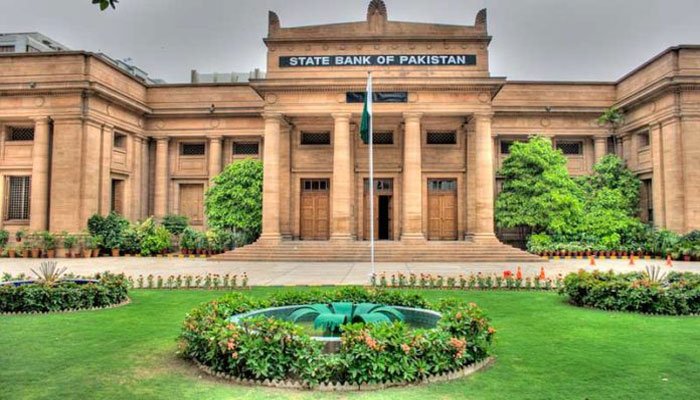

SBP most likely to keep policy rate unchanged for third time

KARACHI: The central bank is widely expected to keep the policy rate unchanged at 7 percent for the third time after generous back-to-back reductions during last year’s lockdowns, as the risks to the outlook for both growth and inflation appear balanced, analysts said on Tuesday.

The State Bank of Pakistan (SBP) said the monetary policy committee will meet on Friday (January 22) to decide about the monetary policy. Saad Hashemy, executive director at BMA Capital expects interest rate to remain unchanged. His forecast is based on soft inflation reading during the ongoing month. “Inflation is expected to come on the lower side in January,” Hashemy said.

Pak-Kuwait Investment Company Research Head Samiullah Tariq agreed with the status quo viewpoint and he expects inflation to come down to 6 percent in January. “Until the balance of payments is stable, there’s still fear of Covid-related economic slowdown and globally central banks continue to inject liquidity in financial markets,” Tariq said.

Analysts believe the dovish stance may continue till July with inflation to stay average within the SBP’s target range of 7 – 9 percent during the current fiscal year of 2020/21.

Consumer price index inflation eased to 8 percent in December from 8.3 percent in the previous month. The SBP wants to stick to its growth projection of 1.5 to 2.5 percent in FY2021, a decent recovery from the dizzying 0.4 percent contraction in FY2020 as a result of coronavirus lockdown.

“The Covid-related uncertainty poses both upside and downside risks to the SBP’s macroeconomic projections,” the SBP said in a latest report.

However, the latest SBP surveys reflect well-anchored inflation expectations of both businesses and consumers.

“Current inflation is a cost push led by food shortages and more administrative than monetary phenomena,” said Muzzammil Aslam, chief executive officer of Tangent Capital Advisors. Unchanged policy rate, surplus current account and no government’s borrowing from the SBP will keep inflationary expectations lower, he added.

Time warrants the soft policy as fiscal stimulus can help the economy to recover, according to the analysts.

-

King Hospitalized In Spain, Royal Family Confirms

King Hospitalized In Spain, Royal Family Confirms -

Japan Launches AI Robot Monk To Offer Spiritual Guidance

Japan Launches AI Robot Monk To Offer Spiritual Guidance -

Japan Plans Missile Deployment Near Taiwan By 2031 Amid Growing Regional Tensions

Japan Plans Missile Deployment Near Taiwan By 2031 Amid Growing Regional Tensions -

Meghan Markle, Prince Harry Spark Reactions With Latest Announcement

Meghan Markle, Prince Harry Spark Reactions With Latest Announcement -

Kate Hudson Reflects On Handling Award Season With No Expectations

Kate Hudson Reflects On Handling Award Season With No Expectations -

6 Celebrities Who Have Been Vocal About Anxiety And 'panic Attacks'

6 Celebrities Who Have Been Vocal About Anxiety And 'panic Attacks' -

Is This The Future Of Train Travel? Robot Dogs, Drones Are Redefining Public Transit Safety Through China’s New Metro Station Deployment

Is This The Future Of Train Travel? Robot Dogs, Drones Are Redefining Public Transit Safety Through China’s New Metro Station Deployment -

Sarah Ferguson Seeks Hollywood Backing As Epstein Files Resurface

Sarah Ferguson Seeks Hollywood Backing As Epstein Files Resurface -

China’s AI Milestone: ByteDance’s Doubao Chatbot Hits 100M Users During Lunar New Year

China’s AI Milestone: ByteDance’s Doubao Chatbot Hits 100M Users During Lunar New Year -

Think You Know ChatGPT? Here Are 5 AI Levels You’ve Never Seen

Think You Know ChatGPT? Here Are 5 AI Levels You’ve Never Seen -

Bitcoin Bounces From $62,000 As On-chain Metrics Signal Prolonged Weakness: Here Is Everything To Know

Bitcoin Bounces From $62,000 As On-chain Metrics Signal Prolonged Weakness: Here Is Everything To Know -

Elon Musk Teases Official Grok CLI For Developers As AI Rivalry With Anthropic Heats Up

Elon Musk Teases Official Grok CLI For Developers As AI Rivalry With Anthropic Heats Up -

Jennifer Aniston Ready To Walk Down The Aisle Again?

Jennifer Aniston Ready To Walk Down The Aisle Again? -

Sarah Ferguson’s Plan Now That Andrew Is Thrown Into The Fire: ‘She’s Not Certain She’ll Come Out The Other Side’

Sarah Ferguson’s Plan Now That Andrew Is Thrown Into The Fire: ‘She’s Not Certain She’ll Come Out The Other Side’ -

‘The AI Doc’: What AI Leaders Told Daniel Roher Will Keep You Up At Night

‘The AI Doc’: What AI Leaders Told Daniel Roher Will Keep You Up At Night -

Sarah Ferguson In Hiding As Arrest Fears Grow After Andrew Was Taken Into Custody

Sarah Ferguson In Hiding As Arrest Fears Grow After Andrew Was Taken Into Custody