Govt to increase direct tax revenue

KARACHI: The government is determined to phase out the final tax regime within the next three years to increase share of direct taxes in revenue base and expand the scope of financial audit, sources said on Tuesday.

The sources said the government prefers to tax the real income and for that to happen the final tax regime needs to be eliminated. Through the last budget, the government initiated phasing out of final tax regime and brought real estate sector and stock brokers into minimum tax regime with requirement of submitting income records and assets declaration.

Prior to the Finance Act 2019, people involved in certain transactions were not required to pay tax on their actual profits. Instead the tax collected or deducted on such transactions was treated as their final tax liability. Since the tax deducted on such transactions was treated as their final tax, such people were not subject to detailed scrutiny through audit.

Prior to the Finance Act 2019, the final tax regime was available for commercial importers, commercial suppliers of goods, contractors and people deriving brokerage or commission income and revenue from compressed natural gas stations. In order to tap the actual tax potential, amendments were made through the Finance Act 2019 whereby the tax collected or deducted from such transactions were made minimum tax except for exporters, people winning prizes and sellers of petroleum products.

Sources said the government would continue the policy of phasing out the final tax regime under its budget strategy during next three years. The sources said the government would increase the share of direct taxes in revenues by phasing out final tax regime. Documentation of the economy to increase taxation in wholesale and retail, real estate and speculation businesses is also a government’s priority.

Under the medium-term budget strategy for next three years, the government would not offer any amnesty scheme. Tax exemptions would further be curtailed, according to the sources. The government also planned to rationalise income tax slabs and lower thresholds to broaden the tax base. During the next three years, simplification of laws and regulations and improvement in tax administration, through amendments in tax law, would ensure risk-based audit system.

The sources said the Federal Board of Revenue (FBR) is effectively using information technology support for efficient detection, monitoring and facilitation of the tax regime. Data on foreign bank accounts of Pakistani citizens are analysed to detect tax evasion. IT-based databank regarding foreign bank accounts would also be established. Tracking and tracing system for collection of federal excises duty on cigarettes has commenced with the issuance of licences. Electronic monitoring of production and sales of various sectors would also commence in due course of time. In 2020/21, the FBR would work to remove structural anomalies in the taxation regime, such as anomalies from statutory regulatory orders (SROs)/aligning certain SROs with the main statute and rules. Tax returns forms would be simplified.

-

ByteDance’s New AI Video Model ‘Seedance 2.0’ Goes Viral

ByteDance’s New AI Video Model ‘Seedance 2.0’ Goes Viral -

Archaeologists Unearthed Possible Fragments Of Hannibal’s War Elephant In Spain

Archaeologists Unearthed Possible Fragments Of Hannibal’s War Elephant In Spain -

Khloe Kardashian Reveals Why She Slapped Ex Tristan Thompson

Khloe Kardashian Reveals Why She Slapped Ex Tristan Thompson -

‘The Distance’ Song Mastermind, Late Greg Brown Receives Tributes

‘The Distance’ Song Mastermind, Late Greg Brown Receives Tributes -

Taylor Armstrong Walks Back Remarks On Bad Bunny's Super Bowl Show

Taylor Armstrong Walks Back Remarks On Bad Bunny's Super Bowl Show -

James Van Der Beek's Impact Post Death With Bowel Cancer On The Rise

James Van Der Beek's Impact Post Death With Bowel Cancer On The Rise -

Pal Exposes Sarah Ferguson’s Plans For Her New Home, Settling Down And Post-Andrew Life

Pal Exposes Sarah Ferguson’s Plans For Her New Home, Settling Down And Post-Andrew Life -

Blake Lively, Justin Baldoni At Odds With Each Other Over Settlement

Blake Lively, Justin Baldoni At Odds With Each Other Over Settlement -

Thomas Tuchel Set For England Contract Extension Through Euro 2028

Thomas Tuchel Set For England Contract Extension Through Euro 2028 -

South Korea Ex-interior Minister Jailed For 7 Years In Martial Law Case

South Korea Ex-interior Minister Jailed For 7 Years In Martial Law Case -

UK Economy Shows Modest Growth Of 0.1% Amid Ongoing Budget Uncertainty

UK Economy Shows Modest Growth Of 0.1% Amid Ongoing Budget Uncertainty -

James Van Der Beek's Family Received Strong Financial Help From Actor's Fans

James Van Der Beek's Family Received Strong Financial Help From Actor's Fans -

Alfonso Ribeiro Vows To Be James Van Der Beek Daughter Godfather

Alfonso Ribeiro Vows To Be James Van Der Beek Daughter Godfather -

Elon Musk Unveils X Money Beta: ‘Game Changer’ For Digital Payments?

Elon Musk Unveils X Money Beta: ‘Game Changer’ For Digital Payments? -

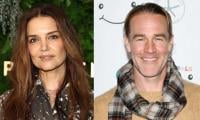

Katie Holmes Reacts To James Van Der Beek's Tragic Death: 'I Mourn This Loss'

Katie Holmes Reacts To James Van Der Beek's Tragic Death: 'I Mourn This Loss' -

Bella Hadid Talks About Suffering From Lyme Disease

Bella Hadid Talks About Suffering From Lyme Disease