Avenfield reference: AC judgment based on clause turned redundant by SC

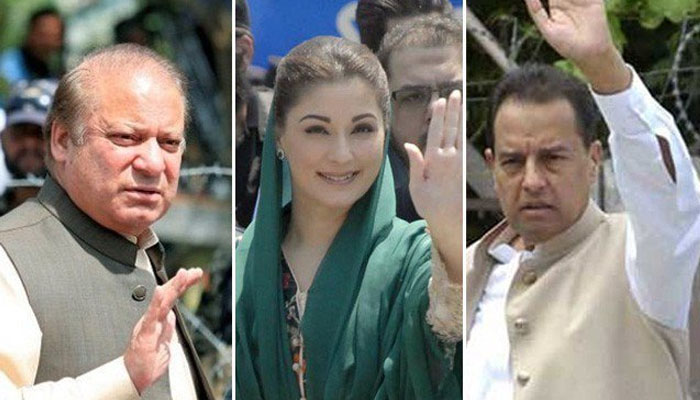

ISLAMABAD: The Friday’s verdict of the accountability court acquitted former Prime Minister Nawaz Sharif of any corruption or dishonesty due to lack of “bright evidence” but convicted him for benami possession of London flats under section 9(a)(v), a section which has become redundant following the latest Supreme Court judgement on the same subject.

Judge of the accountability court held that “All the ingredients of the offenses as defined u/s 9(a)(v) of NAO 1999 are established therefore, heavy burden was shifted to the accused to account of assets/Avenfield apartments that those are not disproportionate to known sources of their income.”

“Here we bring up quote section 9 (a) and read with V, pls. Sub-section iv and v of section 9(a) of the NAB Ordinance reads; 9 (a) A holder of a public office, or any other person, is said to commit or to have committed the offence of corruption and corrupt practices-

iv)- if he by corrupt, dishonest, or illegal means, obtains or seeks to obtain for himself, or for his spouse or dependents or any other person, any property, valuable thing, or pecuniary advantage; or

v)- if he or any of his dependents or benamidar owns, possesses, or has [acquired] right or title in any [“assets or holds irrevocable power of attorney in respect of any assets or pecuniary resources disproportionate to his known sources of income, which he cannot [reasonably] account for [or maintains a standard of living beyond that which is commensurate with his sources of income]; The accountability judge is basically of the view that in the absence of direct evidence of the ownership, only Nawaz Sharif can be the true owner of the London flats and is guilty under section 9(a)(v) of the NAB Ordinance.”

Sharif’s lawyers have consistently maintained complete money trail had been provided to the JIT which prosecution in accountability court could not prove wrong.

This section of the NAB Ordinance declares possessing benami properties disproportionate to known sources of income as a crime. However, a recent judgement of the Supreme Court on this subject titled Ghani-ur-Rehman vs NAB (PLD 2011 Supreme Court 1144) and authored by Justice Asif Saeed Khosa declared that prosecution has to establish a link of the property with the committing of a crime of corruption, failing which no punishment can be awarded. This judgement made this section of NAB Ordinance almost redundant in absence of evidence of committing of corruption.

It is interesting that in the Friday verdict, in order to invoke section 9(a)(v) and while declaring that the London flats were “disproportionate to the known sources of income” of the accused, the balance sheets of different businesses and yearly income tax returns of the members of the Sharif family, which are part of the JIT report, were simply ignored.

The issue that prosecution was trying to establish was that the movement of money to London was not being established.

According to Sharif family, they have provided complete trail of money and its transfer to London and which could not be proved wrong.

A three-member bench of the Supreme Court of Pakistan in a recent judgement has held in categorical terms that a person cannot be convicted in a case of assets beyond means unless the investigators thoroughly investigate and bring on record the sources of income of an accused and establish any nexus between misuse of his authority while holding a public office and amassing of wealth or accumulation of assets by him.

Senior most judge of the Supreme Court and next Chief Justice of Pakistan Justice Asif Saeed Khan Khosa had authored the judgement in the case of Ghani-ur-Rehman vs NAB (PLD 2011 Supreme Court 1144) while Justice (R) Tassaduq Hussain Jillani and Justice (R) Mahmood Akhtar Shahid Siddiqui were also part of the bench.

Justice Khosa had held that mere possession of any pecuniary resources or property is by itself not an offence, but it is failure to satisfactorily account for such possession of pecuniary resources or property that makes the possession objectionable and constitute offence.

Justice Khosa in this judgment also wrote: “In a recent unreported judgment delivered in the case of Khalid Aziz v. The State (Criminal Appeal No. 361 of 2001 decided on 5-10-2010) this court had dilated upon the necessary ingredients of this penal provision and had approvingly reiterated the principles laid down in that respect by a learned Division Bench of the High Court of Sindh in the case of Hakim Ali Zardari v. State (2007 MLD 910) and had reproduced in its judgment a paragraph of that judgment rendered by the High Court of Sindh which read as under:

"In order to prove the case, the prosecution is required to prove the ingredients of the offence, which are (1) it must establish that the accused was holder of a public office (2) the nature and extent of the pecuniary resources of property which were found in his possession, (3) it must be proved as to what were his known sources of income i.e. known to the prosecution after thorough investigation and (4) it must prove, quite objectively, that such resources or property found in possession of the accused were disproportionate to his known sources of income. Once these four ingredients are established, the offence as defined under section 9(a)(v) is complete, unless the accused is able to account for such resources or property. Thus, mere possession of any pecuniary resources or property is by itself not an offence, but it is failure to satisfactorily account for such possession of pecuniary resources or property that makes the possession objectionable and constitute offence. If he cannot explain, presumption under section 14(c) of the Ordinance that accused is guilty of corruption and corrupt practices is required to be drawn.”

The conviction of Maryam Nawaz is also questionable according to some legal sources.

NAB mainly deals with the cases of wrongdoing of public office holders though the ordinance allows it to act against any person who violates this law. However, this judgement and many other judgements bar NAB from acting against general public and restricts its domain to the public office holders. Other than public office holders, NAB has acted against fraudulent housing societies on orders of the court.

-

Winter Olympics 2026: When & Where To Watch The Iconic Ice Dance ?

Winter Olympics 2026: When & Where To Watch The Iconic Ice Dance ? -

Melissa Joan Hart Reflects On Social Challenges As A Child Actor

Melissa Joan Hart Reflects On Social Challenges As A Child Actor -

'Gossip Girl' Star Reveals Why She'll Never Return To Acting

'Gossip Girl' Star Reveals Why She'll Never Return To Acting -

Chicago Child, 8, Dead After 'months Of Abuse, Starvation', Two Arrested

Chicago Child, 8, Dead After 'months Of Abuse, Starvation', Two Arrested -

Travis Kelce's True Feelings About Taylor Swift's Pal Ryan Reynolds Revealed

Travis Kelce's True Feelings About Taylor Swift's Pal Ryan Reynolds Revealed -

Michael Keaton Recalls Working With Catherine O'Hara In 'Beetlejuice'

Michael Keaton Recalls Working With Catherine O'Hara In 'Beetlejuice' -

King Charles, Princess Anne, Prince Edward Still Shield Andrew From Police

King Charles, Princess Anne, Prince Edward Still Shield Andrew From Police -

Anthropic Targets OpenAI Ads With New Claude Homepage Messaging

Anthropic Targets OpenAI Ads With New Claude Homepage Messaging -

US Set To Block Chinese Software From Smart And Connected Cars

US Set To Block Chinese Software From Smart And Connected Cars -

Carmen Electra Says THIS Taught Her Romance

Carmen Electra Says THIS Taught Her Romance -

Leonardo DiCaprio's Co-star Reflects On His Viral Moment At Golden Globes

Leonardo DiCaprio's Co-star Reflects On His Viral Moment At Golden Globes -

SpaceX Pivots From Mars Plans To Prioritize 2027 Moon Landing

SpaceX Pivots From Mars Plans To Prioritize 2027 Moon Landing -

J. Cole Brings Back Old-school CD Sales For 'The Fall-Off' Release

J. Cole Brings Back Old-school CD Sales For 'The Fall-Off' Release -

King Charles Still Cares About Meghan Markle

King Charles Still Cares About Meghan Markle -

GTA 6 Built By Hand, Street By Street, Rockstar Confirms Ahead Of Launch

GTA 6 Built By Hand, Street By Street, Rockstar Confirms Ahead Of Launch -

Funeral Home Owner Sentenced To 40 Years For Selling Corpses, Faking Ashes

Funeral Home Owner Sentenced To 40 Years For Selling Corpses, Faking Ashes