KTBA suggests taxing property traders as ‘separate income class’

KARACHI: Tax practitioners have suggested the Federal Board of Revenue (FBR) to establish a mechanism to tax and regulate the real estate sector for curbing informality, property speculation, money laundering and terror financing.

The Karachi Tax Bar Association (KTBA) on Tuesday asked the FBR to establish a separate class of property traders to deal with these matters, as it would not only help increase the bureau’s revenues but also aid in normalising the increasing property rates.

“Taxation on trading of real estate in Pakistan has either been symbolic or otherwise avoided purposely,” read the KTBA document.

Consequently, trading in the real-estate sector was the single largest factor creating “a huge informal economy” or a “haven to evade taxes in Pakistan”.

Other detrimental consequences of this scenario were money laundering

and terror financing. International donors/regulators have time and again suggested steps to improve the situation, it added.

As a part of its annual exercise, the KTBA has put this suggestion in its proposal to the FBR for the Fiscal Year 2022 in the regimes of income tax and sales taxes.

KTBA has proposed that a new head of income in Section 11 of Income Tax Ordinance 2001 should be added as income from disposal and trading of real estate containing progressive taxation, without allowing any exemption as to holding period and quantum of gain.

It suggested that holding periods of two years or less should be taxed at 20 per cent (rate of tax on gain). Selling property before five years should be taxed 17.5 per cent.

Holding periods of below 10 but above five years should be taxed 15 per cent and more than 10 years, at 10 per cent.

Presently, there was a 10 per cent tax on gain if a property was sold in one year. The tax reduces to five per cent in the second year and 2.5 per cent in the third year. There was no tax on gain if a property was sold after four years.

A separate definition of income from disposal and trading of real estate was suggested.

A separate “Real Estate Regulatory Authority” has also been suggested in the proposal. Meanwhile, the director general commissioner should also be empowered to seek a report from the valuer on any transaction of real estate trading.

“This will strengthen the taxation system and the FBR will be able to collect tax from the elite class,” said KTBA President Zeeshan Merchant.

“Brokers and real estate agents have not been taxed. They should be taxed just like the salaried class or business class have been taxed.”

He said that taxing the property traders would help in increasing tax collection and document economy. It would also normalise property prices and genuine buyers (who buy property for accommodation) would be the ones buying property.

-

ByteDance’s New AI Video Model ‘Seedance 2.0’ Goes Viral

ByteDance’s New AI Video Model ‘Seedance 2.0’ Goes Viral -

Archaeologists Unearthed Possible Fragments Of Hannibal’s War Elephant In Spain

Archaeologists Unearthed Possible Fragments Of Hannibal’s War Elephant In Spain -

Khloe Kardashian Reveals Why She Slapped Ex Tristan Thompson

Khloe Kardashian Reveals Why She Slapped Ex Tristan Thompson -

‘The Distance’ Song Mastermind, Late Greg Brown Receives Tributes

‘The Distance’ Song Mastermind, Late Greg Brown Receives Tributes -

Taylor Armstrong Walks Back Remarks On Bad Bunny's Super Bowl Show

Taylor Armstrong Walks Back Remarks On Bad Bunny's Super Bowl Show -

James Van Der Beek's Impact Post Death With Bowel Cancer On The Rise

James Van Der Beek's Impact Post Death With Bowel Cancer On The Rise -

Pal Exposes Sarah Ferguson’s Plans For Her New Home, Settling Down And Post-Andrew Life

Pal Exposes Sarah Ferguson’s Plans For Her New Home, Settling Down And Post-Andrew Life -

Blake Lively, Justin Baldoni At Odds With Each Other Over Settlement

Blake Lively, Justin Baldoni At Odds With Each Other Over Settlement -

Thomas Tuchel Set For England Contract Extension Through Euro 2028

Thomas Tuchel Set For England Contract Extension Through Euro 2028 -

South Korea Ex-interior Minister Jailed For 7 Years In Martial Law Case

South Korea Ex-interior Minister Jailed For 7 Years In Martial Law Case -

UK Economy Shows Modest Growth Of 0.1% Amid Ongoing Budget Uncertainty

UK Economy Shows Modest Growth Of 0.1% Amid Ongoing Budget Uncertainty -

James Van Der Beek's Family Received Strong Financial Help From Actor's Fans

James Van Der Beek's Family Received Strong Financial Help From Actor's Fans -

Alfonso Ribeiro Vows To Be James Van Der Beek Daughter Godfather

Alfonso Ribeiro Vows To Be James Van Der Beek Daughter Godfather -

Elon Musk Unveils X Money Beta: ‘Game Changer’ For Digital Payments?

Elon Musk Unveils X Money Beta: ‘Game Changer’ For Digital Payments? -

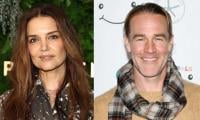

Katie Holmes Reacts To James Van Der Beek's Tragic Death: 'I Mourn This Loss'

Katie Holmes Reacts To James Van Der Beek's Tragic Death: 'I Mourn This Loss' -

Bella Hadid Talks About Suffering From Lyme Disease

Bella Hadid Talks About Suffering From Lyme Disease