KPRA starts tax compliance drive in tourist regions

PESHAWAR: To support businesses in the services sector and ensure tax compliance, the Khyber Pakhtunkhwa Revenue Authority (KPRA) has initiated a special registration, monitoring, and enforcement campaign in Galiyat, Naran, and Kaghan.

KPRA teams will visit businesses to provide on-the-spot registration and review the sales records of already registered service providers to ensure compliance and discourage tax evasion. Director General Fauzia Iqbal emphasised the campaign’s goal to facilitate business registration, improve tax compliance, and ensure taxes reach the Khyber Pakhtunkhwa government treasury. She urged tourists to pay their taxes as a national responsibility, warning that tax evasion will not be tolerated and will result in strict legal action.

Fauzia highlighted that paying taxes is a legal obligation that contributes to the financial stability of the province. She assured that tax revenue would be used for the development and beautification of tourist areas, benefiting businesses and enhancing the region’s appeal.

Addressing businesspersons, she stressed their responsibility to submit taxes honestly to the government’s treasury and reiterated that legal action will be taken against those who evade taxes.

-

Shocking Details Emerge In Martin Short’s Daughter Katherine's Death Investigation: 'Kept To Herself'

Shocking Details Emerge In Martin Short’s Daughter Katherine's Death Investigation: 'Kept To Herself' -

Yerin Ha On Stepping Into The Spotlight In Bridgerton Season Four

Yerin Ha On Stepping Into The Spotlight In Bridgerton Season Four -

Nakiska Ski Area Avalanche Leaves Youth Unresponsive, Second Skier Escapes Unhurt

Nakiska Ski Area Avalanche Leaves Youth Unresponsive, Second Skier Escapes Unhurt -

Igor Komarov Missing In Bali: Seven Foreign Suspects Arrested In Kidnapping Probe

Igor Komarov Missing In Bali: Seven Foreign Suspects Arrested In Kidnapping Probe -

'I Swear' Director Kirk Jones Says Bafta Broadcast Mishap Failed Tourette’s Advocate

'I Swear' Director Kirk Jones Says Bafta Broadcast Mishap Failed Tourette’s Advocate -

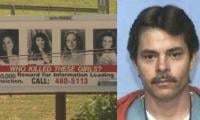

Yogurt Shop Murders Solved: 1991 Austin Cold Case Finally Linked To Serial Killer

Yogurt Shop Murders Solved: 1991 Austin Cold Case Finally Linked To Serial Killer -

Iran Tensions Rise As Trump Says He Is 'not Thrilled' With Nuclear Negotiations

Iran Tensions Rise As Trump Says He Is 'not Thrilled' With Nuclear Negotiations -

Where Is Calvin Klein's Wife Kelly Klein Now After Divorce And Fashion Fame?

Where Is Calvin Klein's Wife Kelly Klein Now After Divorce And Fashion Fame? -

Kourtney Kardashian’s Role As Stepmother Questioned

Kourtney Kardashian’s Role As Stepmother Questioned -

Neil Sedaka Dies At 86 After Hospitalisation In Los Angeles

Neil Sedaka Dies At 86 After Hospitalisation In Los Angeles -

'Lizzie McGuire' Star Robert Carradine's Reason Of Death Laid Bare

'Lizzie McGuire' Star Robert Carradine's Reason Of Death Laid Bare -

Lisa Rinna Breaks Silence After Recent Reunion With Andy Cohen: 'I've Pissed Him Off'

Lisa Rinna Breaks Silence After Recent Reunion With Andy Cohen: 'I've Pissed Him Off' -

Savannah Guthrie Mom Update: Unexpected Visitors Spark Mystery Outside Nancy's Home

Savannah Guthrie Mom Update: Unexpected Visitors Spark Mystery Outside Nancy's Home -

Elle Fanning Shares Detail About Upcoming Oscars Night Plan With Surprise Date

Elle Fanning Shares Detail About Upcoming Oscars Night Plan With Surprise Date -

Demi Lovato Spills Go-to Trick To Beat Social Anxiety At Parties

Demi Lovato Spills Go-to Trick To Beat Social Anxiety At Parties -

Benny Blanco Looks Back At The Time Selena Gomez Lost Her Handrwritten Vows Days Before Wedding

Benny Blanco Looks Back At The Time Selena Gomez Lost Her Handrwritten Vows Days Before Wedding