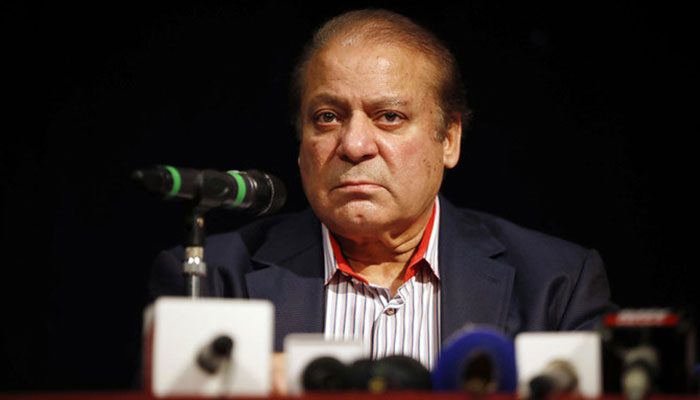

Broadsheet ‘recycled’ NAB’s reports on Sharifs

LONDON: The former director-general of the National Accountability Bureau’s Financial Crimes Investigations Wing told the London High Court that Matrix Researchers investigators, working for Broadsheet LLC, had recycled NAB’s own reports on Nawaz Sharif and presented to the NAB as new information without adding anything or tracing any assets of the former premier and his family members.

According to Talat Ghumman’s statement before Sir Anthony Evans in July 2015, the senior NAB official told the court Broadsheet didn’t have it’s own capacity to investigate and trace assets and it hired Matrix Research Limited to investigate Nawaz Sharif and his family members at a total cost of around £500,000 but the information gathered on the Sharif family didn’t impress the National Accountability Bureau (NAB) investigators who were looking for seriously actionable evidence of wrongdoing and illicit wealth. When Broadsheet asked Pakistan to pay £480,000 for this report but NAB officials refused.

Ghumman said in his statement that Ishaq Dar, former Finance Minister under Nawaz Sharif, had already “provided us with a great deal of this information” and NAB “used information provided by Dar and numerous people close to the Sharif family”.

He told the court that lots of information contained in the Matrix report as new evidence was actually available and the Broadsheet had recycled it.

Talat Ghumman told the court: “Despite the NAB giving them information about the Sharifs, Broadsheet had provided very little that was new to the NAB in relation to our new investigations into the Sharifs. The information we had on the Sharifs related to assets located both within Pakistan as well as the apartments owned by them in the prestigious Park Lane area of London.”

Talat Ghumman worked as General Manager in Askari Bank until he was asked by General Syed Amjad Hussain in October 1999 to join NAB to lead the newly formed financial crimes and banking cell. He stayed in NAB till 2004 and was a witness to the working of NAB-Broadsheet under the Assets Recovery Unit (ARU). He had played no part in drafting or signing the agreement with Broadsheet LLC and International Assets Recovery (IAR) but recommended to General Munir Hafiez in the end of 2003 that Broadsheet was incompetent and unable to deliver what Pakistan wanted.

Talat Ghumman was part of the last-ditch London meeting at the Churchill Hotel where General Munir Hafiez, Taher Nawaz and PGA Mirza met Broadsheet’s senior executives to try and find some way of finding assets and to resolve the differences. Broadsheet’s Jerry James, Chairman Douglas Tisdale and Tariq Fawad Malik were in attendance.

At the meeting, the Pakistani delegation told Broadsheet how disappointed they were at the lack of progress and how Musharraf’s administration was under public pressure to find and repatriate assets and. The Pakistani side told Broadsheet executives that they had not provided what they had provided and there was no “solid and meaningful progress”.

Nawaz Sharif was discussed at length during the meeting, according to all sides. At this meeting, General Munir Hafiez signed another Power of Attorney for Broadsheet to continue investigating Nawaz Sharif and his family. Broadsheet was concerned that Nawaz Sharif had left for Saudi Arabia and may have made a huge payment to Pakistan. The Pakistani delegation told Broadsheet there was no deal and the cases against Sharifs were not withdrawn.

At the same meeting, according to Talat Ghumman, it was decided that Broadsheet will provide a complete progress report within 30 days but nothing was ever received by NAB. Talat Ghumman attached with his witness statement several emails he had sent to Broadsheet through Tariq Fawad Malik requesting progress on the Targets, details of any assets or any meaningful progress but his emails were either ignored or only vague replies given.

He wrote: “This failure increased my skepticism about Broadsheet’s abilities, resources and assurances.”

Talat Ghumman said that in January 2003, Broadsheet claimed to be very close to arresting Syed Abdullah Shah, sought three more months and then nothing happened. He said the UK government had refused to work with Broadsheet because it was a private entity and the only limited help by Broadsheet was provided in the case of Admiral Mansoor-ul-Haq’s $.7.5 million assets recovery for which NAB paid over $1 million to Broadsheet as soon the money landed into Pakistani accounts. Talat Ghumman accepted in his statement that Tariq Fawad Malik played a role in bringing Admiral Haq back to Pakistan from the United States of America.

There were lots of emails and assurances but three years had passed and NAB - according to every NAB official involved in the agreement as well as Broadsheet’s Pakistan representative Tariq Fawad Malik - was not seeing results in the form of actionable and admissible information or asset being repatriated back to Pakistan.

Talat Ghumman told the court that by around April 2003 it became clear to Pakistan that Broadsheet lacked the capabilities or the resources to retrieve foreign assets for Pakistan or to be of any real assistance to NAB. He went to tell the court that Broadsheet had misled before signing the deal and during the agreement period and “prevented or delayed” Pakistan from “using the avenues available to NAB in foreign jurisdictions.

Ghumman also told the court that there was evidence that Broadsheet used information provided by NAB on the Targets to make direct contacts with the Targets without NAB’s knowledge in an attempt to cheat NAB.

The contract was then terminated.

-

‘Narcissist’ Andrew Still Feels ‘invincible’ After Exile

‘Narcissist’ Andrew Still Feels ‘invincible’ After Exile -

Shamed Andrew ‘mental State’ Under Scrutiny Amid Difficult Time

Shamed Andrew ‘mental State’ Under Scrutiny Amid Difficult Time -

Bad Bunny's Super Bowl Halftime Show: What Time Will He Perform Tonight?

Bad Bunny's Super Bowl Halftime Show: What Time Will He Perform Tonight? -

Where Is Super Bowl 2026 Taking Place? Everything To Know About The NFL Showdown

Where Is Super Bowl 2026 Taking Place? Everything To Know About The NFL Showdown -

Chris Pratt Explains Why He And Katherine Schwarzenegger Did Premarital Counseling

Chris Pratt Explains Why He And Katherine Schwarzenegger Did Premarital Counseling -

Drake 'turns Down' Chance To Hit Back At Kendrick Lamar At Super Bowl

Drake 'turns Down' Chance To Hit Back At Kendrick Lamar At Super Bowl -

Sarah Ferguson Had A ‘psychosexual Network’ With Jeffrey Epstein

Sarah Ferguson Had A ‘psychosexual Network’ With Jeffrey Epstein -

Miranda Kerr Shares The One Wellness Practice She Does With Her Kids

Miranda Kerr Shares The One Wellness Practice She Does With Her Kids -

Czech Republic Supports Social Media Ban For Under-15

Czech Republic Supports Social Media Ban For Under-15 -

Khloe Kardashian Shares How She And Her Sisters Handle Money Between Themselves

Khloe Kardashian Shares How She And Her Sisters Handle Money Between Themselves -

Prince William Ready To End 'shielding' Of ‘disgraced’ Andrew Amid Epstein Scandal

Prince William Ready To End 'shielding' Of ‘disgraced’ Andrew Amid Epstein Scandal -

Chris Hemsworth Hailed By Halle Berry For Sweet Gesture

Chris Hemsworth Hailed By Halle Berry For Sweet Gesture -

Blac Chyna Reveals Her New Approach To Love, Healing After Recent Heartbreak

Blac Chyna Reveals Her New Approach To Love, Healing After Recent Heartbreak -

Royal Family's Approach To Deal With Andrew Finally Revealed

Royal Family's Approach To Deal With Andrew Finally Revealed -

Super Bowl Weekend Deals Blow To 'Melania' Documentary's Box Office

Super Bowl Weekend Deals Blow To 'Melania' Documentary's Box Office -

Meghan Markle Shares Glitzy Clips From Fifteen Percent Pledge Gala

Meghan Markle Shares Glitzy Clips From Fifteen Percent Pledge Gala