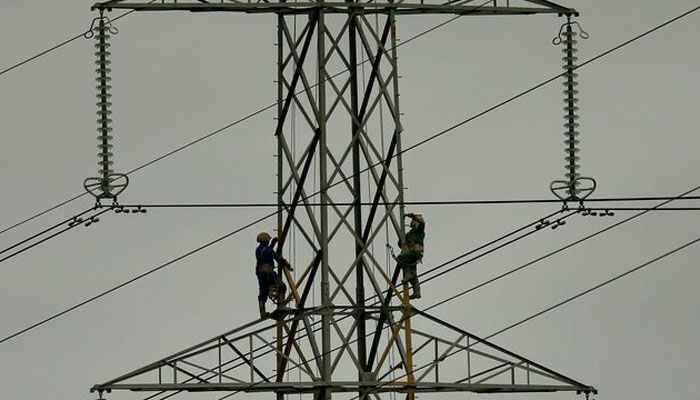

Competitive wholesale electricity market under CTBCM on the cards

Under this competitive regime, there will be a system of multi-sellers and multi-buyers of electric power

ISLAMABAD: The competitive wholesale electricity market/competitive trading bilateral contract market (CTBCM) regime is going to be introduced.

This could be a paradigm shift in the existing power sector structure.

Under this competitive regime, there will be a system of multi-sellers and multi-buyers of electric power.

However, buyers will pay the transmission and distribution use of system charges also for the electricity they will trade bilaterally. Currently, the power sector investments are dominated by government that also owns the power plants and sells electricity to the end consumers under a monopoly structure through its Discos having control on the network and supply business.

The consumers have no choice but to purchase electricity from the government-owned Discos.

So under the new competitive market implementation, bulk electric power consumers will be able to buy electricity from any private supplier, traders and generation companies at the electric power rates bilaterally agreed by parties with no Nepra determination involved and after including the wheeling charges as determined by Nepra for the use of transmission and distribution.

The Nepra to this effect is all set to start tomorrow (Tuesday) public hearing the case of CTBCM--- the much-awaited national dream of 32 years to this effect, almost 24 issues have been framed for candid discussions by the stakeholders to validate market operator and system operator readiness, which will be debated during the public hearing about the implementation and operationalization of CTBCM in the years 2024.

The regulator will start hearing proceedings in the matter of the final test report for CTBCM submitted by the Central Power Purchase Agency (CPPA-G) and open for candid discussions as a welcoming regulatory step encouraging participation.

The Ministry of Water and Resources also wants to give the electricity from Ghazi Barotha Hydropower project having the capacity to generate 1450MW of electricity to the industrial sector at an affordable rate and there are opportunities for the retired plants to repower itself to participate in the market plants like Kapco, Tapral, Gul Ahmed, GENCOs and RLNG plants were also opted by APTMA etc under the CTBCM regime. This hydro plant participation in the market proposal was floated by the Water Resources Ministry in November 2023. The said proposal will be a win-win situation both for the seller and buyer.

The buyer would be able to massively reduce its input cost making its products more competitive in the international market. So the introduction of CTBCM is vital for the economy of the country giving choices to consumers and public and private generators for the bilateral trade in electricity, which is much awaited in Pakistan and aligned with 1992 strategic plan objectives.

The power sector’s transition from vertically integrated utilities (VIUs) to a competitive market structure has been a global trend since the 1980s, aimed at enhancing competition, efficiency, liquidity, reducing costs, and improving service quality.

The heavy concentration of investment, operations, revenues, payments, and returns within government-controlled entities creates inherent conflicts of interest and barriers to privatization and competition. This often leads to inefficient decision-making, bureaucratic delays, deteriorating service, and a lack of accountability.

Additionally, political influence over the sector results in decisions that are more politically motivated than economically rational, further impacting meritocracy, efficiency and performance. However, NEPRA will tomorrow hear the matter of CTBCM operationalization and subsequently approve the CTBCM test-run plan and revised MCC that have been completed by the Market Operator, System Operator and other power sector entities. These issues include if the IT infrastructure deployed by NTDC and CPPA-G for CTBCM transactions has been tested and certified as successfully implemented? Additionally, whether backup or alternative measures are available in case of system failure during market transactions, and whether the absence of SCADA will impact the successful implementation of the market? Whether any delay in the implementation of central economic dispatch of the entire country will have any impact on the implementation of CTBCM? And whether the CTBCM transactions including settlements of energy and capacity of bilateral contracts for prospective market participants (generators and bulk power consumers) have been simulated during the test-run?

The Nepra will also look into if the planned mechanism to shift capacity invoices based on the MDI-based mechanism to commercial allocation factors along with BMC as per the provisions of the National Electricity Plan is justified? What are the bottlenecks of shifting capacity invoices from the existing mechanism to the coincidental system demand-based mechanism immediately after CMOD? Whether the proposal to shift to a new mechanism for calculating firm capacity certification based on an annual dependable capacity test instead of generation contribution in critical peak hours is justified? What were the challenges faced in the approved methodology and are they addressed in the proposed methodology? And if the proposed changes in the formulae of Total Demand, Capacity Obligation, Firm Capacity and Ancillary Services etc. in approved market commercial code are justified and have they been tested during the test run? The regulatory would also peep into whether transmission and distribution constraints will have any impact on the CTBCM transactions especially on the bilateral contracts between bulk power consumers and generators/suppliers? What measures have been put in place by NTDC and CPPA-G in this regard? In addition, NEPRA would also sort out the 16 remaining issues during the hearing.

The overall conclusive of FTR submitted by CPPAG concludes that the systems are all set and ready from people, process, technology and institutional aspects and all is set to declare the CMOD of the CTBCM and prudent and rationale determination of the use of the system charges for the efficient market operationalization, which is much awaited by the consumers of Pakistan.

-

Everything We Know About Jessie J's Breast Cancer Journey

Everything We Know About Jessie J's Breast Cancer Journey -

Winter Olympics 2026: What To Watch In Men’s Hockey Today

Winter Olympics 2026: What To Watch In Men’s Hockey Today -

Winnie Harlow Breaks Vitiligo Stereotypes: 'I'm Not A Sufferer'

Winnie Harlow Breaks Vitiligo Stereotypes: 'I'm Not A Sufferer' -

Apple Martin Opens Up About Getting 'crazy' Lip Filler

Apple Martin Opens Up About Getting 'crazy' Lip Filler -

Why Did OpenAI Remove One Crucial Word From Its Mission Statement?

Why Did OpenAI Remove One Crucial Word From Its Mission Statement? -

Prince William Warned His Future Reign Will Be Affected By Andrew Scandal

Prince William Warned His Future Reign Will Be Affected By Andrew Scandal -

Amy Madigan Reflects On Husband Ed Harris' Support After Oscar Nomination

Amy Madigan Reflects On Husband Ed Harris' Support After Oscar Nomination -

Is Studying Medicine Useless? Elon Musk’s Claim That AI Will Outperform Surgeons Sparks Debate

Is Studying Medicine Useless? Elon Musk’s Claim That AI Will Outperform Surgeons Sparks Debate -

Margot Robbie Gushes Over 'Wuthering Heights' Director: 'I'd Follow Her Anywhere'

Margot Robbie Gushes Over 'Wuthering Heights' Director: 'I'd Follow Her Anywhere' -

'The Muppet Show' Star Miss Piggy Gives Fans THIS Advice

'The Muppet Show' Star Miss Piggy Gives Fans THIS Advice -

Sarah Ferguson Concerned For Princess Eugenie, Beatrice Amid Epstein Scandal

Sarah Ferguson Concerned For Princess Eugenie, Beatrice Amid Epstein Scandal -

Uber Enters Seven New European Markets In Major Food-delivery Expansion

Uber Enters Seven New European Markets In Major Food-delivery Expansion -

Hollywood Fights Back Against Super-realistic AI Video Tool

Hollywood Fights Back Against Super-realistic AI Video Tool -

Meghan Markle's Father Shares Fresh Health Update

Meghan Markle's Father Shares Fresh Health Update -

Pentagon Threatens To Cut Ties With Anthropic Over AI Safeguards Dispute

Pentagon Threatens To Cut Ties With Anthropic Over AI Safeguards Dispute -

Samsung Galaxy Unpacked 2026: What To Expect On February 25

Samsung Galaxy Unpacked 2026: What To Expect On February 25