Steel makers anticipate Rs50bln annual tax revenue loss

ISLAMABAD: Four major steel industry associations on Thursday warned the government of at least Rs50 billion in tax revenue losses due to the policy measures announced in the budget for the next fiscal year.

Pakistan Association of Large Steel Producers (PALSP), Pakistan Steel Melters Association, Pakistan Shipbreakers Association and Pakistan Steel Lines Industry Association rejected the budget proposals during a news briefing.

The government was asked to reverse a decision of moving the steel industry from federal excise duty to general sales tax regime. This will give a freehand to more than 40 units located in federally-administered tribal area (FATA) to illegally sell tax-exempted goods across the country, they said.

Due to weak administrative controls, many rent-seekers have moved their steel manufacturing facilities to FATA areas, taken advantage of the tax incentives and abused the law by selling tax-free goods in settled areas.

Over the past few years, the steel capacity in FATA has risen to approximately one million tons per annum and represents about 16 percent of the long steel output of the country. “Continuation of this practice will lead to closure of many steel units, particularly in Punjab, over the next year,” said an industry official.

The government rejected another proposal of the steel industry to reduce turnover tax on downstream retailers to 0.25 percent. Currently, most steel retailers are forced to work in an undocumented environment due to the huge incidence of turnover tax. There is no reason for the retailers to join the tax net as the turnover tax wipes out their very small profit margins on selling the steel commodity.

“By rejecting the proposal, the government does not want to create documentation in the steel supply chain, improve ease of doing business and facilitate stakeholders towards compliance,” said the official.

The industry’s representatives said the government has not been able to walk the talk on its national tariff policy and has kept tariffs on primary raw materials for revenue reasons, which make the domestic industry uncompetitive. Currently, the raw material imports are taxed at 7 to 10 percent.

The steel industry criticises the government for not taking stakeholders onboard. If policy decisions are taken without consultation, it will be impossible for the regulators to implement the policy, said the industry officials.

Steel scrap prices rose from $300 at the beginning of the fiscal year to $535, translating into cost increase of Rs37,000. Duties and taxes on raw materials account for another Rs5,500 per ton. Electricity tariff increased 37 percent this fiscal year, climbing from Rs13.5 to Rs18.5 and causing a cost escalation of Rs4,000.

Cumulative cost increases are above Rs40,000 per ton, which is partly absorbed by the industry and balance has to be passed on by increasing prices.

Industry experts believe prices must rise again as recent electricity and raw material cost increases have not been passed on and manufacturers are working on razor thin margins.

The government was appealed to pay attention to the industry proposals to avert a major crisis that will jeopardise various developments.

-

Jessie Buckley Utters 'wild' Remarks For 'Hamnet' Co-star Emily Watson At Actor Awards

Jessie Buckley Utters 'wild' Remarks For 'Hamnet' Co-star Emily Watson At Actor Awards -

Who Could Replace Ayatollah Ali Khamenei? Iran’s Top Successor Candidates Explained

Who Could Replace Ayatollah Ali Khamenei? Iran’s Top Successor Candidates Explained -

Oliver 'Power' Grant Cause Of Death Revealed

Oliver 'Power' Grant Cause Of Death Revealed -

Michael B. Jordan Makes Bombshell Confession At Actor Awards After BAFTA Controversy: 'Unbelievable'

Michael B. Jordan Makes Bombshell Confession At Actor Awards After BAFTA Controversy: 'Unbelievable' -

Prince William Willing To Walk Road He ‘loathes’ For ‘horror Show’ Escape: ‘He’s Running Out Of Allies Fast’

Prince William Willing To Walk Road He ‘loathes’ For ‘horror Show’ Escape: ‘He’s Running Out Of Allies Fast’ -

Pentagon Says No Evidence Iran Planned Attack On US, Undercutting Strike Justification

Pentagon Says No Evidence Iran Planned Attack On US, Undercutting Strike Justification -

Prince William’s Changes Priorities With Harry After Kate Middleton’s Remission: ‘It Couldn't Be Worse’

Prince William’s Changes Priorities With Harry After Kate Middleton’s Remission: ‘It Couldn't Be Worse’ -

Justin Bieber Gets Touching Tribute From Mom Pattie Mallette On Turning 32 Amid Limited-edition Birthday Drop

Justin Bieber Gets Touching Tribute From Mom Pattie Mallette On Turning 32 Amid Limited-edition Birthday Drop -

Jada Pinkett Smith Details How Her Memoir Combats 'shame' Around Alopecia

Jada Pinkett Smith Details How Her Memoir Combats 'shame' Around Alopecia -

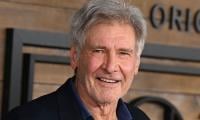

Harrison Ford Reflects On Career As He Receives Life Achievement Award At 2026 Actor Awards

Harrison Ford Reflects On Career As He Receives Life Achievement Award At 2026 Actor Awards -

Timothee Chalamet's Red Carpet Date For Actor Awards Not Kylie Jenner This Year

Timothee Chalamet's Red Carpet Date For Actor Awards Not Kylie Jenner This Year -

Weather Forecast For Tomorrow: Wintry Mix Overnight And Warmer Temps Midweek

Weather Forecast For Tomorrow: Wintry Mix Overnight And Warmer Temps Midweek -

Keith Urban 'solitary' Life Laid Bare After Nicole Kidman Split

Keith Urban 'solitary' Life Laid Bare After Nicole Kidman Split -

SAG Actor Awards 2026 Winners: Complete List

SAG Actor Awards 2026 Winners: Complete List -

UK Asylum System Faces Changes As Refugees Will Get Temporary Protection Only

UK Asylum System Faces Changes As Refugees Will Get Temporary Protection Only -

Meghan Markle Has Realised ‘star Power’ Is Not Enough After Jordan Trip

Meghan Markle Has Realised ‘star Power’ Is Not Enough After Jordan Trip