It took us 30 months’ hard work to qualify: Ishaq Dar

OECD anti-tax evasion convention membership

It consumed Pakistan’s and its Finance Minister’s 30 months of incessant, colossal hard work to comply with the OECD standards and requirements before Pakistan could qualify for acceptance as a Member of OECD's multilateral convention for anti-tax evasion.

This was stated by Federal Finance Minister, Senator Ishaq Dar, while talking exclusively to The News on phone when the Minister was in transit on way to Paris for signing OECD's multilateral convention for anti-tax evasion treaty between 103 countries.

Dar further stated that it was a task almost next to impossible to qualify for this acceptability but “We took it as a challenge not only with the objective of being a part of the international anti-tax evasion drive but also with the idea of looking into openings to facilitate and motivate the existing and potential tax-payers to contribute towards national growth”.

He reiterated, “It took me lot of hard work for 30 months to comply with their standards and requirements before Pakistan would have been acceptable as a Member. We will Insha-Allah sign on 14th September afternoon. Besides I have a huge busy schedule throughout the Eidul Azha holidays and thereafter i.e from Monday afternoon till Friday evening when I fly back to Islamabad Insha-Allah but I’m happy with these engagements during holidays because I will be serving the nation by working during Eid holidays?. Keep praying for Pakistan”.

It is worth mentioning that the Convention on Mutual Administrative Assistance in Tax Matters ("the Convention") was developed jointly by the Organization of Economic Cooperation and Development (OECD) and the Council of Europe in 1988 and amended by Protocol in 2010. The Convention is the most comprehensive multilateral instrument available for all forms of tax co-operation to tackle tax evasion and avoidance, a top priority for all countries.

The Convention was amended to respond to the call of the G20 at its 2009 London Summit to align it to the international standards on exchange of information on request and to open it to all countries, in particular to ensure that developing countries could benefit from the new, more transparent environment. The amended Convention was opened for signature on 1 June 2011.

Since 2009, the G20 has consistently encouraged countries to sign the Convention including most recently at the meeting of the G20 Finance Ministers and Central Bank Governors’ meeting in February 2016 where the communique stated "We reiterate our call for all countries to join the Multilateral Convention on Mutual Administrative Assistance in Tax Matters".

103 jurisdictions are currently participating in the Convention, including 15 jurisdictions covered by territorial extension. This represents a wide range of countries including all G20 countries, all BRIICS, all OECD countries, major financial centres and an increasing number of developing countries.

And the amended Convention facilitates international co-operation for a better operation of national tax laws, while respecting the fundamental rights of taxpayers. The amended Convention provides for all possible forms of administrative co-operation between states in the assessment and collection of taxes, in particular with a view to combating tax avoidance and evasion. This co-operation ranges from exchange of information, including automatic exchanges, to the recovery of foreign tax claims.

-

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

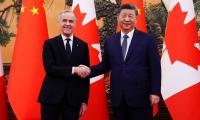

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training -

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light -

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push -

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down -

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career -

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer -

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis -

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI -

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds -

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years -

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome