PTCL Q1 profit falls 84 percent, lags forecast

KARACHI: Pakistan Telecommunication Company Limited (PTCL), the country’s largest phone service provider, on Wednesday reported an 84 percent fall in its first quarter 2015 net profit as increased financial costs offset higher gross margin.In a statement to the Karachi Stock Exchange, the company reported a net profit of Rs716.4 million

By Hina Mahgul Rind

April 16, 2015

KARACHI: Pakistan Telecommunication Company Limited (PTCL), the country’s largest phone service provider, on Wednesday reported an 84 percent fall in its first quarter 2015 net profit as increased financial costs offset higher gross margin.

In a statement to the Karachi Stock Exchange, the company reported a net profit of Rs716.4 million for the quarter ended March 31, down from Rs4.4 billion, the same period last year. Earnings per share came in at Rs0.14/share, compared with Rs0.85/share.

The result was significantly below the market expectations and analysts said acquisition cost of 3G licence and renewal of 2G licence by the company bites profitability. The company said its sales remained stable in the quarter to Rs30.2 billion, while the cost of sales declined by 8.4 percent to Rs21.7 billion. Gross margins, hence, witnessed improvement of 542bps to 28.2 percent.

“We attribute reduction in cost of sales to an expected decline in salaries, allowances and other benefits (15 percent of total cost of goods sold) on the back of Voluntary Separation Scheme in 4Q2014,” said analyst Tahir Saeed at Topline Research.

“Finance cost of the company surged by 385 percent during the quarter and 251 percent on year-on-year basis to Rs1.4 billion, primarily due to heavy debt taken by its subsidiary Ufone for the acquisition of 3G licence and renewal of 2G licence last year.”

The government held auctions for 3G and 4G network licences in April last year and raised $1.1 billion. The four winners of the 3G auction were Russian-owned Mobilink, Chinese-controlled Zong, Norway’s Telenor, and Ufone - a company jointly owned by the Pakistan government and the United Arab Emirates’ Etisalat. As for the 4G spectrum, the winner was Zong.

Saeed said other income of the company also declined 11 percent on quarter-on-quarter and 34 percent year-on-year to Rs852 million. “This decline is due to the 150bps cut in the discount rate in the first quarter of 2015,” he added.

Analysts said revenue from Ufone, the cell phone service provider, also declined by six percent on quarter-on-quarter to Rs10.9 billion due to the verification process initiated by the Pakistan Telecommunication Authority. Ufone subscribers fell one percent to 21.7 million in February 2015 from 21.9 million in December 2014.

However, gross margins of the sister concern of PTCL increased by 692bps to 25 percent versus 18 percent in the last quarter of 2014. “Increase in the gross margins is due to retention of quality customers,” Saeed said.

Analysts said the company is expected to regain its bottom line growth during the current year on strong growth in its subscriber base.

The company has potential to grow in the longer run if the management succeeds in implementing steps taken for 3G network expansion, cost cutting and introduction of new service and efficiency measures, they added.

The company in a statement said its cash flows remained strong owing to the steady growth in the subscriber base and strong market position backed by the company’s growing fixed and wireless broadband business.

“PTCL’s strategy of continuous investment in next generation communications infrastructure has translated in a robust first quarter performance and enabled us to deliver for our shareholders,” Walid Irshaid, President & CEO PTCL said. “This impetus continued across all of our business segments, especially in our wireless and fixed broadband and enterprise solutions.”

In a statement to the Karachi Stock Exchange, the company reported a net profit of Rs716.4 million for the quarter ended March 31, down from Rs4.4 billion, the same period last year. Earnings per share came in at Rs0.14/share, compared with Rs0.85/share.

The result was significantly below the market expectations and analysts said acquisition cost of 3G licence and renewal of 2G licence by the company bites profitability. The company said its sales remained stable in the quarter to Rs30.2 billion, while the cost of sales declined by 8.4 percent to Rs21.7 billion. Gross margins, hence, witnessed improvement of 542bps to 28.2 percent.

“We attribute reduction in cost of sales to an expected decline in salaries, allowances and other benefits (15 percent of total cost of goods sold) on the back of Voluntary Separation Scheme in 4Q2014,” said analyst Tahir Saeed at Topline Research.

“Finance cost of the company surged by 385 percent during the quarter and 251 percent on year-on-year basis to Rs1.4 billion, primarily due to heavy debt taken by its subsidiary Ufone for the acquisition of 3G licence and renewal of 2G licence last year.”

The government held auctions for 3G and 4G network licences in April last year and raised $1.1 billion. The four winners of the 3G auction were Russian-owned Mobilink, Chinese-controlled Zong, Norway’s Telenor, and Ufone - a company jointly owned by the Pakistan government and the United Arab Emirates’ Etisalat. As for the 4G spectrum, the winner was Zong.

Saeed said other income of the company also declined 11 percent on quarter-on-quarter and 34 percent year-on-year to Rs852 million. “This decline is due to the 150bps cut in the discount rate in the first quarter of 2015,” he added.

Analysts said revenue from Ufone, the cell phone service provider, also declined by six percent on quarter-on-quarter to Rs10.9 billion due to the verification process initiated by the Pakistan Telecommunication Authority. Ufone subscribers fell one percent to 21.7 million in February 2015 from 21.9 million in December 2014.

However, gross margins of the sister concern of PTCL increased by 692bps to 25 percent versus 18 percent in the last quarter of 2014. “Increase in the gross margins is due to retention of quality customers,” Saeed said.

Analysts said the company is expected to regain its bottom line growth during the current year on strong growth in its subscriber base.

The company has potential to grow in the longer run if the management succeeds in implementing steps taken for 3G network expansion, cost cutting and introduction of new service and efficiency measures, they added.

The company in a statement said its cash flows remained strong owing to the steady growth in the subscriber base and strong market position backed by the company’s growing fixed and wireless broadband business.

“PTCL’s strategy of continuous investment in next generation communications infrastructure has translated in a robust first quarter performance and enabled us to deliver for our shareholders,” Walid Irshaid, President & CEO PTCL said. “This impetus continued across all of our business segments, especially in our wireless and fixed broadband and enterprise solutions.”

-

ByteDance’s New AI Video Model ‘Seedance 2.0’ Goes Viral

ByteDance’s New AI Video Model ‘Seedance 2.0’ Goes Viral -

Archaeologists Unearthed Possible Fragments Of Hannibal’s War Elephant In Spain

Archaeologists Unearthed Possible Fragments Of Hannibal’s War Elephant In Spain -

Khloe Kardashian Reveals Why She Slapped Ex Tristan Thompson

Khloe Kardashian Reveals Why She Slapped Ex Tristan Thompson -

‘The Distance’ Song Mastermind, Late Greg Brown Receives Tributes

‘The Distance’ Song Mastermind, Late Greg Brown Receives Tributes -

Taylor Armstrong Walks Back Remarks On Bad Bunny's Super Bowl Show

Taylor Armstrong Walks Back Remarks On Bad Bunny's Super Bowl Show -

James Van Der Beek's Impact Post Death With Bowel Cancer On The Rise

James Van Der Beek's Impact Post Death With Bowel Cancer On The Rise -

Pal Exposes Sarah Ferguson’s Plans For Her New Home, Settling Down And Post-Andrew Life

Pal Exposes Sarah Ferguson’s Plans For Her New Home, Settling Down And Post-Andrew Life -

Blake Lively, Justin Baldoni At Odds With Each Other Over Settlement

Blake Lively, Justin Baldoni At Odds With Each Other Over Settlement -

Thomas Tuchel Set For England Contract Extension Through Euro 2028

Thomas Tuchel Set For England Contract Extension Through Euro 2028 -

South Korea Ex-interior Minister Jailed For 7 Years In Martial Law Case

South Korea Ex-interior Minister Jailed For 7 Years In Martial Law Case -

UK Economy Shows Modest Growth Of 0.1% Amid Ongoing Budget Uncertainty

UK Economy Shows Modest Growth Of 0.1% Amid Ongoing Budget Uncertainty -

James Van Der Beek's Family Received Strong Financial Help From Actor's Fans

James Van Der Beek's Family Received Strong Financial Help From Actor's Fans -

Alfonso Ribeiro Vows To Be James Van Der Beek Daughter Godfather

Alfonso Ribeiro Vows To Be James Van Der Beek Daughter Godfather -

Elon Musk Unveils X Money Beta: ‘Game Changer’ For Digital Payments?

Elon Musk Unveils X Money Beta: ‘Game Changer’ For Digital Payments? -

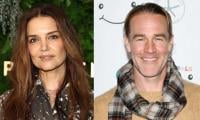

Katie Holmes Reacts To James Van Der Beek's Tragic Death: 'I Mourn This Loss'

Katie Holmes Reacts To James Van Der Beek's Tragic Death: 'I Mourn This Loss' -

Bella Hadid Talks About Suffering From Lyme Disease

Bella Hadid Talks About Suffering From Lyme Disease