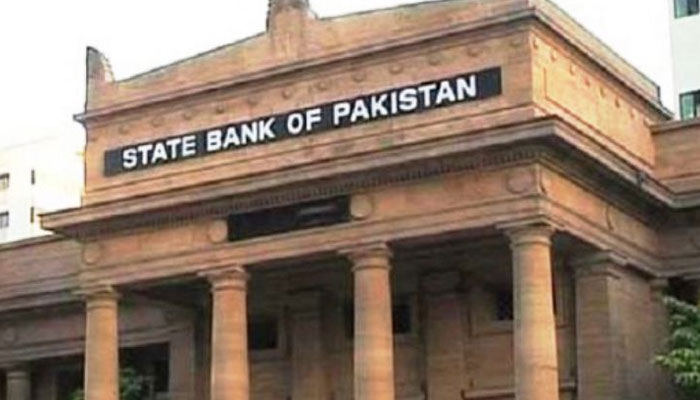

Govt reluctant to link State Bank Governor’s tenure with performance

ISLAMABAD: The PTI-led government seems reluctant to link tenure of State Bank of Pakistan (SBP) Governor with performance and placing proper accountability in upcoming proposed amendments to the SBP Act.

A technical mission of IMF is scheduled to visit Pakistan from next week for finalising draft of SBP amendments for granting autonomy to the central bank.

The SBP is all set to share draft amendments to SBP Act with Finance Ministry by end January 2020.

“We are going to abide by timelines given for proposing amendments to SBP Act,” said the official sources and added that it would be quite important how much independence the government proposed for operational autonomy of the central bank.

Top official sources disclosed to The News on Saturday that there was clear-cut difference between the commitments made by Pakistani side related to granting autonomy to the SBP Act with the IMF.

On eve of the IMF programme, Pakistani side had committed that the lengthening of tenure of SBP Governor will be linked with performance and accountability.

But after first review under the IMF programme, Pakistani authorities excluded certain commitments from the signed set documents to the IMF through MEFP.

In the first IMF document released after approval of $6 billion Extended Fund Facility (EFF), it stated that Pakistani side will submit to Parliament amendments to the SBP Act by end-December 2019 (structural benchmark) addressing the recommendations of the new 2019 Safeguards Assessment Report including by (i) ensuring its full operational independence in pursuit of price stability as its primary objective; (ii) lengthening the governor's tenure and delinking it from the electoral cycle (iii) improving SBP's governance, including by clear delineation between management and oversight functions, establishment of the Executive Board, protecting personal autonomy of SBP Board and MPC members (iv) enhancing SBP's financial autonomy and accountability by strengthening the profit distribution rules and specifying adequate recapitalisation requirement; and

(v) prohibiting any form of direct credit to government.

Now after completion of first review under IMF programme, Pakistani side sent out signed Memorandum of Financial and Economic Policies (MEFP) by making commitment in writing that “We are taking the necessary measures to strengthen SBP’s autonomy, governance, and mandate in line with the recommendations of the IMF safeguards assessment.”

“We are preparing amendments to the SBP Act to address recommendations of the new 2019 Safeguards Assessment Report, including: (i) setting domestic price stability as a primary objective; (ii) prohibiting monetary financing of the public sector debt; (iii) removing quasi-fiscal operations following a phase-out period; (iv) statutory mechanisms for sufficient capitalisation and profit retention; (v) securing stronger protection of the personal autonomy of senior officials; (vi) statutory underpinnings for external auditors, audit committee, and internal audit function; (vii) enhancing collegial decision making at the executive management; and (viii) providing stronger oversight by the Board.

We have requested IMF-provided technical assistance to support us in the preparation of this broad-ranging piece of legislation. Amendments to the SBP Act will be forwarded by the SBP to the Ministry of Finance by end-January 2020, and submitted to cabinet.”

“Thereafter, we will submit the amendments to Parliament by end-March 2020 (a new deadline for this structural benchmark, reset from end-December 2019)”.

Now the technical mission of IMF will help authorities to finalise the draft amendments into SBP Act by apprising them about world best practices for making the central bank more powerful and independent in the pursuit of goal of achieving price stability as its first and foremost objectives.

-

Neve Campbell Opens Up About Her 'difficult Decision' To Not Sign 'Scream 6'

Neve Campbell Opens Up About Her 'difficult Decision' To Not Sign 'Scream 6' -

Nobel-winning Scientist Resigns From Columbia University After Epstein Links Revealed

Nobel-winning Scientist Resigns From Columbia University After Epstein Links Revealed -

Prince William Remarks At BAFTAs 'indicative' Of King Charles Physical, Mental Health Too

Prince William Remarks At BAFTAs 'indicative' Of King Charles Physical, Mental Health Too -

Kanye West's Last Measure To Save Bianca Censori Marriage As He Tries To Salvage Image

Kanye West's Last Measure To Save Bianca Censori Marriage As He Tries To Salvage Image -

Kim Kardashian Finally Takes 'clear Stand' On Meghan Markle, Prince Harry

Kim Kardashian Finally Takes 'clear Stand' On Meghan Markle, Prince Harry -

Christina Applegate Makes Rare Confession About What Inspires Her To Keep Going In Life

Christina Applegate Makes Rare Confession About What Inspires Her To Keep Going In Life -

Patrick J. Adams Shares The Moment That Changed His Life

Patrick J. Adams Shares The Moment That Changed His Life -

Selena Gomez Getting Divorce From Benny Blanco Over His Unhygienic Antics?

Selena Gomez Getting Divorce From Benny Blanco Over His Unhygienic Antics? -

Meet Arvid Lindblad: Here’s Everything To Know About Youngest F1 Driver And New Face Of British Racing

Meet Arvid Lindblad: Here’s Everything To Know About Youngest F1 Driver And New Face Of British Racing -

At Least 30 Dead After Heavy Rains Hit Southeastern Brazil, 39 Missing

At Least 30 Dead After Heavy Rains Hit Southeastern Brazil, 39 Missing -

Courtney Love Recalls How ‘comparison’ Left Marianne Faithfull ‘broken’

Courtney Love Recalls How ‘comparison’ Left Marianne Faithfull ‘broken’ -

Pedro Pascal Confirms Dating Rumors With Luke Evans' Former Boyfriend Rafael Olarra?

Pedro Pascal Confirms Dating Rumors With Luke Evans' Former Boyfriend Rafael Olarra? -

Ghost's Tobias Forge Makes Big Announcement After Concluding 'Skeletour World' Tour

Ghost's Tobias Forge Makes Big Announcement After Concluding 'Skeletour World' Tour -

Katherine Short Became Vocal ‘mental Illness’ Advocate Years Before Death

Katherine Short Became Vocal ‘mental Illness’ Advocate Years Before Death -

SK Hynix Unveils $15 Billion Semiconductor Facility Investment Plan In South Korea

SK Hynix Unveils $15 Billion Semiconductor Facility Investment Plan In South Korea -

Buckingham Palace Shares Major Update After Meghan Markle, Harry Arrived In Jordan

Buckingham Palace Shares Major Update After Meghan Markle, Harry Arrived In Jordan