An unviable finance policy

With the ongoing ‘accountability’, the Imran Khan government has also unleashed the tyranny of the IMF’s tougher conditions, breaking the back of the people and whatever life was left in an unsustainable economy.

Budget 2019-20 was a very bitter doze for an already-growth economy. Exhausting all the ridiculous notions of filling the financial gaps through the recovery of plundered wealth (indeed, all wealth is accumulated through the plunder of others’ labour or rent), the finance bill has loaded taxpayers and common citizens with a massive burden of Rs5,555 billion taxes. With an estimated GDP growth rate of less than 3 percent, and in the absence of meaningful taxation reforms, the ambitious target is hard to achieve; some would say it could jeopardize the IMF deal itself.

As the government failed to achieve its revenue target of Rs4,435 billion with a big margin in the outgoing fiscal year, it is not expected to raise Rs1400 billion in additional taxes. Even if it succeeds, the fiscal deficit is going to be Rs3.6 trillion or 8.2 percent of GDP, if the provinces will not cough up a surplus of Rs432 billion. The IMF has focused on the reduction of primary deficit to allow debt payments.

Against many tall promises of austerity, the government has ended up overspending Rs2000 billion or 48 percent on current expenditure as compared to the previous year. Both debt and defence are going to consume 67.4 percent of the federal expenditure next year. Unless these expenditures substantially come down and the federal government is cut down to its size in accordance with the imperatives of the 18th Amendment, Pakistan cannot come out of its fiscal and financial crises.

It is not just corruption which has brought us to our current near-insolvency; one can also blame the over-burdening super-structure of the state. Over a dozen IMF packages had failed in the past to help achieve sustainability. The same will happen to this new agreement if it does not address the principal conflict between the unsustainable economic base and parasitic heavy superstructure and under-development of the real economy.

Given the rent-seeking nature of our urban and rural elite, the tax base remains shallow and most of its burden is shifted to the masses through indirect taxes, as is shown by the finance bill. With the inflation rate expected to go higher than 13 percent and the interest rates going up to 15 percent, you cannot expect to revive the economy, nor generate jobs for an increasing bulge of unemployed youth.

The taxation measures taken by abolishing the zero-rated regime for five export-based industries are going to dampen the prospects of exports. Similarly, a 7 percent additional customs duty on 2400 tariff lines with the highest slab going up to 27 percent will add to the costs of living and doing business. The best way would have been to bring all the taxable urban and rural incomes into the tax net and altogether stop the import of most non-essential goods. But this was beyond the character of the regime and the combination of the social forces it represents.

Much dust has been raised by Prime Minister Imran Khan about the accumulation of debt – and more than that about the siphoning away of borrowed money into the coffers of the leaders of the two previous governments. Perhaps, the prime minister is not that aware about how debts are contracted, spent and monitored. While he has been using debt as a whip in his narrative against the opposition, the real question is: how does domestic and external debt increase and where is it invested?

If debt is borrowed to meet current or unproductive expenditures and invested in useless projects, it becomes a trap; and if invested in productive projects, it helps break the begging bowl. In our case, most debt was accumulated due to the state’s habit of living beyond its means, resulting in a vicious cycle of borrowing debt to pay debt. A dependent economy cannot afford to take the ever-increasing burdens of a warrior state that continues to expand its stranglehold across all sectors of state and society.

Interestingly, according to the Economic Survey of Pakistan, the debt in June 2018 was Rs24,607 billion, which now under the current government is likely to climb up by Rs5000 billion – almost half that earned by the PML-N government in five years (Rs10,660 billion). How would Prime Minister Khan respond if he is asked about the Rs5 trillion debt that he has accumulated by the debt inquiry commission that he has announced? Living on borrowed money has become a permanent feature and will not change unless we stop spending on any pretext beyond our means.

After scaring away potential investors, the PTI government’s somersault over the whitening of ill-gotten or undeclared money has not helped it either. This is largely because people have distrusted such schemes because of the PM’s past rhetoric. So far, only 250 Pakistanis have declared their assets worth Rs450 million and the government’s expectation of raising Rs200 billion in penalties/revenue seem a bit too ambitious.

Quite ridiculously, the government also ended up resorting to rather unfair tactics to avoid any serious discourse over the finance bill in parliament. It has diverted public attention from its failure to handle the economy and come up with a viable plan for economic revival. As opposed to its egalitarian claims, the government has come up with a budget that will further decrease per capita income and employment, increase cost of living and further reduce economic growth.

The reduction in allocations for education and health shows the lack of concern in the government as far as the needs of the people are concerned. There are hard days ahead for fixed income groups and working people with little increase in salaries/wages, reduction of taxable income limit to Rs600,000 per annum for salaried people and Rs300,000 per annum for non-salaried groups.

The government is going to face resistance over the price hike as well as its failed economic policies. It will not be able to take refuge behind the creation of the National Development Council and a commission of inquiry into debt. Nor can it any more divert public attention by shifting the blame on its predecessors, who of course did have their share in contributing to this dead end of unsustainability.

The real question is to change the character of the state to an economically and socially sustainable state at peace with its own people and beyond.

The writer is a senior journalist. Email: imtiaz.safma@gmail.com

Twitter: @ImtiazAlamSAFMA

-

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

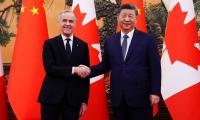

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training -

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light -

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push -

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down -

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career -

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer -

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis -

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI -

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds -

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years -

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome