KCCI criticises reinstatement of affidavit requirement

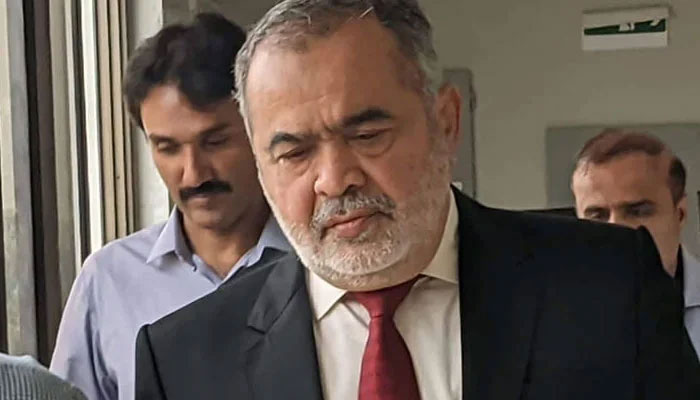

KARACHI: President of the Karachi Chamber of Commerce and Industry (KCCI) Muhammad Jawed Bilwani has criticised the reinstatement of the requirement to file an affidavit with sales tax returns.

He demanded that authorities suspend the affidavit requirement immediately until comprehensive consultations are conducted and effective alternative measures are put in place.

Bilwani said that, in response to the KCCI’s request, the Federal Board of Revenue (FBR) had rightfully withdrawn this burdensome requirement for September 2024. The decision was communicated via a press release, which clearly stated that: a) the filing of an affidavit would not be required for returns for the tax period of September 2024, due in October 2024; b) the FBR would actively seek alternative proposals from stakeholders by October 31 to address the issue of falsified sales tax returns; and c) the Board would consider modifying the affidavit requirements in response to legitimate stakeholder concerns.

Bilwani pointed out that no consultations with stakeholders have taken place to date, nor have any viable alternative solutions been explored. He said that the business community is already under significant pressure, and this ill-conceived requirement only serves to add to their challenges, creating unnecessary hurdles and fostering an environment of intimidation.

He argued that the obligation to file the affidavit poses considerable challenges. Taxpayers and their employees, including chief financial officers (CFOs), cannot be expected to provide guarantees or assurances regarding tax credits arising from fraudulent or fictitious invoices linked to suppliers and other tiers in the supply chain.

“The ability to verify the registration status of suppliers as active taxpayers is limited to what is available on the FBR’s website,” he said. He also pointed out that since the FBR holds comprehensive powers such as auditing, verification and investigation to ensure tax compliance, it was unreasonable to expect individual taxpayers -- who lack these capabilities -- to bear the burden of responsibility for issues that fall within the FBR’s scope.

Bilwani further criticised the FBR’s decision to compel CFOs to submit an affidavit along with sales tax returns for the tax period starting September 2024. He said that this move placed undue pressure on filers to verify the accuracy of submitted returns, with the added threat of severe legal consequences, including potential arrest under Section 37(A) and imprisonment for up to t10 years, as stipulated in Section 33(13) of the Sales Tax Act of 1990.

“Matters that are already sub judice in various legal forums should not be included in the affidavit,” he added. Bilwani urged the FBR not to place the responsibility of ensuring transparency across the entire supply chain on individual filers, as this is neither logical nor legal.

-

AI Film School Trains Hollywood’s Next Generation Of Filmmakers

AI Film School Trains Hollywood’s Next Generation Of Filmmakers -

Royal Expert Claims Meghan Markle Is 'running Out Of Friends'

Royal Expert Claims Meghan Markle Is 'running Out Of Friends' -

Bruno Mars' Valentine's Day Surprise Labelled 'classy Promo Move'

Bruno Mars' Valentine's Day Surprise Labelled 'classy Promo Move' -

Ed Sheeran Shares His Trick Of Turning Bad Memories Into Happy Ones

Ed Sheeran Shares His Trick Of Turning Bad Memories Into Happy Ones -

Teyana Taylor Reflects On Her Friendship With Julia Roberts

Teyana Taylor Reflects On Her Friendship With Julia Roberts -

Bright Green Comet C/2024 E1 Nears Closest Approach Before Leaving Solar System

Bright Green Comet C/2024 E1 Nears Closest Approach Before Leaving Solar System -

Meghan Markle Warns Prince Harry As Royal Family Lands In 'biggest Crises' Since Death Of Princess Diana

Meghan Markle Warns Prince Harry As Royal Family Lands In 'biggest Crises' Since Death Of Princess Diana -

Elon Musk Weighs Parenthood Against AI Boom, Sparking Public Debate

Elon Musk Weighs Parenthood Against AI Boom, Sparking Public Debate -

'Elderly' Nanny Arrested By ICE Outside Employer's Home, Freed After Judge's Order

'Elderly' Nanny Arrested By ICE Outside Employer's Home, Freed After Judge's Order -

Keke Palmer On Managing Growing Career With 2-year-old Son: 'It's A Lot'

Keke Palmer On Managing Growing Career With 2-year-old Son: 'It's A Lot' -

Key Details From Germany's Multimillion-euro Heist Revealed

Key Details From Germany's Multimillion-euro Heist Revealed -

David E. Kelley Breaks Vow To Cast Wife Michelle Pfeiffer In 'Margo's Got Money Troubles'

David E. Kelley Breaks Vow To Cast Wife Michelle Pfeiffer In 'Margo's Got Money Troubles' -

AI-powered Police Robots To Fight Crime By 2028: Report

AI-powered Police Robots To Fight Crime By 2028: Report -

Everything We Know About Jessie J's Breast Cancer Journey

Everything We Know About Jessie J's Breast Cancer Journey -

Winter Olympics 2026: What To Watch In Men’s Hockey Today

Winter Olympics 2026: What To Watch In Men’s Hockey Today -

Winnie Harlow Breaks Vitiligo Stereotypes: 'I'm Not A Sufferer'

Winnie Harlow Breaks Vitiligo Stereotypes: 'I'm Not A Sufferer'