Plan okayed to slap ban on import of 50 ‘luxury items’

The government does not want to impose a ban on the import of CKD and SKD cars and will seek cooperation from the industry players for slowing down imports for a few months period on account of balance of payment crisis

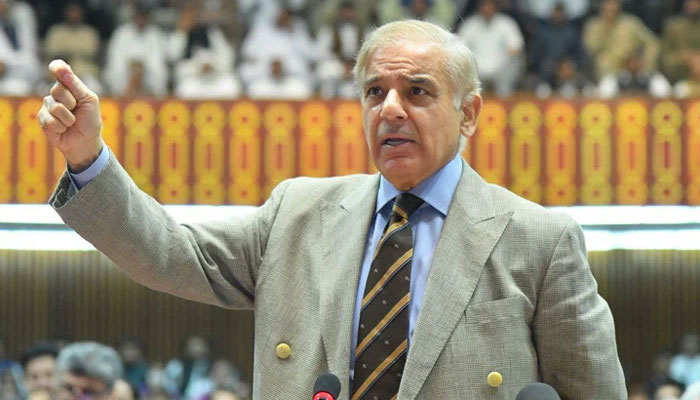

ISLAMABAD: In order to slash the burgeoning import bill, Prime Minister Shehbaz Sharif on Wednesday approved a plan to slap a ban on the import of 50 ‘luxury items’, including cars, mobile phones, cheese, jams, frozen food items, fish, dried fruit, cosmetics and tyres.

On the other hand, the rupee continued to nosedive against the dollar in both the currency markets on Wednesday on worry about politics and Fund bailout talks for clues to bolster dwindling foreign currency reserves and stabilise the currency.

Earlier, Wednesday, in the top functionaries meeting, chaired by Prime Minister Shehbaz Sharif, it was also decided that the Ministry of Industries and Engineering Development Board would be assigned to convince automakers to slash down imports of CKD (Completely Knocked Down) and Semi Knocked Down (SKD) cars. If the automakers did not cooperate with the government, then the import of different spare parts could also be considered for a complete ban.

However, the government does not want to impose a ban on the import of CKD and SKD cars and will seek cooperation from the industry players for slowing down imports for a few months period on account of balance of payment crisis.

Now this decision of imposing a ban will be linked to the approval of the World Trade Organization (WTO) and International Monetary Fund (IMF). The government has decided to consult the IMF review mission on the ban during the ongoing talks and then the federal cabinet’s approval will be sought to amend the Import Policy.

“We will have to follow a procedure to move ahead with imposition of ban on import of 50 luxury items. The WTO allows imposition of ban if its member country faces balance of payment crisis. But this ban can be imposed for a few months period only,” top official sources confirmed while talking to The News here on Wednesday.

The WTO consults with the IMF because it is the mandate of the lender of the last resort to gauge the economic health of loan recipient country. When the IMF certifies about the balance of payment crisis, then the WTO grants permission to slap ban on import of items for specified timeframe of few months period, ranging three to four months.

The decision is expected to be taken by the federal cabinet as Pakistani authorities are currently engaged with the IMF review mission in Doha (Qatar) to take them into confidence before moving ahead. However, the premier has granted his nod in principle to slap a complete ban on import of Completely Built Unit (CBUs) of cars, mobile phones, home appliances, frozen foods, ceramics, marbles and many other such items. “The government has estimated that the banning of luxury items in the range of 50 to 60 products could save $250 million on monthly basis,” top official sources confirmed while talking to The News here on Wednesday.

A high-level meeting chaired by Prime Minister Shehbaz Sharif considered different proposals for reducing the import bill. Pakistan’s import bill climbed to $65.5 billion in first 10 months (July-April) period of the current fiscal year and it is projected to touch $75-78 billion till end June 2022.

“We have decided imposing a ban on import of Completely Built Units (CBUs) vehicles, mobile phones, luxury food items such as frozen foods, fish, dry fruits (except Afghanistan) and many other items,” one senior official of the government disclosed on Wednesday.

The current account deficit surged to $13.3 billion for the first nine months and foreign currency reserves are depleting at an accelerated pace, so the government is left with no other option but to slap ban on import of 50 luxury items.

According to sources in the Federal Board of Revenue (FBR), a proposal to increase duty on the following items has been submitted: Regulatory duty on machinery will be up by 10% and home appliances by 50%; Power generation machinery regulations to go up by 30%; Steel products regulatory duty to go up by 10%; Duty on cars above 1,000cc to be up by 100% and 30% ACD

Regulatory duty on ceramics to be up by 40%; Duty on mobile phones to rise within a range of Rs6,000 to Rs44,000 per unit.

Meanwhile, the rupee dipped to another record low on Wednesday, falling past 200 to the dollar in the open market, continuing its sharp slide for the seventh consecutive session. It was trading at 200.50 versus the greenback, according to the rates quoted by the Exchange Companies Association of Pakistan. The local unit weakened by 2.50 rupees.

In the interbank market, the rupee breached the 198 level, hitting a new low against the dollar. It closed at 198.39 per dollar, down 1.34 percent from the previous close of 195.74. It traded as low as 199.50 in intraday trading. The rupee has been under pressure since the last 10 trading sessions, losing 6.65 percent versus the dollar.

Pakistan began negotiations with the IMF in Doha, Qatar, in an effort to secure more funds from a $6 billion financial package agreed in 2019 to help shore up its falling economy.

The coalition government sought to increase the size and duration of the loan programme as the foreign exchange reserves of the central bank declined to 10.3 billion during the week ending May 6 that can cover less than two months of imports. The government is struggling with soaring inflation, while a surging current account deficit amid higher imports is putting pressure on the rupee. The government is expected to withdraw energy subsidies and roll back unfunded subsidies to the oil and power sector.

“The government needs a positive indication at least this week from the IMF about the resumption of the loan facility. The currency is likely to be driven by the signals coming from the IMF on its reluctance to release the next loan tranche of around $1 billion,” said a forex trader.

“Not passing on the petroleum price increase has two effects: 1) external deficit increases as oil continues to be imported in larger volumes because of low domestic prices and 2) fiscal deficit and government borrowing rises because of subsidy instead of tax revenue on local petrol sales," said Saad Hashemy, the CEO at BMA Capital.

“The IMF will remain very critical of these two impacts and will push the government to pass on the price increase in fuel,” Hashemy added.

The PKR is falling because of not only the government not passing on the fuel price increase but also because of continued uncertainty on the local political and economic front, according to Hashemy.

The new government is concerned about the weak rupee as it is taking steps to contain unnecessary imports. The regulatory duties on a number of items such as power generation machinery, cars and mobile phones have been proposed in a bid to ease pressure on the forex reserves and the currency.

-

Prince Harry Warns Meghan Markle To 'step Back'

Prince Harry Warns Meghan Markle To 'step Back' -

Selena Gomez Explains Why She Thought Lupus Was 'life-or-death'

Selena Gomez Explains Why She Thought Lupus Was 'life-or-death' -

New Zealand Flood Crisis: State Of Emergency Declared As North Island Braces For More Storms

New Zealand Flood Crisis: State Of Emergency Declared As North Island Braces For More Storms -

Nancy Guthrie Case: Mystery Deepens As Unknown DNA Found At Property

Nancy Guthrie Case: Mystery Deepens As Unknown DNA Found At Property -

James Van Der Beek's Brother Breaks Silence On Actor's Tragic Death

James Van Der Beek's Brother Breaks Silence On Actor's Tragic Death -

Megan Thee Stallion On New Romance With Klay Thompson: 'I'm Comfy'

Megan Thee Stallion On New Romance With Klay Thompson: 'I'm Comfy' -

Nicole Kidman Celebrates Galentine’s Day Months After Keith Urban Split

Nicole Kidman Celebrates Galentine’s Day Months After Keith Urban Split -

Justin Bieber Unveils Hailey Bieber As First Face Of SKYLRK In Intimate Campaign Debut

Justin Bieber Unveils Hailey Bieber As First Face Of SKYLRK In Intimate Campaign Debut -

Caitlin O’Connor Says Fiance Joe Manganiello Has Changed Valentine’s Day For Her

Caitlin O’Connor Says Fiance Joe Manganiello Has Changed Valentine’s Day For Her -

Rachel Zoe Sends Out Message For Womne With Her Post-divorce Diamond Ring

Rachel Zoe Sends Out Message For Womne With Her Post-divorce Diamond Ring -

James Van Der Beek's Final Conversation With Director Roger Avary Laid Bare: 'We Cried'

James Van Der Beek's Final Conversation With Director Roger Avary Laid Bare: 'We Cried' -

Jaden Smith Walks Out Of Interview After Kanye West Question At Film Premiere

Jaden Smith Walks Out Of Interview After Kanye West Question At Film Premiere -

Michelle Obama Gets Candid About Spontaneous Decision At Piercings Tattoo

Michelle Obama Gets Candid About Spontaneous Decision At Piercings Tattoo -

Why Halle Berry Wasn't Ready For Marriage After Van Hunt Popped Question? Source

Why Halle Berry Wasn't Ready For Marriage After Van Hunt Popped Question? Source -

Bunnie Xo Shares Raw Confession After Year-long IVF Struggle

Bunnie Xo Shares Raw Confession After Year-long IVF Struggle -

Brooks Nader Reveals Why She Quit Fillers After Years

Brooks Nader Reveals Why She Quit Fillers After Years