External sector vulnerabilities multiply: Pakistan has to pay $8.638 bn foreign loans till June

Dr Hafiz Pasha says that foreign debt obligation has become a monster for Pakistan

ISLAMABAD: Pakistan’s external sector vulnerabilities have multiplied and touched alarming levels as official data confirms that Islamabad will have to pay back a bulk amount of $8.638 billion on account of foreign loans in the second half (Dec-June) period of the current fiscal year. The repayment of foreign loans has gone up by 399 percent in the last four years in rupee term. It stood at Rs286.6 billion in 2017-18 and now it is estimated at Rs1,427.5 billion. In dollar terms, Pakistan had to repay foreign loans, both the principal and mark-up, to the tune of over $12.4 billion.

With the prevailing situation of the external sector, if the IMF program does not revive by the end of January or early February 2022, then a full-fledged crisis will be knocking at the doors of Pakistan’s struggling economy by end of the current fiscal year.

Amid the yawning Current Account Deficit (CAD) and decreasing foreign exchange reserves despite receiving generous dollar inflows of $3 billion from Saudi Arabia, over $2 billion from the IMF, $1 billion through International Eurobond in the first half (July-Dec) period, the foreign currency reserves stood at $17.6 billion held by the State Bank of Pakistan (SBP) till December 31, 2021. The foreign exchange reserves held by the SBP stood at $17.8 billion in July 2021. Despite dollar inflows of around $6 billion, the foreign exchange reserves could not be built up in the first six months of the current fiscal year.

According to the official data available with The News, the country paid out in the shape of principle and mark up on account of foreign loans to the tune of $3.78 billion during the first five months (July-Nov) period of the current fiscal year.

Why did an alarming situation emerge? Now the major bulk repayment on account of foreign loan obligation would become due during December to June period of the fiscal year 2021-22 that runs into over $8.6 billion. If the IMF program does not revive till the end of January or early February 2022, then it will become difficult for Pakistan to avoid depletion of foreign currency reserves held by the SBP.

This scribe sent out a written question to the spokesperson of the Economic Affairs Division (EAD) for getting the official version. It was confirmed that Pakistan's total foreign repayments stood at over $12.3 billion during the current fiscal year, including principal and interest repayments.

This scribe contacted former finance minister Dr Hafiz A Pasha and inquired from him about the increased external sector vulnerabilities. He said, "The situation has become difficult as the country’s external financing requirements climbed to at least $30 billion on a short-term basis." It depicts a horrifying picture and cited the example of Sri Lanka whereby the country’s foreign exchange reserves stood close to $1 billion but its debt obligations were more than $7 to $8 billion. He said that now Sri Lanka’s foreign minister in his statement, had refused to go to the IMF and indicated that they would approach China to help them to pay off their debt obligations and in return, they might hand over one of their ports to Beijing.

Dr Pasha said that foreign debt obligation became a monster as the country would have to pay back the bulk of the amount of over $8 billion in the second half of the current fiscal year. He was of the view that the debt repayment would further escalate in the next fiscal year 2022-23 exactly at a time when the country would be entering into a fever of electioneering after completion of a five-year term by the incumbent ruling regime. He said that the current account deficit might touch $15 to $16 billion for the current fiscal year. In such a scenario, he warned that the foreign currency reserves might start declining, so there are fears of the eruption of a full-fledged balance of payment crisis on the horizon of Pakistan’s economy.

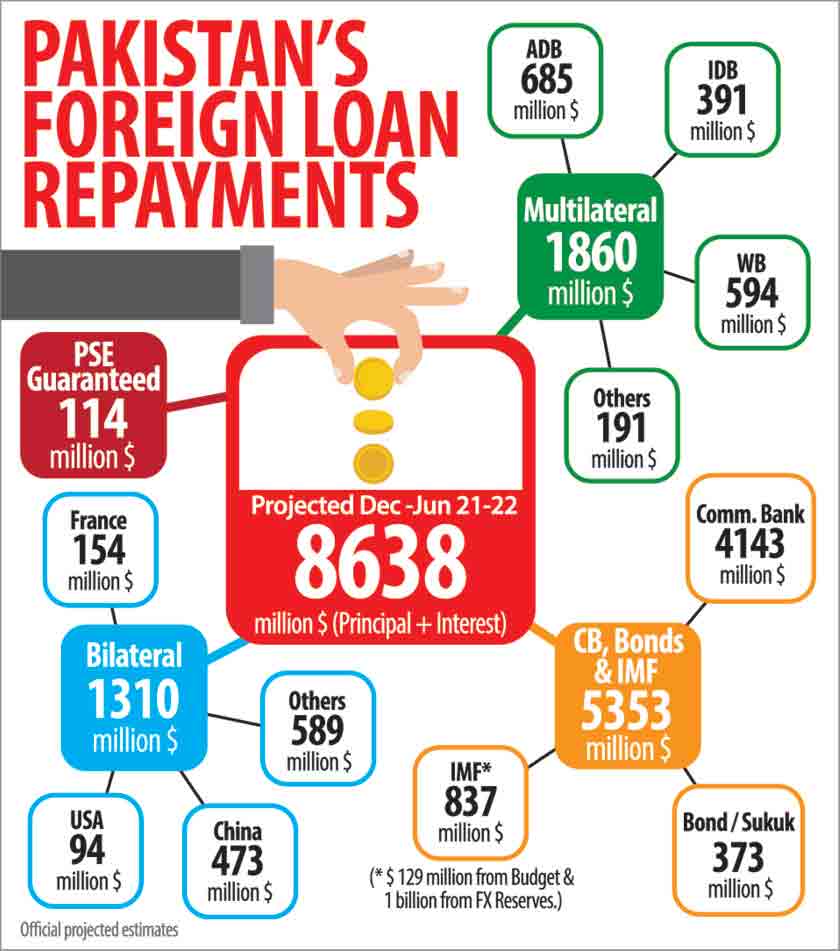

Official data available with The News reveals that Pakistan paid back the principal and mark-up of $3.7 billion on the account of foreign loans during the first five months (July-Nov) period of the current fiscal year out of which $974 million were paid back to multilateral donors, $34 million to bilateral creditors, $2.74 billion to commercial banks, international bonds, and IMF.

In the next seven-month (Dec-June) period of 2021-22, Pakistan is projected to pay back on account of both principal and mark-up of $8.638 billion out of which $1.860 billion would be paid back to multilateral donors, $1.310 billion to bilateral donors and a major chunk of $5.353 billion to commercial banks, Bond/Sukuk and the IMF. The foreign loan repayment on account of PSEs guarantees is projected at $114 million in the second half of the current fiscal year, so total outstanding foreign debt liabilities climbed to $8.63 billion.

Further research done by this scribe also revealed that the foreign loan repayments in rupee term escalated manifold in recent years as it stood at Rs286.6 billion in the fiscal year 2017-18 when the PMLN led government ended after the completion of five years. Now foreign loan repayment has been estimated at Rs1,427.5 billion, or 399 percent. The foreign loan repayment stood at Rs1,228.8 billion in the fiscal year 2020-21, Rs1,095.2 billion in FY2019-20, and Rs601.7 billion in 2018-19, Rs286 billion in FY2017-18 and Rs443.6 billion in FY2016-17.

The repayment of foreign loans obligations stood at Rs215.9 billion in the fiscal year 2012-13 when the PPP-led government ended its five-year term. The foreign loans repayment stood at Rs132.4 billion during the fiscal year 2009-10.

In a comparison of the last 12 years starting from the fiscal year 2009-10 to 2021-22, the foreign loan repayment escalated from Rs132.4 billion in 2009-10 to Rs1,427.5 billion in 2021-22. It has gone up at supersonic speed, increasing vulnerabilities on the external front manifold.

When contacted, former Director-General Economic Reform Unit (ERU) Ministry of Finance, Dr. Khaqan Najeeb, on Thursday said Pakistani authorities must remain vigilant about Pakistan’s external financing needs. These needs can be broadly understood as short, medium- and long-term debt of the country becoming payable during a fiscal year, plus the current account deficit.

The external financing requirement for Pakistan is likely to exceed $27 billion for FY2022. This is after assuming that the Chinese safe deposit of $4 billion would be rolled over, he added. Authorities have to ensure envisaged sources of external funding are more than sufficient to meet these high external financing needs in FY22.

Dr. Khaqan highlighted some concerns based on the analyses of the data for the first half of FY22. The debt repayment made on external loans of the government in the first six months is only $3.7 billion. The annual liability is estimated at $12.4 billion. Therefore, the much higher repayment of $8.7 billion in the second half of FY2022 can put pressure on the country’s balance of payments.

He said considering the external needs, Pakistan’s ability to complete IMF's 6th review is thus crucial for securing the $1 billion and for access to other creditors. The IMF approval can ensure continued access to concessional multilateral financing, private creditors' money, and the country’s ability to float bonds in international markets. In addition, ensuring a budgeted amount of foreign direct investment is also essential. We must remember all this money is necessary to meet the $27 billion need.

While commenting on the current account deficit explained, he said that it had become larger than initially anticipated. Whereas authorities had initial estimates of 3 percent of GDP, the current account deficit is likely to now be near 5 percent of GDP in FY2022. This will be the largest deficit after FY2018. The trend of the current account deficit has remained elevated on a monthly basis at an average of over $1.4 billion for the first five months of FY2022. It is hoped the heavy adjustment of the rupee as well other containment measures taken by the authorities are able to bring down the widening deficit in the coming months.

He pointed out three other areas of concern for the balance of payments. In recent months, remittances to Pakistan have begun to decline as the global lockdown is scaled down. The price of Brent (oil) has bounced back beyond $84 a barrel with some analysts pointing to a rising trend. The rising demand for food and related items continues to hike the import bill like the recent import of urea of 50,000 tons. The urea shortage in the country could adversely affect the Rabi crops. All these trends could exert pressure on the country’s balance of payment and need sound monitoring by the government and taking timely remedial steps if needed, he concluded.

-

King Charles ‘very Much’ Wants Andrew To Testify At US Congress

King Charles ‘very Much’ Wants Andrew To Testify At US Congress -

Rosie O’Donnell Secretly Returned To US To Test Safety

Rosie O’Donnell Secretly Returned To US To Test Safety -

Meghan Markle, Prince Harry Spotted On Date Night On Valentine’s Day

Meghan Markle, Prince Harry Spotted On Date Night On Valentine’s Day -

King Charles Butler Spills Valentine’s Day Dinner Blunders

King Charles Butler Spills Valentine’s Day Dinner Blunders -

Brooklyn Beckham Hits Back At Gordon Ramsay With Subtle Move Over Remark On His Personal Life

Brooklyn Beckham Hits Back At Gordon Ramsay With Subtle Move Over Remark On His Personal Life -

Meghan Markle Showcases Princess Lilibet Face On Valentine’s Day

Meghan Markle Showcases Princess Lilibet Face On Valentine’s Day -

Harry Styles Opens Up About Isolation After One Direction Split

Harry Styles Opens Up About Isolation After One Direction Split -

Shamed Andrew Was ‘face To Face’ With Epstein Files, Mocked For Lying

Shamed Andrew Was ‘face To Face’ With Epstein Files, Mocked For Lying -

Kanye West Projected To Explode Music Charts With 'Bully' After He Apologized Over Antisemitism

Kanye West Projected To Explode Music Charts With 'Bully' After He Apologized Over Antisemitism -

Leighton Meester Reflects On How Valentine’s Day Feels Like Now

Leighton Meester Reflects On How Valentine’s Day Feels Like Now -

Sarah Ferguson ‘won’t Let Go Without A Fight’ After Royal Exile

Sarah Ferguson ‘won’t Let Go Without A Fight’ After Royal Exile -

Adam Sandler Makes Brutal Confession: 'I Do Not Love Comedy First'

Adam Sandler Makes Brutal Confession: 'I Do Not Love Comedy First' -

'Harry Potter' Star Rupert Grint Shares Where He Stands Politically

'Harry Potter' Star Rupert Grint Shares Where He Stands Politically -

Drama Outside Nancy Guthrie's Home Unfolds Described As 'circus'

Drama Outside Nancy Guthrie's Home Unfolds Described As 'circus' -

Marco Rubio Sends Message Of Unity To Europe

Marco Rubio Sends Message Of Unity To Europe -

Savannah's Interview With Epstein Victim, Who Sued UK's Andrew, Surfaces Amid Guthrie Abduction

Savannah's Interview With Epstein Victim, Who Sued UK's Andrew, Surfaces Amid Guthrie Abduction