Inflation respite

This is the first time inflation has dropped to the single digits since October 2021

Pakistan’s struggle to tame inflation is far from over but signs that things are not getting worse are growing, as the year-on-year headline inflation rate fell to a 34-month low of 9.6 per cent for the month of August. This is the first time inflation has dropped to the single digits since October 2021, with stabilizing commodity prices and a relatively strong rupee seen as among the key factors driving down inflationary pressures. It is now hoped that the lower inflation rate has cleared enough room for the SBP to initiate a significant interest rate cut, with the central bank set to hold its next review on September 12. The official interest rates currently stand at 19.5 per cent and real interest rates (the current official rates minus the rate of inflation) are at around 9.9 per cent. The latter turned positive after 37 months in March of this year and have only risen since, building expectations for further rate cuts. Lower borrowing costs for households and businesses could help kick-start economic activity and lift the sluggish growth rate. Moreover, lower rates could also lower the government’s debt-servicing burden and help make the fiscal deficit more manageable.

However, even if the SBP does deliver the goods, the country is far from any victory lap as far as the overall economy grows. The ongoing decline in the inflation rate is highly contingent on stable commodity prices at the global level, something that is largely beyond the control of domestic policymakers, and a stable rupee. The latter will require the government to keep its fiscal house in order, while any delays in securing the IMF programme could also threaten the progress that has been made thus far. In this context, the FBR’s Rs98 billion shortfall is not welcome news and highlights the state’s imperative to establish a proper tax collection system as soon as possible. Setting aside the fragility of the inflation decline, the fact remains that most Pakistanis are still struggling to meet the cost of living; even those with relatively better jobs and incomes are struggling with high prices and high utility bills. Some economists are even attributing August’s seeming inflation victory to the base effect, which occurs when the previous year’s inflation rate (the base) is very high and distorts the current rate by making it seem lower than it actually is.

Anyone who has just paid their electricity bill or bought this week’s groceries would sympathize with this theory. Prices might be growing at a much slower rate than this time last year, but given just how rapidly prices skyrocketed at the time, a lower inflation reading does not necessarily imply affordability. Changing the economic picture for the average Pakistani will require much deeper economic reforms and changes than have been attempted thus far. IMF programmes and rate cuts can only mask the economy’s underlying structural weaknesses for so long.

-

Andy Cohen Gets Emotional As He Addresses Mary Cosby's Devastating Personal Loss

Andy Cohen Gets Emotional As He Addresses Mary Cosby's Devastating Personal Loss -

Andrew Feeling 'betrayed' By King Charles, Delivers Stark Warning

Andrew Feeling 'betrayed' By King Charles, Delivers Stark Warning -

Andrew Mountbatten's Accuser Comes Up As Hillary Clinton Asked About Daughter's Wedding

Andrew Mountbatten's Accuser Comes Up As Hillary Clinton Asked About Daughter's Wedding -

US Military Accidentally Shoots Down Border Protection Drone With High-energy Laser Near Mexico Border

US Military Accidentally Shoots Down Border Protection Drone With High-energy Laser Near Mexico Border -

'Bridgerton' Season 4 Lead Yerin Ha Details Painful Skin Condition From Filming Steamy Scene

'Bridgerton' Season 4 Lead Yerin Ha Details Painful Skin Condition From Filming Steamy Scene -

Matt Zukowski Reveals What He's Looking For In Life Partner After Divorce

Matt Zukowski Reveals What He's Looking For In Life Partner After Divorce -

Savannah Guthrie All Set To Make 'bravest Move Of All'

Savannah Guthrie All Set To Make 'bravest Move Of All' -

Meghan Markle, Prince Harry Share Details Of Their Meeting With Royals

Meghan Markle, Prince Harry Share Details Of Their Meeting With Royals -

Hillary Clinton's Photo With Jeffrey Epstein, Jay-Z And Diddy Fact-checked

Hillary Clinton's Photo With Jeffrey Epstein, Jay-Z And Diddy Fact-checked -

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

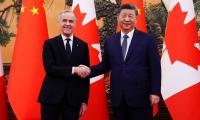

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

Police Arrest A Man Outside Nancy Guthrie’s Residence As New Terrifying Video Emerges

Police Arrest A Man Outside Nancy Guthrie’s Residence As New Terrifying Video Emerges -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training