Economic burden of tobacco disease, death tops Rs615bln

LAHORE: Pakistan, with 24 million active tobacco users, is among world’s top tobacco-consuming nations and the economic burden of related diseases is relatively huge here, findings of a study showed on Monday.

The study titled “The Economic Cost Of Tobacco-Induced Diseases in Pakistan” was released in April 2021 by the Pakistan Institute of Development Economics (PIDE) with the financial support of the University of Illinois Chicago’s (UIC) Institute for Health Research and Policy.

According to a survey tobacco industry pays taxes in billions, which helps it exert influence on government policies especially those related to taxation.

“It is a well established fact the country’s tax policy is among the weakest action areas, the reason for which may be that the government does not want to lose the revenues it collects from the tobacco industry,” it said.

“These taxes are not significant when compared to the total costs attributable to all smoking-related diseases and deaths in Pakistan for 2019 that come to Rs 615.07 billion and the indirect costs (morbidity and mortality) make up 70 percent of the total cost.”

Rural residents bear 61 percent, males 77 percent and 35–64 years age group bears 86 percent of the total cost, as per the study. The total tax contribution of tobacco industry (Rs120 billion in 2019) was only around 20 percent of the total cost of smoking, it added.

This financial support was provided to conduct economic research on tobacco taxation in Pakistan. PIDE was developed by the Government of Pakistan and later on awarded status of autonomous research organisation.

The study was based on a sample size of 12,298 households from 615 blocks determined on the basis of cluster sampling technique. Expecting some refusals, the authors also had the provision of replacement sample of 702 households (about 6 percent of the sample size). The sample size and replacement sample add up to 13,000 households.

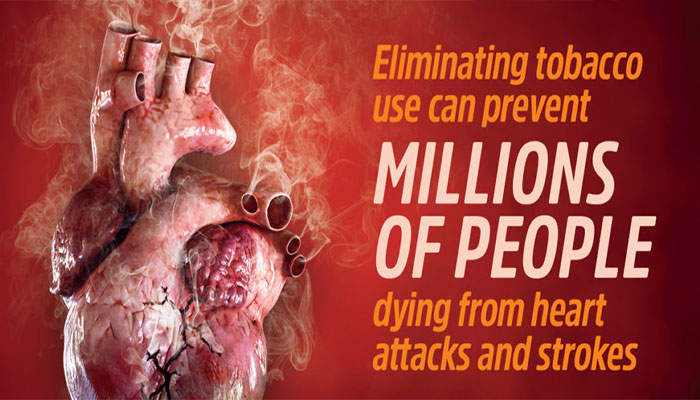

The study says that in reality, tobacco use incurs huge direct and indirect cost to its subjects. Direct costs include in-and out-patient hospital expenses, whereas, the indirect cost includes the care-giving expenditures, opportunity cost of the lost workdays of the patients and their caregivers. By using the cost of illness (COI) approach, this study estimates the economic burden of three major smoking-induced diseases (cancer, cardiovascular, and respiratory) in Pakistan.

Anti-tobacco campaigners have responded to the findings of the study and stressed the taxes on tobacco products shall be raised considerably. They said every year the industry raised hue and cry that high taxes on tobacco products were leading to an increase in illicit trade of tobacco products, which was denting the expected revenue collection.

Malik Muhammad Imran, Country Representative, Tobacco Free Kids, says a proof of their claim is that when the government removed the third tier of tobacco taxation in 2019 the revenue from the industry increased to Rs120 billion up from the Rs 92 billion in 2016 when this tier was there. The third tier provided low tax rate for low-priced products which gave an option to the cigarette manufacturers to reduce their price and benefit from the tax relief, Imran added. He said in terms of percentage of total tax collection, the tobacco industry’s share reached 3 percent in 2019 from 2.15 percent in FY16.

The study refers to this example and stresses that increasing tax rate on tobacco raises revenues and does not lead to an alarming increase in illicit trade as claimed by the industry.

Imran said the government must not get blackmailed by the tobacco industry just for the reason that it was paying taxes, which were a fraction of the tobacco disease burden and morbidity- and mortality-related costs.

According to the study, smoking-attributable total direct and indirect cost of cancer, cardiovascular, and respiratory diseases amount to a total of Rs437.76 billion, 3.65 times higher than the overall tax revenue from the tobacco industry (120 billion in 2019). Of this, the direct cost is 23 percent and indirect mortality cost 64 percent.

The major share (71 percent) of the smoking-induced costs comes from cancer, cardiovascular, and respiratory diseases. The total smoking-attributable costs are 1.6 percent of the GDP, whereas the smoking-attributable cost of cancer, cardiovascular and respiratory diseases is 1.15 percent of the GDP.

The share of morbidity and mortality costs for females is underestimated because of their lower rates of labour force participation and difficulties in putting monitory value on their informal contribution to household production.

The smoking-attributable direct cost is 8.3 percent of the total health expenditures, which is very high, the study says.

-

Shia LaBeouf Makes Bold Claim About Homosexuals In First Interview After Mardi Gras Arrest

Shia LaBeouf Makes Bold Claim About Homosexuals In First Interview After Mardi Gras Arrest -

Princess Beatrice, Eugenie ‘strained’ As They Are ‘not Turning Back’ On Andrew

Princess Beatrice, Eugenie ‘strained’ As They Are ‘not Turning Back’ On Andrew -

Benny Blanco Addresses ‘dirty Feet’ Backlash After Podcast Moment Sparks Online Frenzy

Benny Blanco Addresses ‘dirty Feet’ Backlash After Podcast Moment Sparks Online Frenzy -

Sarah Ferguson Unusual Trait That Confused Royal Expert

Sarah Ferguson Unusual Trait That Confused Royal Expert -

Prince William, Kate Middleton Left Sarah Ferguson Feeling 'worthless'

Prince William, Kate Middleton Left Sarah Ferguson Feeling 'worthless' -

Ben Affleck Focused On 'real Prize,' Stability After Jennifer Garner Speaks About Co Parenting Mechanics

Ben Affleck Focused On 'real Prize,' Stability After Jennifer Garner Speaks About Co Parenting Mechanics -

Luke Grimes Reveals Hilarious Reason His Baby Can't Stop Laughing At Him

Luke Grimes Reveals Hilarious Reason His Baby Can't Stop Laughing At Him -

Why Kate Middleton, Prince William Opt For ‘show Stopping Style’

Why Kate Middleton, Prince William Opt For ‘show Stopping Style’ -

Here's Why Leonardo DiCaprio Will Not Attend This Year's 'Actors Award' Despite Major Nomination

Here's Why Leonardo DiCaprio Will Not Attend This Year's 'Actors Award' Despite Major Nomination -

Ethan Hawke Reflects On Hollywood Success As Fifth Oscar Nomination Arrives

Ethan Hawke Reflects On Hollywood Success As Fifth Oscar Nomination Arrives -

Tom Cruise Feeling Down In The Dumps Post A Series Of Failed Romances: Report

Tom Cruise Feeling Down In The Dumps Post A Series Of Failed Romances: Report -

'The Pitt' Producer Reveals Why He Was Nervous For The New Ep Of Season Two

'The Pitt' Producer Reveals Why He Was Nervous For The New Ep Of Season Two -

Maggie Gyllenhaal Gets Honest About Being Jealous Of Jake Gyllenhaal

Maggie Gyllenhaal Gets Honest About Being Jealous Of Jake Gyllenhaal -

'Bridgerton' Star Luke Thompson Gets Honest About Season Five

'Bridgerton' Star Luke Thompson Gets Honest About Season Five -

Prince William On Verge Of Breakdown Because Of 'disgraced' Andrew

Prince William On Verge Of Breakdown Because Of 'disgraced' Andrew -

Tig Notaro Reflects On Oscar Nod For 'Come See Me In The Good Light': 'I Was Sleeping'

Tig Notaro Reflects On Oscar Nod For 'Come See Me In The Good Light': 'I Was Sleeping'