SBP forex reserves drop by $397m to $9.02bn

The country’s foreign exchange reserves dropped by $369 million to $14.335 billion

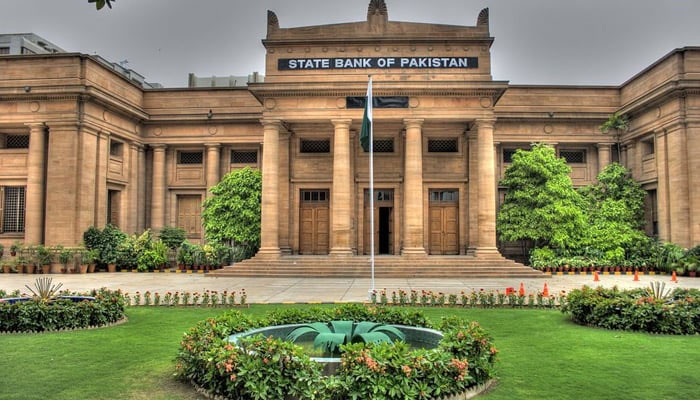

KARACHI: Pakistan’s foreign exchange reserves held by the central bank decreased by $397 million to $9.027 billion in the week ending July 19 due to external debt repayments, the State Bank of Pakistan reported on Thursday.

The country’s foreign exchange reserves dropped by $369 million to $14.335 billion. However, the reserves of commercial banks increased by $28 million to $5.308 billion.This month Pakistan reached a new $7 billion loan deal with the International Monetary Fund to support the struggling economy and manage its growing debts. The agreement is now subject to approval by the IMF Executive Board.

Pakistan will have better financial prospects thanks to the new IMF programme, which would secure funding from other bilateral and multilateral partners to meet its demands for external financing and increase its foreign exchange reserves.

Analysts note that the nation’s external position is still precarious and that the country would need a significant amount of external financing over the next three to five years.According to the latest report from a global rating agency, Fitch, the country has built up significant external liabilities. This includes both official debt issued by the state and private debt owed by non-financial corporations. Except for the central bank’s (limited) reserves, the economy has few FX assets, it said.

Pakistan’s current account deficit fell by 79 per cent to $681 million in the fiscal year 2024 supported by a decline in the trade deficit and a rise in remittances.Analysts anticipate that the current account deficit will be around $5 billion or 1.2 per cent of the GDP in FY25, with remittances amounting to $32 billion. However, Fitch suggests that despite Pakistan’s overall current deficit remaining small at an average of just 1.1 per cent of the GDP over the next five years, the country may face challenges in financing this deficit.

“We expect that Pakistan will remain dependent on imports to meet a large share of its domestic energy and consumer goods needs. While remittances from the country’s large diaspora will help cover these imports, we expect that the current account will remain in deficit over the duration of our forecast period,” it said.“FDI inflows will not be sufficient to cover this shortfall, which will leave the country dependent on portfolio inflows and foreign borrowing,” it added.

-

Princess Eugenie Breaks Cover Amid Explosive Family Scandal

Princess Eugenie Breaks Cover Amid Explosive Family Scandal -

Will Kate And Anthony Have 'Bridgerton' Spin Off? Revealed

Will Kate And Anthony Have 'Bridgerton' Spin Off? Revealed -

Schoolgirl Eaten Alive By Pigs After Brutal Assault By Farmworker

Schoolgirl Eaten Alive By Pigs After Brutal Assault By Farmworker -

King Charles’ Statement About Epstein Carries A Secret Meaning: Here’s Why It Can Be An Invite To Police

King Charles’ Statement About Epstein Carries A Secret Meaning: Here’s Why It Can Be An Invite To Police -

Demi Lovato Delivers Heartbreaking Message To Fans About Her Concerts

Demi Lovato Delivers Heartbreaking Message To Fans About Her Concerts -

Sweden's Princess Sofia Explains Why She Was Named In Epstein Files

Sweden's Princess Sofia Explains Why She Was Named In Epstein Files -

Activist Shocks Fellow Conservatives: 'Bad Bunny Is Winner'

Activist Shocks Fellow Conservatives: 'Bad Bunny Is Winner' -

Noel Gallagher Challenges Critics Of Award Win To Face Him In Person

Noel Gallagher Challenges Critics Of Award Win To Face Him In Person -

Minnesota Man Charged After $350m IRS Tax Scam Exposed

Minnesota Man Charged After $350m IRS Tax Scam Exposed -

Meghan Markle 'terrified' Over Possible UK Return

Meghan Markle 'terrified' Over Possible UK Return -

Did Opiate Restrictions Lead To Blake Garrett's Death?

Did Opiate Restrictions Lead To Blake Garrett's Death? -

Royal Expert Reflects On Princess Eugenie, Beatrice 'priorities' Amid Strained Relationship With Sarah, Andrew

Royal Expert Reflects On Princess Eugenie, Beatrice 'priorities' Amid Strained Relationship With Sarah, Andrew -

Prince William's 'concerning' Statement About Andrew Is Not Enough?

Prince William's 'concerning' Statement About Andrew Is Not Enough? -

50 Cent Gets Called Out Over Using Slur For Cardi B

50 Cent Gets Called Out Over Using Slur For Cardi B -

Scientists Discover Rare Form Of 'magnets' That Might Surprise You

Scientists Discover Rare Form Of 'magnets' That Might Surprise You -

Nancy Guthrie’s Kidnapper Will Be Caught Soon: Here’s Why

Nancy Guthrie’s Kidnapper Will Be Caught Soon: Here’s Why