Valuation of under-investigation immovable properties: Unsought clause included in amendments to NAB law

ISLAMABAD: A clause relating to valuation of immovable properties, which has not been sought by any segment of society at any point of time, has also been inserted in the recent amendments to the National Accountability Ordinance (NAO), 1999.

The provision says notwithstanding anything contained in this ordinance (containing amendments) or any other law for the time being in force, the valuation of immovable properties for the purposes of assessing as to whether a holder of a public office has assets disproportionate to his known sources of income shall be reckoned either according to the applicable rate prescribed by the district collector (DC) or the Federal Board of Revenue (FBR), whichever is higher. No evidence contrary to the latter shall be admissible.

It will be instructive to first understand the difference between the rates of properties, stipulated by the DC, FBR and the prevailing market. Of them, the market price is always the highest followed by the FBR and the DC.

A real estate player explained to The News that the FBR price was specified for most urban centres while the DC rate has been applied to the rural areas. In some cases, both rates have been enforced, he said.

For example, he said, the FBR rate has been announced for the urban properties of the federal capital while its surrounding rural areas falling in the Islamabad Capital Territory (ICT) are covered by the DC rate.

Because of the FBR drive particularly against the real estate sector to document the largely unregulated economy, buyers and purchasers of properties have been inclined due to fear of law to disclose quite real prices, which, however, are still comparatively less than the market value. But they are higher than the FBR rate.

It always happened that while investigating the allegations of assets disproportionate to the known sources of income, the National Accountability Bureau (NAB) has been estimating the value of the properties in question much beyond the market rate to blow up the charge against the accused persons. If the NAB has been excessively fixing the worth of the properties under probe, the present scheme is believed to ascertain their value on the lower side.

The new provision in the NAO discounts the price mentioned by the buyers and sellers in the registries or other documents on stamp papers, deposited with concerned departments, even when it is higher than the FBR and DC rates.

“Such payments are always made through cheques, pay orders or bank drafts, but these most authentic documents and modes are not acceptable according to the new amendment about the valuation of properties,” a senior official, who critically examined the amendments, told The News.

To reinforce this kind of valuation, the clause stated that no evidence contrary to the latter (higher rate) shall be admissible before any official forum including the courts. This means that even if the value written in the official documents by the buyer and seller for a property is higher than the DC/FBR rate, it will not be acceptable in the eye of the instant law.

It is not publicly known that any circle ever projected the demand that the valuation of the properties under investigation should be fixed as per the formula introduced by the new clause. It is noteworthy that such a call also did not figure in the recommendations made by the federal secretaries’ committee, which, however, were mostly ignored while formulating the current amendments. Also, a number of changes in the NAO including the provision of facility of bail, significant reduction in physical remand period etc., which have been pressed by the Supreme Court and opposition parties since long, have not been made.

“The clause about valuation of the assets has not thus far attracted public attention or debate, is tailor-made to benefit some people who are currently facing the NAB inquest for having assets disproportionate to their known sources of income,” the official believed.

He said that the FBR rates were introduced in 2018 to have an idea about the value of urban properties for the purpose of taxation and duties. However, he pointed out that they were put in practice in a haphazard manner as they lacked uniformity. For example, similar rates have been applied in fixing the value of residential properties in different posh sectors of Islamabad and the commercial properties although their value grossly differ. The value of residential and commercial properties in F sectors is different.

No official explanation has been given for insertion of this provision. However, Special Assistant to the Prime Minister on Accountability Barrister Shahzad Akbar has stated that the purpose of the amendments is “rationalisation” of the NAB law. “The issue was repeatedly discussed in several cabinet meetings. Verbal assurances given to various segments including businessmen by different top government leaders have no value unless they have been translated into reality through the present amendments now,” he said.

It is generally accepted reality in Pakistan that the DC rates of immoveable property have been hovering around 50 percent of real time market based valuation rates in different parts of the country. Despite hiking the valuation rates notified by the FBR in the past, it ranges around 80 percent of real market value. Now the NAB ordinance only talked about DC rates and FBR notified rates or whichever is higher. There is no mention of real market value.

-

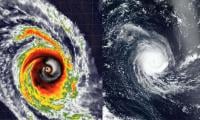

Tropical Cyclone Horacio Becomes World’s First Category 5 Superstorm Of 2026: Latest Forecast & Risks Explained

Tropical Cyclone Horacio Becomes World’s First Category 5 Superstorm Of 2026: Latest Forecast & Risks Explained -

Hilary Duff Recalls Brutal Thing She Did To Husband Matthew Koma After Losing Their Home In Los Angeles Wildfire

Hilary Duff Recalls Brutal Thing She Did To Husband Matthew Koma After Losing Their Home In Los Angeles Wildfire -

Princess Beatrice, Edo Mapelli Mozzi Fall Into Marital Woes: ‘He Doesn’t Want Her Seen With Andrew’

Princess Beatrice, Edo Mapelli Mozzi Fall Into Marital Woes: ‘He Doesn’t Want Her Seen With Andrew’ -

Meta’s Internal Memo Reveals How Executives Ignore Safety Warnings To Push Messenger Encryption Rollout Despite Risks To Teen Safety

Meta’s Internal Memo Reveals How Executives Ignore Safety Warnings To Push Messenger Encryption Rollout Despite Risks To Teen Safety -

Robert Carradine's Shocking Suicide Answer 'lies' In Brother David Old Tragic Incident

Robert Carradine's Shocking Suicide Answer 'lies' In Brother David Old Tragic Incident -

'CIA' Star Tom Ellis Drops Bombshell Reason Why He Stayed Away From 'FBI': I Know What They Do'

'CIA' Star Tom Ellis Drops Bombshell Reason Why He Stayed Away From 'FBI': I Know What They Do' -

Biographer Calls Andrew National Security Risk: ‘This Huge Can Of Worms Is Getting Closer To King’

Biographer Calls Andrew National Security Risk: ‘This Huge Can Of Worms Is Getting Closer To King’ -

DeepSeek Under Fire: Anthropic Accuses Chinese AI Firm Of Misusing Claude For Unauthorized Model Training

DeepSeek Under Fire: Anthropic Accuses Chinese AI Firm Of Misusing Claude For Unauthorized Model Training -

Would You Drive In A Driverless Taxi? AI-powered Robotaxis Roll Out In London Amid Growing Debates Over Road Safety, Passenger Convenience

Would You Drive In A Driverless Taxi? AI-powered Robotaxis Roll Out In London Amid Growing Debates Over Road Safety, Passenger Convenience -

Trump’s Tariff Plan: 10 Percent Rate Takes Effect Despite 15 Percent Announcement Following Supreme Court Ruling

Trump’s Tariff Plan: 10 Percent Rate Takes Effect Despite 15 Percent Announcement Following Supreme Court Ruling -

Eric Church Reveals How Vince Gill Made His Brother Barndon's Death 'a New Normal'

Eric Church Reveals How Vince Gill Made His Brother Barndon's Death 'a New Normal' -

Harry, Meghan Offer Help To Beatrice, Eugenie As They Navigate Big Decision

Harry, Meghan Offer Help To Beatrice, Eugenie As They Navigate Big Decision -

Robert Carradine's Heartbroken Brother Keith Breaks Silence On Actor's Tragic Death

Robert Carradine's Heartbroken Brother Keith Breaks Silence On Actor's Tragic Death -

How Deepfake Scams Are Reaching Record Levels By Targeting Social Media Users: Everything You Need To Know

How Deepfake Scams Are Reaching Record Levels By Targeting Social Media Users: Everything You Need To Know -

Taylor Swift Embraces Herself As Her Career Hits Major Milestone: 'I Am Blown Away'

Taylor Swift Embraces Herself As Her Career Hits Major Milestone: 'I Am Blown Away' -

Andrew’s Arrest Takes Over US Elites: ‘They’re Calling Lawyers In Fear The Police Will Pounce’

Andrew’s Arrest Takes Over US Elites: ‘They’re Calling Lawyers In Fear The Police Will Pounce’