Industry leaders criticize latest rate cut

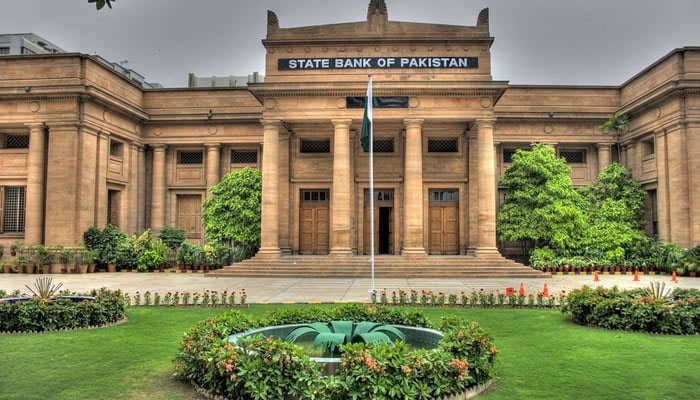

KARACHI: The business community has expressed significant disappointment with the State Bank of Pakistan’s (SBP) recent decision to reduce the key interest rate by 2.0 per cent, lowering it to 17.5 per cent. This rate cut, announced amidst declining inflation, has been criticized by several industry leaders for being insufficient.

President of the SITE Association of Industry Kamran Arbi argued that the reduction did not meet the expectations given the current economic conditions. He suggested that with inflation dropping to a single digit, the effective interest rate should be between 10 and 11 per cent.

Arbi criticized the SBP for its slow response to changing economic conditions and called for a more substantial and immediate rate cut, or even a gradual reduction of at least 5.0 per cent.President of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) Atif Ikram Sheikh voiced frustration with the SBP’s approach. Despite acknowledging the 200 basis points cut, Sheikh argued that it was too modest given the core inflation rate of 9.6 per cent as of August 2024.

He highlighted that international oil prices have recently decreased to a three-year low, which, combined with lower core inflation forecasts, should have prompted a more aggressive reduction.

Sheikh emphasized that a significant rate cut is essential to reduce the cost of doing business and enhance the country’s competitiveness in global markets.Patron-in-Chief of the United Business Group (UBG) SM Tanveer urged the SBP to focus on core inflation rather than general inflation, which includes volatile items like food and energy.

He criticized the SBP’s previous rate hikes for failing to address persistent inflation and advocated for policy adjustments based on Pakistan’s economic realities.Acting President of the Karachi Chamber of Commerce & Industry (KCCI) Altaf A Ghaffar also criticized the rate cut, arguing that it fell short of expectations. Ghaffar called for a more substantial reduction, ideally bringing the rate closer to single digits.

He pointed out that while the recent rate cut was the third consecutive reduction, it has not sufficiently addressed the high cost of borrowing that has burdened businesses. He noted that the recent drop in inflation was more due to government measures and improved agricultural production rather than the SBP’s policies.

The industry leaders expressed concerns about the government’s approach to economic policymaking. They criticized the lack of transparency and consultation with the business community, urging the government to provide clear answers regarding its plans for economic stabilization and the impact of the International Monetary Fund (IMF) programme.

The business community is urging the SBP to consider a more aggressive approach in its monetary policy to stimulate economic growth and alleviate the financial strain on businesses and consumers.

-

Worst Cricket Moments That Shocked The Game

Worst Cricket Moments That Shocked The Game -

Prince Harry, Meghan Markle Reach A Crossroads: ‘You Could Lose Everything’

Prince Harry, Meghan Markle Reach A Crossroads: ‘You Could Lose Everything’ -

F1 Title Race: Who Will Win 2026 Drivers’ And Constructors’ Championships?

F1 Title Race: Who Will Win 2026 Drivers’ And Constructors’ Championships? -

New Observatory Sends 800,000 Asteroid Alerts In One Night

New Observatory Sends 800,000 Asteroid Alerts In One Night -

Cher’s Son Elijah Blue Allman Apprehended On Two Counts Of Assault At Elite Prep School

Cher’s Son Elijah Blue Allman Apprehended On Two Counts Of Assault At Elite Prep School -

Beatrice, Eugenie Now Face Andrew, Sarah's ‘nightmares’: 'They're Hugely Conflicted'

Beatrice, Eugenie Now Face Andrew, Sarah's ‘nightmares’: 'They're Hugely Conflicted' -

X Debuts Topic Filtering To Help Users Shape Their ‘For You’ Recommendations

X Debuts Topic Filtering To Help Users Shape Their ‘For You’ Recommendations -

Scientists Built World's First Computer That Learns Like Human Brain

Scientists Built World's First Computer That Learns Like Human Brain -

Robert Carradine’s Daughter Makes Bombshell Confession As Actor's Death Cause Confirmed

Robert Carradine’s Daughter Makes Bombshell Confession As Actor's Death Cause Confirmed -

Beatrice, Eugenie Put On Blast: ‘Only Nitwits Wouldn’t See An Association With A Pedophile As Toxic’

Beatrice, Eugenie Put On Blast: ‘Only Nitwits Wouldn’t See An Association With A Pedophile As Toxic’ -

OpenAI Defies Industry Pressure, Secures Guardrails Under New US Defense Department Pact

OpenAI Defies Industry Pressure, Secures Guardrails Under New US Defense Department Pact -

'Sinners' Delroy Lindo Breaks Silence On BAFTA's Tourette’s Incident At NAACP Image Awards

'Sinners' Delroy Lindo Breaks Silence On BAFTA's Tourette’s Incident At NAACP Image Awards -

Billy Joel Admits Cancelling Of Tour Due To Brain Disorder 'sounds A Lot Worse' Than It Is

Billy Joel Admits Cancelling Of Tour Due To Brain Disorder 'sounds A Lot Worse' Than It Is -

US And Israeli Strikes On Iran: Everything You Need To Know

US And Israeli Strikes On Iran: Everything You Need To Know -

US Strikes On Iran Ignite Emergency Push For Powers Legislation: Report

US Strikes On Iran Ignite Emergency Push For Powers Legislation: Report -

Kelly Osbourne's Mom Sharon Receives 'shut Up' Call Accepting An Award For Late Hubby?

Kelly Osbourne's Mom Sharon Receives 'shut Up' Call Accepting An Award For Late Hubby?