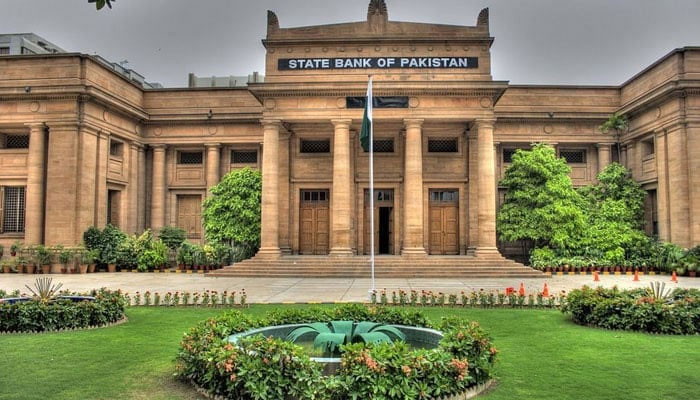

SBP posts Rs3.4tr profits in FY24

KARACHI: The State Bank of Pakistan (SBP) reported a significant profit of Rs3.4 trillion in the fiscal year 2024 ended on June 30, up from Rs1.1 trillion in the previous year, according to its financial results.

The central bank submitted its annual financial statement and auditors’ report for FY24 to the government last week, as per information posted on the SBP’s website.

During an analyst briefing session after the monetary policy meeting on September 12, the SBP’s governor Jameel Ahmad stated that the SBP will soon transfer dividends of over Rs2.5 trillion to the government from its FY24 profits.

Mohammed Sohail, CEO at Topline Securities, referred to the audited annual account of the central bank, saying that a record Rs3.4 trillion was earned in 2023-24 compared with Rs1.1 trillion in the previous year. He mentioned that the bumper profits of the SBP are helping the government.

“Higher interest rates and stable Pak Rupee helped SBP to post this huge profit,” Sohail said.

“And as 80 per cent of these profits are given to the government, the overall government liquidity has improved,” he added.

“Resultantly we are seeing a rally in local currency bonds recently.”

Analysts have noted that the amount raised via the latest Pakistan Investment Bonds auction was lower than the original target and the government had rejected all bids in the Treasury bills auction held on Wednesday. This indicates a decline in the borrowing needs of the government.

Analysts anticipate a significant interest rate cut in the upcoming SBP monetary policy meeting scheduled for November 4.

The SBP cut its benchmark interest rate for a third consecutive meeting last week in an effort to boost economic growth amid easing inflation pressures.

The SBP lowered the policy rate by 200 basis points to 17.5 percent, the lowest level since January 2023.

The rate reduction follows August’s single-digit inflation, which was caused by a high base effect, declining food prices and a comfortable external position.

-

Leonardo DiCaprio's Co-star Reflects On His Viral Moment At Golden Globes

Leonardo DiCaprio's Co-star Reflects On His Viral Moment At Golden Globes -

SpaceX Pivots From Mars Plans To Prioritize 2027 Moon Landing

SpaceX Pivots From Mars Plans To Prioritize 2027 Moon Landing -

J. Cole Brings Back Old-school CD Sales For 'The Fall-Off' Release

J. Cole Brings Back Old-school CD Sales For 'The Fall-Off' Release -

King Charles Still Cares About Meghan Markle

King Charles Still Cares About Meghan Markle -

GTA 6 Built By Hand, Street By Street, Rockstar Confirms Ahead Of Launch

GTA 6 Built By Hand, Street By Street, Rockstar Confirms Ahead Of Launch -

Funeral Home Owner Sentenced To 40 Years For Selling Corpses, Faking Ashes

Funeral Home Owner Sentenced To 40 Years For Selling Corpses, Faking Ashes -

Why Is Thor Portrayed Differently In Marvel Movies?

Why Is Thor Portrayed Differently In Marvel Movies? -

Dutch Seismologist Hints At 'surprise’ Quake In Coming Days

Dutch Seismologist Hints At 'surprise’ Quake In Coming Days -

Australia’s Liberal-National Coalition Reunites After Brief Split Over Hate Laws

Australia’s Liberal-National Coalition Reunites After Brief Split Over Hate Laws -

DC Director Gives Hopeful Message As Questions Raised Over 'Blue Beetle's Future

DC Director Gives Hopeful Message As Questions Raised Over 'Blue Beetle's Future -

King Charles New Plans For Andrew In Norfolk Exposed

King Charles New Plans For Andrew In Norfolk Exposed -

What You Need To Know About Ischemic Stroke

What You Need To Know About Ischemic Stroke -

Shocking Reason Behind Type 2 Diabetes Revealed By Scientists

Shocking Reason Behind Type 2 Diabetes Revealed By Scientists -

SpaceX Cleared For NASA Crew-12 Launch After Falcon 9 Review

SpaceX Cleared For NASA Crew-12 Launch After Falcon 9 Review -

Meghan Markle Gives Old Hollywood Vibes In New Photos At Glitzy Event

Meghan Markle Gives Old Hollywood Vibes In New Photos At Glitzy Event -

Simple 'finger Test' Unveils Lung Cancer Diagnosis

Simple 'finger Test' Unveils Lung Cancer Diagnosis