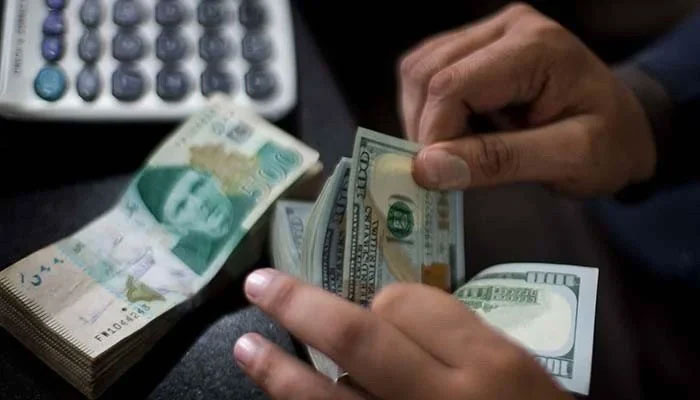

Ahead of IMF talks: Rupee breaches 199 level vs dollar in open market

The rupee was selling at 199.50 against the dollar in the kerb dealings, while some money changers even quoted it at 200

KARACHI: The rupee slumped to a new record low on Tuesday, breaching the level of 199 to the dollar in the open market on prevailing uncertainty on the resumption of the International Monetary Fund (IMF) bailout programme.

The rupee was selling at 199.50 against the dollar in the kerb dealings, while some money changers even quoted it at 200. However, the rates provided by the Exchange Companies Association of Pakistan (ECAP) showed that the rupee closed at 198 versus the greenback.

Zafar Paracha, the general secretary of ECAP, said the local currency continued its losing streak, tracking a steeper decline in the value of the rupee in the interbank market. “Despite a huge pressure on the currency, there is no speculative buying of dollars in the open market mainly because of the strict measures and good control of the central bank including a thorough know-your-customer and due diligence of each and every transaction,” Paracha said.

Paracha said the pressure on the rupee may ease if the government imposed ban on luxurious products and announced an economic emergency. “Decisions are necessary this week,” he added.

The rupee is likely to recover if the IMF bailout resumes as the IMF approval will unlock external funding from other bilateral and multilateral creditors, improving the country’s sovereign ratings

The rupee ended at 195.74 per dollar, it’s an all-time low closing for the sixth consecutive session in the interbank market. The rupee closed at 194.18 on Monday. The currency fell by 0.80 percent or 1.50 rupees.

“There is a level of uncertainty in the market as investors are worried on whether the new collation government is able to meet the IMF demand of eliminating energy subsidies at review meeting to be started from May 18 (Wednesday),” said a foreign exchange trader.

“The investors are looking at the IMF on when $1 billion funds will arrive to the country to bolster depleting foreign currency reserves and stabilize the economy,” he added.

The market is also waiting for the outcome of the meeting among Prime Minister Shehbaz Sharif and the coalition partners. The government is in the consultation process with the coalition parties to take tough decisions related to right the economy or to announce new elections.

Analysts said the rupee is gradually heading towards 200 in the interbank market days to come if the government doesn’t wake up to bring economic and political stability in the country.

“A balance of payments crisis is expected to climax soon if the government fails to arrange fast foreign assistance to foster the forex reserves as import payments continued going up due to more opening of letter of credit for import in anticipation of further weakness in the rupee, while exporters are not brining dollars to the market,” said an analyst.

However, some analysts said the increase in fuel prices is imminent however, it is being delayed on political grounds to make it a collective decision rather than just being PMLN’s decision alone.

“Though increased fuel prices will sharply increase the inflation reading in the months to come, it will reduce the fiscal strain of the government thereby reducing pressure on KIBOR. The decision will also reduce Pakistan’s default probability since the decision will pave the way for IMF’s help to finance the external imbalance and thereby reduce market risk premium,” said an analyst at Alfalah Securities in a report.

-

Ghost's Tobias Forge Makes Big Announcement After Concluding 'Skeletour World' Tour

Ghost's Tobias Forge Makes Big Announcement After Concluding 'Skeletour World' Tour -

Katherine Short Became Vocal ‘mental Illness’ Advocate Years Before Death

Katherine Short Became Vocal ‘mental Illness’ Advocate Years Before Death -

SK Hynix Unveils $15 Billion Semiconductor Facility Investment Plan In South Korea

SK Hynix Unveils $15 Billion Semiconductor Facility Investment Plan In South Korea -

Buckingham Palace Shares Major Update After Meghan Markle, Harry Arrived In Jordan

Buckingham Palace Shares Major Update After Meghan Markle, Harry Arrived In Jordan -

Demi Lovato Claims Fans Make Mental Health Struggle Easier

Demi Lovato Claims Fans Make Mental Health Struggle Easier -

King Hospitalized In Spain, Royal Family Confirms

King Hospitalized In Spain, Royal Family Confirms -

Japan Launches AI Robot Monk To Offer Spiritual Guidance

Japan Launches AI Robot Monk To Offer Spiritual Guidance -

Japan Plans Missile Deployment Near Taiwan By 2031 Amid Growing Regional Tensions

Japan Plans Missile Deployment Near Taiwan By 2031 Amid Growing Regional Tensions -

Meghan Markle, Prince Harry Spark Reactions With Latest Announcement

Meghan Markle, Prince Harry Spark Reactions With Latest Announcement -

Kate Hudson Reflects On Handling Award Season With No Expectations

Kate Hudson Reflects On Handling Award Season With No Expectations -

6 Celebrities Who Have Been Vocal About Anxiety And 'panic Attacks'

6 Celebrities Who Have Been Vocal About Anxiety And 'panic Attacks' -

Is This The Future Of Train Travel? Robot Dogs, Drones Are Redefining Public Transit Safety Through China’s New Metro Station Deployment

Is This The Future Of Train Travel? Robot Dogs, Drones Are Redefining Public Transit Safety Through China’s New Metro Station Deployment -

Sarah Ferguson Seeks Hollywood Backing As Epstein Files Resurface

Sarah Ferguson Seeks Hollywood Backing As Epstein Files Resurface -

China’s AI Milestone: ByteDance’s Doubao Chatbot Hits 100M Users During Lunar New Year

China’s AI Milestone: ByteDance’s Doubao Chatbot Hits 100M Users During Lunar New Year -

Think You Know ChatGPT? Here Are 5 AI Levels You’ve Never Seen

Think You Know ChatGPT? Here Are 5 AI Levels You’ve Never Seen -

Bitcoin Bounces From $62,000 As On-chain Metrics Signal Prolonged Weakness: Here Is Everything To Know

Bitcoin Bounces From $62,000 As On-chain Metrics Signal Prolonged Weakness: Here Is Everything To Know