Surging oil, political uncertainty Stocks shed massive 1,284 points

KARACHI: Stocks on Monday hit a tailspin in tow with a global rout, mostly after crude oil spiked to its highest level since 2008, while local political tumult that's gaining traction by the day also weighed, traders said.

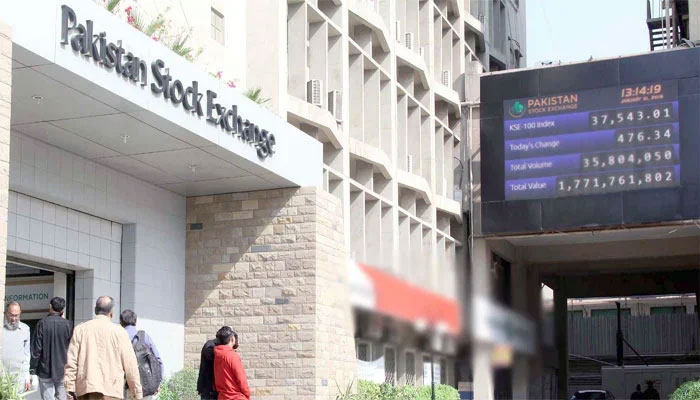

KSE-100 Share Index, the main gauge of the country’s capital market, shed a staggering 1,284.38 points or 2.88 percent to close at 43,266.97 points at Pakistan Stock Exchange (PSX), after wildly swinging between a high of 44,551.35 and a low of 43,049.41 points in the day trade.

Brent index spiked to above $139/bbl, before easing back to below $130/bbl. Analysts at AKD Research, higher oil prices may trigger a global recession, like one triggered by Middle-eastern oil embargo of 1970s, and Pakistan would be no different.

“In Pakistan’s case, the risks get magnified further as the country is already struggling with elevated current account deficit, which may touch around US$18bn in FY2022 (~5.2 percent of GDP),” the brokerage said. “I had said if oil prices increased over $125/bbl things would take a turn for the worse,” said Zafar Moti, a former director of PSX.

Moti said on the local front cement sector suffered hugely as coal prices are set to burn their revenues. The crash started from Japan and spread to Hong Kong, China, India and across the world, he said.

“Kyiv’s siege and soaring oil prices coupled with local political commotion bulldozed the sentiment amid renewed security concerns, especially after Peshawar terrorism incident, turmoil is likely to stay for a while,” said Moti.

KSE-30 Share Index also sank 604.12 points or 3.47 percent to 16,824.73 points compared with 17,428.85 points recorded in the last session.

Traded voulme shrank 102 million shares to 236.88 million from 134.79 million, while value also increased to Rs8.211 billion from Rs4.736 billion. Market capital narrowed to Rs7.445 trillion from Rs7.659 trillion. Out of 358 companies active in the session, 41 posted gains, 301 losses, while 16 remained unchanged.

Ahsan Mehanti, an analyst at Arif Habib Corp, said, stocks fell across the board on global equity selloff and uncertainty over SBP (State Bank of Pakistan) policy announcement tomorrow. FATF’s decision over keeping Pakistan in the grey list over unmet targets until June 2022 and record surge in global crude oil prices, which was likely to impact current account balance, crushed the stocks, Mehanti said.

During the trade, the highest increase was recorded in shares of Rafhan Maize, which rose Rs99 to Rs11,799/share, followed by Sapphire Textile that jumped Rs46.98 to Rs949.96/share.

Share prices of Premium Textile suffered the worst losses, falling Rs54 to Rs666 per share, followed by Sapphire Fiber, by Rs66.75 to Rs823.25 per share.

Topline Securities said the equities witnessed a selling spree across the board as Russia-Ukraine conflict deteriorated over the last weekend. “Global commodity prices (oil, coal, wheat, and other major ones), which are already trading at their multiyear highs, further escalated due to the aforesaid dispute,” the brokerage said.

Moreover, it said negative local political vibes further added fuel to the fire and the market nosedived as a result. Cement, power, technology, and banking stocks took the major hit where LUCK, HUBC, TRG, SYS, and HBL cumulatively lost 275 points, while NATF, AICL, and DCR together added 25 points to the index.

Hum Network was the volume leader with 20.07 million shares, followed by WorldCall Telecom with 11.54 million shares. Stocks that recorded significant turnover included Flying cement (R), TRG Pakistan Ltd, Telecard Limited, Ghani Global Holding, Unity Foods Ltd, Oil & Gas Development Company, Cnergyico PK, and Dost Steels Ltd. Futures contracts turnover nearly doubled to 63.97 million shares from 38.57 million recorded on the last trading day.

-

Travis Kelce Plays Key Role In Taylor Swift's 'Opalite' Remix

Travis Kelce Plays Key Role In Taylor Swift's 'Opalite' Remix -

How Jennifer Aniston's 57th Birthday Went With Boyfriend Jim Curtis

How Jennifer Aniston's 57th Birthday Went With Boyfriend Jim Curtis -

JoJo Siwa Shares Inspiring Words With Young Changemakers

JoJo Siwa Shares Inspiring Words With Young Changemakers -

James Van Der Beek Loved Ones Breaks Silence After Fundraiser Hits $2.2M

James Van Der Beek Loved Ones Breaks Silence After Fundraiser Hits $2.2M -

Disney’s $336m 'Snow White' Remake Ends With $170m Box Office Loss: Report

Disney’s $336m 'Snow White' Remake Ends With $170m Box Office Loss: Report -

Travis Kelce's Mom Donna Kelce Breaks Silence On His Retirement Plans

Travis Kelce's Mom Donna Kelce Breaks Silence On His Retirement Plans -

Premiere Date Of 'Spider-Noir' Featuring Nicolas Cage Announced

Premiere Date Of 'Spider-Noir' Featuring Nicolas Cage Announced -

Pedro Pascal's Sister Reveals His Reaction To Her 'The Beauty' Role

Pedro Pascal's Sister Reveals His Reaction To Her 'The Beauty' Role -

Kate Middleton Proves She's True 'children's Princess' With THIS Move

Kate Middleton Proves She's True 'children's Princess' With THIS Move -

Paul Anka Reveals How He Raised Son Ethan Differently From His Daughters

Paul Anka Reveals How He Raised Son Ethan Differently From His Daughters -

'A Very Special Visitor' Meets Queen Camilla At Clarence House

'A Very Special Visitor' Meets Queen Camilla At Clarence House -

Jodie Turner Smith Shares One Strict Rule She Follows As A Mom

Jodie Turner Smith Shares One Strict Rule She Follows As A Mom -

Hailey Bieber Reveals KEY To Balancing Motherhood With Career

Hailey Bieber Reveals KEY To Balancing Motherhood With Career -

Photo Of Jay-Z, Other Prominent Figures With Jeffrey Epstein Proven To Be Fake

Photo Of Jay-Z, Other Prominent Figures With Jeffrey Epstein Proven To Be Fake -

Hillary Clinton's Munich Train Video Sparks Conspiracy Theories

Hillary Clinton's Munich Train Video Sparks Conspiracy Theories -

Fans Slam Talk Show Host For 'cringe' Behavior In Chris Hemsworth Interview

Fans Slam Talk Show Host For 'cringe' Behavior In Chris Hemsworth Interview