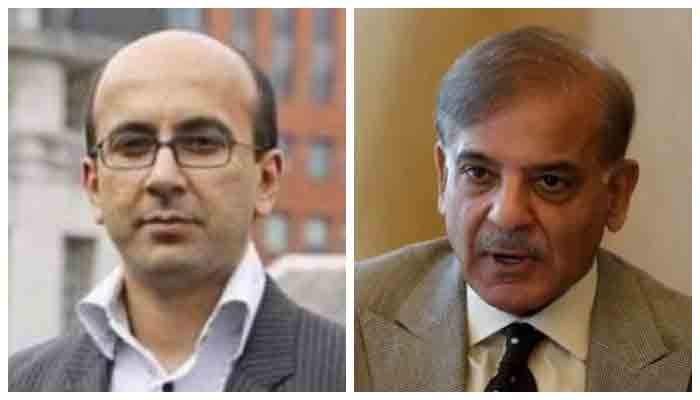

NCA Money-laundering probe: Shehbaz Sharif probed for purchasing London flat on loan from Aneel Musarrat

The NCA’s International Corruption Unit had asked Shehbaz to provide full detail of the loan of £59,993 from Aneel Musarrat

LONDON: The UK’s National Crime Agency (NCA) investigated Leader of the Opposition in the National Assembly Shehbaz Sharif in relation to purchase of a flat in Central London for which he had received a loan from a businessman, it emerged on Tuesday.

The NCA’s International Corruption Unit had asked Shehbaz to provide the full money trail for purchasing flat 2, 30 Upper Berkeley Street, London, W1h 5QE in May 2005, including the loan of £59,993 from well-known British Pakistani businessman Aneel Musarrat.

In a letter to Sharif’s lawyer on May 15, 2020, the NCA asked for “additional consent” of both Shehbaz and Suleman to access conveyance material (act of transferring property from one party to another) and the Barclays Bank mortgage arrangement. The NCA told the lawyers that it was giving both the father and the son a chance to agree to the consent orders or else the NCA will use its “coercive power for a production order”. The NCA said that both Conway and Co and Barclays Bank confirmed their willingness to provide the material needed to continue the investigation expeditiously. The NCA demanded “any files filed by Mian Muhammad Shehbaz Sharif or his representatives relating to the conveyance file for the original purchase of flat 2, 30 Upper Berkeley Street, London, W1H 5QF in May 2005”.

“An explanation and supporting documents for the £59,993 contributed towards the purchase of this property in May 2005 by Musarrat and sufficient details to enable us to contact him in order to verify this” was also demanded. This correspondent understands that the NCA looked into this payment and found it to be a loan arrangement between two parties. Aneel Musarrat was not available for comments. It is understood that the NCA accessed Musarrat’s account also but found nothing illegal in the loan arrangement, the source of £23,500 deposit paid by Shehbaz towards the property purchase in May 2005 and the source of subsequent mortgage repayments. The NCA asked for “further details in relation to the cash deposits made into the Barclays account of Suleman Sharif which are referenced as gifts from family members in your letter dated 22 April 2020”. “A breakdown of each deposit and where it was received from? The origin of the source of each deposit? When and how was this cash transferred or brought to the UK?” sought the NCA’s inquiry.

On May 16, 2020, Shehbaz issued two consent orders on the advice of his lawyers. His consent note read: “I, Mian Muhammad Shehbaz Sharif give consent to Barclays Bank PLC and Barclays and UK PLC to provide the following material to the NCA in respect of a mortgage acquired by myself in May 2005 for £160,000 in purchase of 2, 30 Upper Berkeley Street” and other matters.

The Geo News exclusively reported on Monday that the Westminster Magistrates’ Court ordered the unfreezing of the bank accounts belonging to the Sharifs after establishing that there was no money-laundering, criminal conduct or fraud. The NCA also investigated businessman Zulfiquar Ahmed and froze his account after he made payment to the client account of Carter Ruck solicitors representing Shehbaz Sharif in his defamation case against Daily Mail. It also filed a unilateral application before Judge Nicholas Rimmer to declare that its two-year high-profile investigation in the jurisdictions of Pakistan, UK and Dubai found no evidence of money laundering and criminal conduct on part of the two Sharifs.

According to the documents obtained by Geo News the bank accounts of Suleman Sharif were frozen and Shehbaz Sharif’s accounts were probed through a December 17, 2019, court order and both were subjected to high-profile criminal forensic investigation under the Proceeds of Crime Act 2002 (POCA), conducted by the NCA’s Investigations Command at the International Corruption Unit. Their accounts were frozen after the Pakistan government asked the UK to “assist in the recovery of criminal assets to the state of Pakistan”, triggering a wide-ranging investigation.

-

Ethan Hawke Reflects On Hollywood Success As Fifth Oscar Nomination Arrives

Ethan Hawke Reflects On Hollywood Success As Fifth Oscar Nomination Arrives -

Tom Cruise Feeling Down In The Dumps Post A Series Of Failed Romances: Report

Tom Cruise Feeling Down In The Dumps Post A Series Of Failed Romances: Report -

'The Pitt' Producer Reveals Why He Was Nervous For The New Ep Of Season Two

'The Pitt' Producer Reveals Why He Was Nervous For The New Ep Of Season Two -

Maggie Gyllenhaal Gets Honest About Being Jealous Of Jake Gyllenhaal

Maggie Gyllenhaal Gets Honest About Being Jealous Of Jake Gyllenhaal -

'Bridgerton' Star Luke Thompson Gets Honest About Season Five

'Bridgerton' Star Luke Thompson Gets Honest About Season Five -

Prince William On Verge Of Breakdown Because Of 'disgraced' Andrew

Prince William On Verge Of Breakdown Because Of 'disgraced' Andrew -

Tig Notaro Reflects On Oscar Nod For 'Come See Me In The Good Light': 'I Was Sleeping'

Tig Notaro Reflects On Oscar Nod For 'Come See Me In The Good Light': 'I Was Sleeping' -

Kenyon Sadiq Sets 40-yard Dash Record At NFL Scouting Combine, Eyes First Round

Kenyon Sadiq Sets 40-yard Dash Record At NFL Scouting Combine, Eyes First Round -

Talk Show Host Drops Hint About Taylor Swift, Travis Kelce Wedding Date

Talk Show Host Drops Hint About Taylor Swift, Travis Kelce Wedding Date -

Andrew Scandal Brings New Worries For Prince Harry, Meghan Markle

Andrew Scandal Brings New Worries For Prince Harry, Meghan Markle -

King Charles Imposes New Restrictions On Ex-Prince Andrew In Surprise Move

King Charles Imposes New Restrictions On Ex-Prince Andrew In Surprise Move -

Chris Hemsworth Reveals How Elsa Pataky Guides His Career Moves

Chris Hemsworth Reveals How Elsa Pataky Guides His Career Moves -

Was Travis Barker In A Relationship With Kim Kardashian Before Marrying Her Sister?

Was Travis Barker In A Relationship With Kim Kardashian Before Marrying Her Sister? -

Brad Pitt Feeling Down In The Dumps After Kids' Snubs As Pals Continue To Paint Angelina Jolie A Villain

Brad Pitt Feeling Down In The Dumps After Kids' Snubs As Pals Continue To Paint Angelina Jolie A Villain -

Ex-PM Speaks Out On Andrew Mountbatten-Windsor In Newspaper Column

Ex-PM Speaks Out On Andrew Mountbatten-Windsor In Newspaper Column -

Eric Dane Remembered In Glowing Tribute By Trans Activist In 'Grey's Anatomy'

Eric Dane Remembered In Glowing Tribute By Trans Activist In 'Grey's Anatomy'