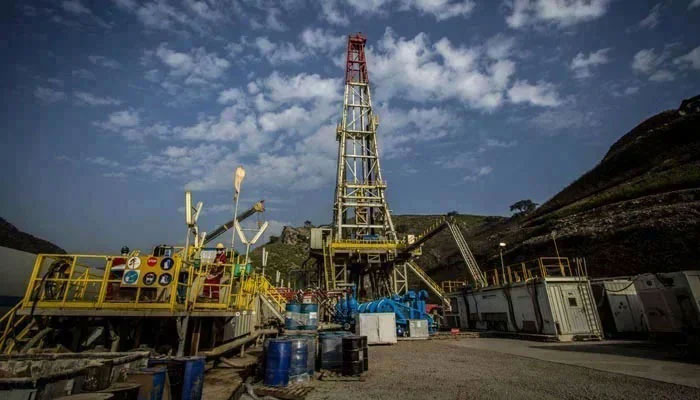

Kuwait company sells $60m assets to PEL, exits Pakistan

KUFPEC decides to recoup its investments by selling its assets and concessions in various blocks across Pakistan

ISLAMABAD: Kuwait Foreign Petroleum Exploration Company (KUFPEC) has initiated its exit from Pakistan’s oil and gas sector by selling its key assets, valued at nearly $60 million, to Pakistan Exploration (Private) Limited (PEL), a senior official from the Ministry of Energy told The News on Monday.

“The foreign E&P companies are increasingly disheartened, primarily due to the massive circular debt in the gas sector, which has reached Rs2,700 billion. Of this, Rs1,500 billion, including $600 million owed to local and foreign Exploration and Production (E&P) companies, remains unpaid due to defaults by the gas companies. The 12-month delay in approving amendments to the 2012 E&P policy also contributed to KUFPEC’s decision,” the official stated.

KUFPEC has decided to recoup its investments by selling its assets and concessions in various blocks across Pakistan to reinvest in other countries, according to the official source. KUFPEC, a subsidiary of Kuwait Petroleum Corporation (KPC), was established in April 1981. The company focuses on the discovery, development, and extraction of crude oil and natural gas outside Kuwait. It operates in 10 countries across five continents, including Australia, Asia, Africa, North America, and Europe.

Interestingly, in a press release dated November 23, 2023, KUFPEC announced the signing of Memorandums of Understanding (MoUs) with Pakistani companies, including Oil and Gas Development Company Limited (OGDCL), Mari Petroleum Company Limited (MPCL), and Prime Pakistan Limited. The MoUs were aimed at enhancing KUFPEC’s strategic partnerships, exploration portfolio, and asset value in Pakistan.

KUFPEC CEO Mohammad Al-Haimer had stated at the time, “The MoUs are not limited to strengthening strategic partnerships to expand our exploration portfolio in Pakistan but also provide significant opportunities to enhance KUFPEC’s assets, independent peer reviews, knowledge exchange, and utilising the expertise of our global partners.”

However, just a year later, KUFPEC’s decision to sell its assets and concessions has raised serious concerns for policymakers in Pakistan. When contacted, PEL confirmed the acquisition, stating, “Yes, we have acquired KUFPEC Pakistan’s assets after winning the bid.”

However, the company declined to disclose the asset value, citing non-disclosure agreement (NDA) obligations. PEL also confirmed making advance payments to KUFPEC. According to a press release on PEL’s website, the acquisition includes assets in Pakistan’s Dadu, Kirthar, Tajjal, and Qadirpur concessions, along with the Bhit and Qadirpur leases.

“This strategic acquisition marks a significant milestone for PEL as it expands its exploration portfolio and strengthens its presence in Pakistan’s energy sector. It underscores PEL’s commitment to discovering and harnessing the country’s energy potential,” the release stated.

The acquisition aligns with PEL’s long-term strategy to explore energy opportunities and unlock Pakistan’s vast natural resources. “We are confident that these assets will help us meet the growing energy demands of Pakistan,” PEL said. PEL reiterated its commitment to the exploration and development of Pakistan’s natural resources and its role in contributing to the country’s energy security and sustainable growth.

-

Social Media Addiction ‘like Smoking’: Mumsnet Calls For Under-16s Ban With Cigarette-style Warnings

Social Media Addiction ‘like Smoking’: Mumsnet Calls For Under-16s Ban With Cigarette-style Warnings -

Andrew Mountbatten, Virginia Giuffre's Photos Attached To Buckingham Palace Gates

Andrew Mountbatten, Virginia Giuffre's Photos Attached To Buckingham Palace Gates -

Everything We Know About Bruce Willis Frontotemporal Dementia

Everything We Know About Bruce Willis Frontotemporal Dementia -

Singapore's Grab Plans AI-driven Expansion And New Services To Boost Profit By 2028

Singapore's Grab Plans AI-driven Expansion And New Services To Boost Profit By 2028 -

Adele Reveals How She 'snapped Out Of' Sever Postpartum Depression

Adele Reveals How She 'snapped Out Of' Sever Postpartum Depression -

‘Chinamaxxing’ Explained: Inside Viral Gen Z Trend Taking Over TikTok And Instagram

‘Chinamaxxing’ Explained: Inside Viral Gen Z Trend Taking Over TikTok And Instagram -

Fears Erupt About Sarah Ferguson Pulling A ‘Harry’ While Sitting On A King’s Ransom: ‘Her Leverage Still Stands’

Fears Erupt About Sarah Ferguson Pulling A ‘Harry’ While Sitting On A King’s Ransom: ‘Her Leverage Still Stands’ -

Lisa Rinna Slams Andy Cohen For His Below The Belt Move: 'So Shady'

Lisa Rinna Slams Andy Cohen For His Below The Belt Move: 'So Shady' -

Stunning New Photos Of The Milky Way Shed Light On How Stars Are Formed

Stunning New Photos Of The Milky Way Shed Light On How Stars Are Formed -

Prince Harry, Meghan Face Fresh Calls To Lose Royal Titles Over ‘pseudo-royal’ Visit

Prince Harry, Meghan Face Fresh Calls To Lose Royal Titles Over ‘pseudo-royal’ Visit -

Gordon Ramsay On His Basal Cell Carcinoma Diagnosis

Gordon Ramsay On His Basal Cell Carcinoma Diagnosis -

Fukushima Decommissioning: Japan Deploys Snake-like Robot To Remove Nuclear Debris

Fukushima Decommissioning: Japan Deploys Snake-like Robot To Remove Nuclear Debris -

Brenda Song Turns Macaulay Culkin's 'Home Alone' Into 'terrible' Lesson: 'Children Have To Be A Little Scared'

Brenda Song Turns Macaulay Culkin's 'Home Alone' Into 'terrible' Lesson: 'Children Have To Be A Little Scared' -

MrBeast Vows To Book Only Starlink-equipped Flights As Global Airline Adoption Surges

MrBeast Vows To Book Only Starlink-equipped Flights As Global Airline Adoption Surges -

Kim Jong Un Says North Korea Ready To ‘get Along’ With US But Sets Key Condition

Kim Jong Un Says North Korea Ready To ‘get Along’ With US But Sets Key Condition -

Andrew Fears What Comes Next As Jeffrey Epstein Scandal Deepens

Andrew Fears What Comes Next As Jeffrey Epstein Scandal Deepens