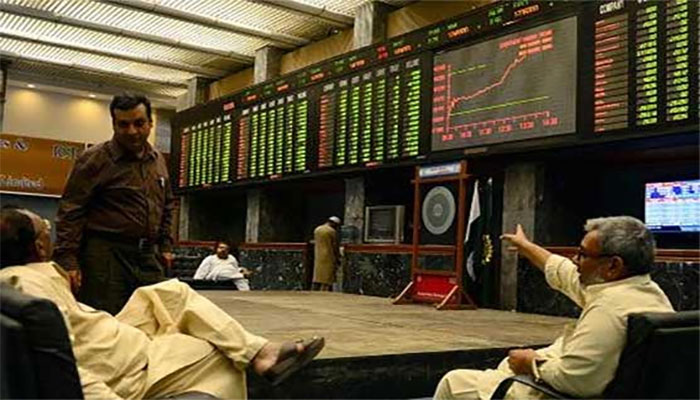

Market to bet on budget stimulus, fundamentals

Stocks put up a spectacular show in the rollover week cheering some promising tidings and are likely to stay the course betting on budgetary incentives and growth-spurring measures, dealers said.

The KSE-100 shares index gained 2.63 percent or 1,211.31 points to close the week at 47,126.29 points.

“The positive sentiment in the market may have been backed by expectations built around a growth-oriented FY22 federal budget which is scheduled to be announced on June 11, 2021,” Ali Zaidi at JS Global Capital said.

KSE-30 shares index gained 3.1 percent or 582.33 points to close at 19,299.48 points.

Daily traded volume touched an all-time high of 1,563 million shares on Wednesday, only to shatter that record again the very next day with a volume of 2,220 million shares.

Worldcall Telecom’s contribution to total volumes contributed substantially on both days. As a result, average daily traded volume reported a massive increase of 103 percent to 1.237 billion shares a day, while daily value of traded securities averaged $178 million, up 30 percent.

An analyst at Arif Habib Limited said the outgoing week’s trading commenced on a positive note with the index increasing by 182 points on Monday.

The uptrend was driven by National Accounts Committee’s provisional data on GDP growth, which is projected at 3.94 percent in FY21, the analyst said.

Optimism at the bourse was further fueled by current account posting a surplus of $773 million in 10MFY21; whle government’s cancelling its divestment plan for Pakistan Petroleum Limited and Oil and Gas Development Company as well as higher oil prices also resulted in heavy buying in these scrips.

Technology sector gained traction amid re-rating of sector multiple along with expectation of relief in the upcoming budget resulted in massive activity in the sector.

Foreign buying was witnessed this week arriving at $2.1 million against a net sell of $49.3 million last week.

Buying was witnessed in cement ($23.9 million) and technology and communication ($9.2 million).

On the domestic front, major selling was reported by individuals ($10.2 million) and mutual funds ($7.4 million).

An analyst at Pearl Securities said during the week, the market remained bullish on the back of government expectations of 3.94 percent GDP growth for FY21, Moody’s statement that the credit profile of Pakistan reflected the country’s economic strength, which was supported by the long-term GDP growth potential and government's projection of even better economic numbers for 4QFY21.

Moreover, SBP has announced to keep the interest rate unchanged at 7.0 percent for the next two months.

“We expect the market to remain positive in line with the upcoming budget incentives and strengthening fundamentals,” the Pearl Securities analyst said.

Going forward, most of the researchers expect the market to remain bullish in the upcoming week amid hopes of relief in the upcoming budget, reduction in duties on imported raw material for construction sector and export-oriented sector to spur growth which might keep these sectors in limelight.

On the other hand, exploration and production sector is expected to continue performing well due to higher international oil prices and government shelving divestment plan of some key stocks.

-

Prince William Criticized Over Indirect Epstein Connection

Prince William Criticized Over Indirect Epstein Connection -

'Finding Her Edge' Creator Explains Likeness Between Show And Jane Austin Novel

'Finding Her Edge' Creator Explains Likeness Between Show And Jane Austin Novel -

Margot Robbie Delivers Sweet Message Ahead Of Valentine's Day

Margot Robbie Delivers Sweet Message Ahead Of Valentine's Day -

How AI Boyfriends Are Winning Hearts In China: Details Might Surprise You

How AI Boyfriends Are Winning Hearts In China: Details Might Surprise You -

Blake Lively Mocked Over 'dragons' After Latest Court Appearance

Blake Lively Mocked Over 'dragons' After Latest Court Appearance -

Gmail For Android Now Lets Users Create Labels On Mobile

Gmail For Android Now Lets Users Create Labels On Mobile -

Emma Slater Reveals Final Moments With James Van Der Beek Before His Death

Emma Slater Reveals Final Moments With James Van Der Beek Before His Death -

Princess Kate Makes Surprise Visit To Support Mental Health Initiative

Princess Kate Makes Surprise Visit To Support Mental Health Initiative -

Reese Witherspoon Sparks Nostalgia With 'Green Sisters' Tribute To Jennifer Aniston

Reese Witherspoon Sparks Nostalgia With 'Green Sisters' Tribute To Jennifer Aniston -

Royal Family Faces Fresh Crisis While Andrew's Controversy Refuses To Die

Royal Family Faces Fresh Crisis While Andrew's Controversy Refuses To Die -

Travis Kelce’s Mom Talks About Taylor Swift’s Wedding Dance Song And Whether She’s Signed An NDA

Travis Kelce’s Mom Talks About Taylor Swift’s Wedding Dance Song And Whether She’s Signed An NDA -

James Van Der Beek's Final Days 'hard To Watch' For Loved Ones

James Van Der Beek's Final Days 'hard To Watch' For Loved Ones -

Lewis Hamilton Ditched Question About Kim Kardashian?

Lewis Hamilton Ditched Question About Kim Kardashian? -

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets -

'Fake' Sexual Assault Report Lands Kentucky Teen In Court

'Fake' Sexual Assault Report Lands Kentucky Teen In Court -

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death