bad Bunny Slight: 'He Makes You Look Small'

AOC Blasts Jake Paul Over Bad Bunny Slight: 'He Makes You Look Small' -

At Least 53 Dead After Migrant Boat Capsizes Off Libya

At Least 53 Dead After Migrant Boat Capsizes Off Libya -

'God Of War' Announces Casting Major Key Role In Prime Video Show

'God Of War' Announces Casting Major Key Role In Prime Video Show -

Real Reason Prince William, Kate Broke Silence On Andrew Scandal Revealed

Real Reason Prince William, Kate Broke Silence On Andrew Scandal Revealed