Fake accounts case: Return the money sent abroad through launches, says CJP

The apex court gave the Joint Investigation Team (JIT) two more weeks for furnishing its progress report in the money laundering case of Rs35 billion through fake accounts.

ISLAMABAD: The Chief Justice of Pakistan (CJP), Mian Saqib Nisar, ordered the people to return the money sent abroad through the launches.

The Supreme Court (SC) on Monday gave the Joint Investigation Team (JIT) two more weeks for furnishing its progress report in the money laundering case of Rs35 billion through fake accounts. A three-member bench of the apex court headed by Chief Justice Mian Saqib Nisar resumed hearing into the suo motu case of investigation into the case.

The court directed the NAB to produce Abdul Ghani Majeed on Nov 17, the next date of hearing, at the Lahore Registry. Similarly, the court also summoned senior officials of the banks that claim to have loaned billions of rupees to the Omni Group. The banks, including the National Bank of Pakistan, Silk Bank Private Limited and others, have filed criminal applications under Section 201(a) of the Financial Institutions (Recovery of Finances) Ordinance, 2001, seeking action against the CEOs/directors of sugar mills that are allegedly owned by the Omni Group, accusing them of pilferage of the sugar stocks, pledged against the bank loans acquired by them.

The former president, Asif Ali Zardari, his sister Faryal Talpur and others are the respondents in the instant case being investigated by the FIA for using fake accounts and their alleged involvement in fraudulent bank transactions to the tune of Rs35 billion. The Federal Investigation Agency (FIA) is investigating a 2015 case pertaining to fake accounts and fictitious transactions conducted through 29 benami accounts in Summit Bank, Sindh Bank and United Bank Limited (UBL).

The FIA had recommended to the apex court to constitute a Joint Investigation Team (JIT). On September 6, the apex court constituted a six-member JIT to probe a money laundering and fake accounts case. Headed by Ahsan Sadiq ,Additional Director General (Economic Crime Wing), FIA Headquarters, Islamabad, the JIT was given all powers relating to inquiries and investigations including those available in the Code of Criminal Procedure, 1908; National Accountability Ordinance, 1999; Federal Investigation Agency Act, 1974, the Anti-Corruption Laws, etc. Other JIT members are Imran Latif Minhas, Commissioner-IR (Corporate Zone), Regional Tax Office, Islamabad, Majid Hussain, Joint Director BID-I, State Bank of Pakistan, Islamabad, Noman Aslam, Director, National Accountability Bureau, Islamabad, Muhammad Afzal, Director, Specialised Companies Division, Securities and Exchange Commission of Pakistan, Islamabad; and Brigadier Shahid Parvez of Inter-Services Intelligence.

On Monday, the court asked Nimr Majeed about the security pledged to the bank to which he expressed his ignorance. At this, the CJP said as to why he should not be sent to jail. “We did not send you to prison so you can sort out the matters regarding the Omni group’s bank,” the CJP remarked. The CJP observed that Abdul Ghani Majeed should be sent to the Adiala Jail as he is looking after his business through phone despite the court's repeated directions to take away his phone.

The CJP asked about the JIT progress report to which its head Ahsan Sadiq sought some time to submit the report. Chief Justice Mian Saqib Nisar said the court has given sufficient time to sort out the bank matters. “We know as to where Rs54 billion went”, the CJP said adding they are also aware about the documents of hundi. The DG FIA told the court that the JIT is continuing its probe into the matter.

Meanwhile, the FIA submitted its report pertaining to the alleged disappearance of sugar stocks from mills owned by the Omni Group. In its report, the agency stated that the Omni Group owed a total debt of Rs13.5 billion, of which the banks’ losses made up Rs11.5 billion. It was revealed that the sugar stocks mortgaged against the bank loans comprising 6,692,946 bags went missing from the mills. It informed the court that the JIT had seized the record of the sugar mills and was examining the details. Similarly, the court was informed that two witnesses who appeared before the JIT in connection with the fake accounts case have been kidnapped. The court issued notice to Inspector General Sindh Police to appear and explain whether the witnesses were kidnapped or went missing of their own will.

-

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

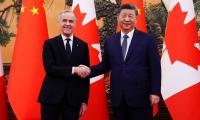

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training -

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light -

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push -

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down -

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career -

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer -

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis -

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI -

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds -

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years -

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome