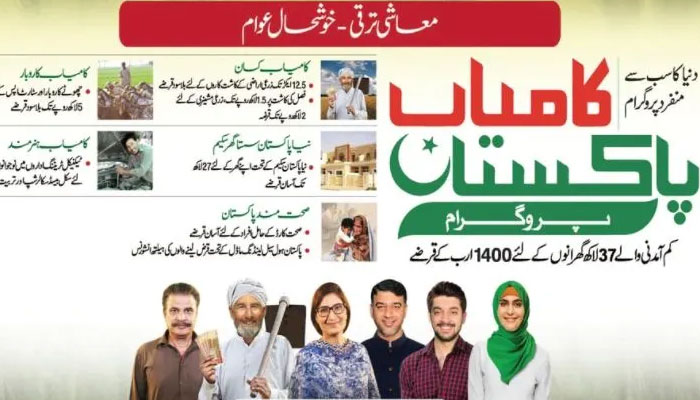

Kamyab Pakistan Programme: Govt picks three banks for disbursement of Rs30 bn loans

ISLAMABAD: The government has selected three commercial banks including the National Bank of Pakistan, Habib Bank Limited and Bank of Punjab for the disbursement of a total of Rs30 billion loans amount in three months’ period under the much-hyped Kamyab Pakistan Program (KPP).

Out of total five bids received from the four commercial banks and one from Pakistan Mortgage Refinance Company (PMRC) for participating in the bidding for KPP, the Ministry of Finance selected three commercial banks, including the NBP, HBL, and BoP with a guarantee for provision of 50 percent amount to the tune of Rs15 billion, including nine billion rupees from the Bank of Punjab, three billion rupees from HBL and three billion rupees from the NBP.

After the inclusion of 50 percent more amount by each of the selected banks, the Bank of Punjab would disburse Rs18 billion, NBP Rs6 billion, and HBL remaining Rs6 billion for the disbursement of the total amount of Rs30 billion among the borrowers during three months (November to January) period of the current fiscal year 2021-22.

The official sources said that the two biddings were rejected which were received from Askari Bank Limited and PMRC as the one bidding document was received unsealed and the per-month amount was below the target of one billion rupees per-month basis. In the second rejected bid offer, the amount of one billion rupees was offered for three months, so it was also rejected by the government.

Against the demand of 100 percent guarantees sought by the banks, the Ministry of Finance has provided a 50 percent guarantee, so the remaining 50 percent of the disbursed amount will have to be arranged by the banks by themselves keeping in view their involved risks.

The Ministry of Finance will provide a mark-up subsidy to the tune of KIBOR plus nine percent on three major schemes under the KPP, including the Kamyab Karobar programme, Kamyab Kissan programme and the low-cost housing schemes.

In case of default, the Ministry of Finance and the respective commercial banks will bear the cost on the basis of 50:50 percent respectively. The banks wanted the default amount be borne by the government from 51 percent but the government did not accept it.

For three major schemes, such as Kamyab Karobar, Kamyab Kissan, and the low-cost housing schemes, the markup subsidies paid out to the wholesale lenders, such as the banks and DFIs will be hovering around one year as the Karachi Inter-Bank Offered Rates (KIBOR) plus eight to nine percent interest rate. So the total interest rate borne by the government will be standing at 17 to 18 percent on the three schemes of KPP.

The government will provide a 10 percent default loss to the Executing Agencies (EAs) for Kamyab Pakistan Micro Loans portfolios booked under the KPP. The programme has been designed to ensure there are minimal claims under the guarantee of the federal government.

The payment of credit loss subsidy to the executing agencies and the wholesale lenders will be made up to 10 percent and 50 percent of the disbursed portfolio, respectively, under the program on a quarterly basis through the SBP. The loan application form (LAF) to be used by all those participating will contain the Kamyab Pakistan logo.

A subsidy of Rs 30 to 35 billion will be given from the budget to pick the 17 to 18 percent interest cost. The sources said that now more banks have started approaching to get selected for participating in the KPP for the upcoming quarter of the current fiscal year. It is yet to be seen how the KPP schemes will get momentum and how much amount of the loan will be disbursed among the borrowers in the three-month period.

-

'The Wrong Paris' Star Veronica Long Shares What New Crime Series 'Blue Skies' Is About

'The Wrong Paris' Star Veronica Long Shares What New Crime Series 'Blue Skies' Is About -

King Charles Remains Immersed In Work Amid Andrew Scrutiny

King Charles Remains Immersed In Work Amid Andrew Scrutiny -

Bobby J. Brown's Passing Adds To Growing List Of Celebrity Deaths In 2026

Bobby J. Brown's Passing Adds To Growing List Of Celebrity Deaths In 2026 -

Prince William Fears For Andrew's Mental Health

Prince William Fears For Andrew's Mental Health -

Paige DeSorbo Breaks Silence On New Relationship With Joe D'Amelio

Paige DeSorbo Breaks Silence On New Relationship With Joe D'Amelio -

'Marshals' Showrunner Reveals If Kayce And Beth Will Cross Paths In 'Yellowstone' Spinoff

'Marshals' Showrunner Reveals If Kayce And Beth Will Cross Paths In 'Yellowstone' Spinoff -

Belgium Watchdog Launches Antitrust Probe Into Google Ads Business

Belgium Watchdog Launches Antitrust Probe Into Google Ads Business -

Andrew Ready To Fight Back: 'He's Very Vengeful'

Andrew Ready To Fight Back: 'He's Very Vengeful' -

After Surpassing 100 Million YouTube Subscribers, BLACKPINK Returns With New Release

After Surpassing 100 Million YouTube Subscribers, BLACKPINK Returns With New Release -

Rihanna Sends Fans Into Frenzy With BTS Footage Of Music Making: Watch

Rihanna Sends Fans Into Frenzy With BTS Footage Of Music Making: Watch -

More Americans Say They Sympathise With Palestinians Than Israelis, Poll Finds

More Americans Say They Sympathise With Palestinians Than Israelis, Poll Finds -

Princess Finally Releases Meghan Markle, Prince Harry's Photos

Princess Finally Releases Meghan Markle, Prince Harry's Photos -

Victoria Beckham Makes Exciting Announcement Amid Ongoing Rift With Brooklyn Beckham

Victoria Beckham Makes Exciting Announcement Amid Ongoing Rift With Brooklyn Beckham -

King Charles Receives Major Blow After Meghan Markle, Harry's Trip

King Charles Receives Major Blow After Meghan Markle, Harry's Trip -

Kate Middleton Apologizes After Her Umbrella Bumps Child's Head

Kate Middleton Apologizes After Her Umbrella Bumps Child's Head -

Retired US Fighter Pilot Arrested Over Alleged Training Of Chinese Military

Retired US Fighter Pilot Arrested Over Alleged Training Of Chinese Military