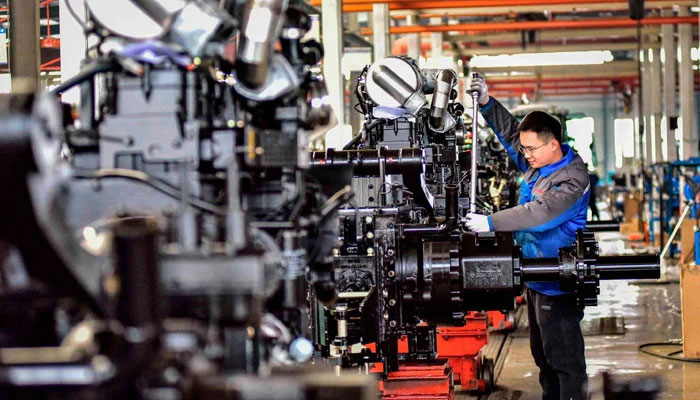

‘Chinese firms face challenges in Pakistan’s business climate’

CCCPK has conducted its first survey as part of this initiative and launched it here on Sunday.

ISLAMABAD: A newly released survey by the China Chamber of Commerce in Pakistan (CCCPK) has painted a complex picture of the business climate for Chinese companies operating in Pakistan, revealing a Business Climate Index score of 49.63, just below the crucial 50-point threshold separating optimism from pessimism. The CCCPK, with guidance from the Chinese embassy in Pakistan, developed the “Business Climate Index of Chinese Companies in Pakistan”. The CCCPK has conducted its first survey as part of this initiative and launched it here on Sunday.

The findings underscore significant challenges stemming from security risks, difficulty in remittances outflow due foreign exchange controls, policy and currency instability, which are constraining the operations of Chinese firms in the country.

This first-ever Business Climate Index highlights the need for sustained efforts from both governments to address these challenges and facilitate a more favorable business environment, crucial for realizing the full potential of CPEC and broader economic cooperation.

The survey, which sampled 48 Chinese companies — accounting for about 30 per cent of all Chinese businesses in Pakistan — indicated that 83.4 per cent of respondents perceive the security situation as deteriorating and not likely to improve in the short term. Security risks emerged as the primary factor hindering business development, reflecting a broader concern about the safety of investments in the region.

“Pakistan’s current security situation is severe and complex, with a slow economic recovery,” the survey stated, emphasizing the external pressures that have begun to impact various operational aspects.

In addition to security issues, 60.4 per cent of companies reported that foreign exchange controls hinder timely payments, while 58.3 percent cited a lack of policy continuity and poor policy implementation as significant obstacles affecting their business decisions. Moreover, 56.3 percent of respondents noted that the depreciation of Pakistani rupee has eroded their net assets when measured in US dollars.

“Despite these challenges, Chinese companies have actively worked to overcome difficulties and maintained overall stability in their operations, with some companies showing signs of expansion,” the report added. Around 54.2 percent companies noted the government’s low administrative efficiency as challenge.

Despite the hurdles, the survey revealed a resilient spirit among Chinese enterprises. Over 52.1 percent of firms indicated that their business volume remained stable, while 33.3 per cent reported growth in their operations.

Looking forward, 70 percent of respondents expressed optimism about Pakistan’s economic development, with 47.9 percent expecting stability in new order volumes over the next three months.

Recent economic indicators suggest a potential turnaround for Pakistan. Inflation has decreased to 6.9 percent, and foreign exchange reserves have exceeded $14.7 billion, reaching a two-year high. Additionally, exports surged by 14 percent in the first two months of the new fiscal year, hinting at a stabilizing economy.

The survey highlighted that the majority of Chinese companies plan to maintain their production scale, with 58.3 percent aiming to keep their workforce stable. Meanwhile, 37 percent of firms indicated intentions to expand their production scale, although 18.8 percent projected minor layoffs.

In a positive outlook, 39 percent of respondents believe Pakistan’s overall economic situation will improve in the next three months, while 43.8 per cent expect it to remain stable.

-

Jerome Tang Calls Out Team After Embarrassing Home Defeat

Jerome Tang Calls Out Team After Embarrassing Home Defeat -

Cynthia Erivo Addresses Bizarre Rumour About Her Relationship With Ariana Grande

Cynthia Erivo Addresses Bizarre Rumour About Her Relationship With Ariana Grande -

Prince Harry, Meghan Markle Spotted Cosying Up At NBA All-Star Game

Prince Harry, Meghan Markle Spotted Cosying Up At NBA All-Star Game -

Lady Gaga Explains How Fibromyalgia Lets Her 'connect With People Who Have It'

Lady Gaga Explains How Fibromyalgia Lets Her 'connect With People Who Have It' -

Metro Detroit Weather Forecast: Is The Polar Vortex Coming Back?

Metro Detroit Weather Forecast: Is The Polar Vortex Coming Back? -

Daniel Radcliffe Reveals Surprising Way Fatherhood Changed Him

Daniel Radcliffe Reveals Surprising Way Fatherhood Changed Him -

‘Disgraced’ Andrew At Risk Of Breaking Point As Epstein Scandal Continues

‘Disgraced’ Andrew At Risk Of Breaking Point As Epstein Scandal Continues -

Alan Cumming Shares Plans With 2026 Bafta Film Awards

Alan Cumming Shares Plans With 2026 Bafta Film Awards -

OpenClaw Founder Peter Steinberger Hired By OpenAI As AI Agent Race Heats Up

OpenClaw Founder Peter Steinberger Hired By OpenAI As AI Agent Race Heats Up -

Kate Middleton's Reaction To Harry Stepping Back From Royal Duties Laid Bare

Kate Middleton's Reaction To Harry Stepping Back From Royal Duties Laid Bare -

Rose Byrne Continues Winning Streak After Golden Globe Awards Victory

Rose Byrne Continues Winning Streak After Golden Globe Awards Victory -

Ice Hockey Olympics Update: Canada Stays Unbeaten With Dominant Win Over France

Ice Hockey Olympics Update: Canada Stays Unbeaten With Dominant Win Over France -

Brooklyn Beckham Makes This Promise To Nicola Peltz Amid Family Feud

Brooklyn Beckham Makes This Promise To Nicola Peltz Amid Family Feud -

Chinese New Year Explained: All You Need To Know About The Year Of The Horse

Chinese New Year Explained: All You Need To Know About The Year Of The Horse -

Canadian Passport Holders Can Now Travel To China Visa-free: Here's How

Canadian Passport Holders Can Now Travel To China Visa-free: Here's How -

Maya Hawke Marries Christian Lee Hutson In New York Ceremony

Maya Hawke Marries Christian Lee Hutson In New York Ceremony