Rupee pressured by rising trade balance: Deutsche Bank

KARACHI: Pakistan’s currency could be weakened as the surge in energy and commodities prices deepens the nation’s current account deficit, according to Deutsche Bank AG’s country head, referring to the broadest measure of trade, Bloomberg reported on Thursday.

“That’s a key concern for the economy and for the business community,” the bank’s chief country officer, Syed Kamran Zaidi, said in an interview. “That is obviously something which the banks are also cautious about.”

The South Asian nation, which imports most of its fuel needs, saw its energy bill rise to $13 billion in the first eight months of the year that started in July, more than double the same period of the last fiscal, according to government data.

Costs could increase further as oil prices have since surged above $100 a barrel amid supply concerns following Russia’s invasion of Ukraine.

A weaker rupee may be among the factors that pressure the central bank to raise borrowing costs, he added, estimating the benchmark target rate to increase between 50 and 100 basis points in the next few meetings, after being left unchanged for the previous two.

“The market has already incorporated this change as can be seen by secondary market yields of Treasury Bills and Pakistan Investment Bonds” that reflect short- and long-tenor instruments, said Zaidi.

Pakistan’s short-term bond yields have increased by at least 150 basis points in the past month, according to central bank data. Meanwhile, Pakistan’s rupee slipped for a seventh day to a record low 181.73 per dollar on Tuesday. Zaidi declined to share a forecast for the rupee.

The current account last month was a $545 million deficit, narrower than the $2.5 billion record shortfall in January, but still more than 16-times larger than the same month last year, according to central bank data.

The Frankfurt-based firm, which has been in Pakistan for 60 years, has described itself as one of the largest custodian businesses in the country and facilitates more than 40% of onshore institutional investment flows. It only offers corporate and not consumer banking in Pakistan. It has also launched a new foreign exchange trading platform for corporate clients in Pakistan.

Zaidi added that “Pakistan will be in good shape” longer term, partly on rising exports, and that many multinational firms are bullish on the country and a few rank Pakistan among their top five destinations.

At least two of those companies are planning new factories in Pakistan, he said, declining to provide details as the information is private.

-

Michael B. Jordan Makes Bombshell Confession At Actor Awards After BAFTA Controversy: 'Unbelievable'

Michael B. Jordan Makes Bombshell Confession At Actor Awards After BAFTA Controversy: 'Unbelievable' -

Prince William Willing To Walk Road He ‘loathes’ For ‘horror Show’ Escape: ‘He’s Running Out Of Allies Fast’

Prince William Willing To Walk Road He ‘loathes’ For ‘horror Show’ Escape: ‘He’s Running Out Of Allies Fast’ -

Pentagon Says No Evidence Iran Planned Attack On US, Undercutting Strike Justification

Pentagon Says No Evidence Iran Planned Attack On US, Undercutting Strike Justification -

Prince William’s Changes Priorities With Harry After Kate Middleton’s Remission: ‘It Couldn't Be Worse’

Prince William’s Changes Priorities With Harry After Kate Middleton’s Remission: ‘It Couldn't Be Worse’ -

Justin Bieber Gets Touching Tribute From Mom Pattie Mallette On Turning 32 Amid Limited-edition Birthday Drop

Justin Bieber Gets Touching Tribute From Mom Pattie Mallette On Turning 32 Amid Limited-edition Birthday Drop -

Jada Pinkett Smith Details How Her Memoir Combats 'shame' Around Alopecia

Jada Pinkett Smith Details How Her Memoir Combats 'shame' Around Alopecia -

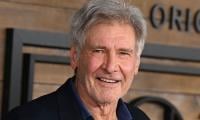

Harrison Ford Reflects On Career As He Receives Life Achievement Award At 2026 Actor Awards

Harrison Ford Reflects On Career As He Receives Life Achievement Award At 2026 Actor Awards -

Timothee Chalamet's Red Carpet Date For Actor Awards Not Kylie Jenner This Year

Timothee Chalamet's Red Carpet Date For Actor Awards Not Kylie Jenner This Year -

Weather Forecast For Tomorrow: Wintry Mix Overnight And Warmer Temps Midweek

Weather Forecast For Tomorrow: Wintry Mix Overnight And Warmer Temps Midweek -

Keith Urban 'solitary' Life Laid Bare After Nicole Kidman Split

Keith Urban 'solitary' Life Laid Bare After Nicole Kidman Split -

SAG Actor Awards 2026 Winners: Complete List

SAG Actor Awards 2026 Winners: Complete List -

UK Asylum System Faces Changes As Refugees Will Get Temporary Protection Only

UK Asylum System Faces Changes As Refugees Will Get Temporary Protection Only -

Meghan Markle Has Realised ‘star Power’ Is Not Enough After Jordan Trip

Meghan Markle Has Realised ‘star Power’ Is Not Enough After Jordan Trip -

USC Leading Scorer Chad Baker-Mazara Leaves Program Amid Losing Streak

USC Leading Scorer Chad Baker-Mazara Leaves Program Amid Losing Streak -

Google Is Winding Down Popular App 'Pixel Studio': Here's Why

Google Is Winding Down Popular App 'Pixel Studio': Here's Why -

Zendaya, Tom Holland Secretly Married?

Zendaya, Tom Holland Secretly Married?