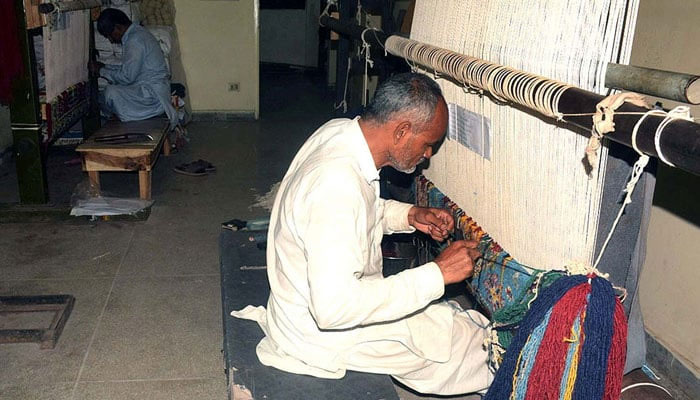

Carpet industry loses sheen as exports plummet

LAHORE: Pakistan’s famed hand-knotted carpet industry is facing a crisis, with exports plummeting to their lowest levels in years. This decline is triggered by the rising cost of production and other issues.

The year-wise data on carpet export statistics from 2004 to 2023 reveals a gradual yet significant fall in earnings in the following period until 2020. In 2005, there was a peak in carpet exports valued at $276.82 million, followed by a consistent decline to $54 million in 2020. However, there has been a modest recovery in recent years, with values reaching $87 million in 2023.

Industry leaders are apprehensive of losing momentum in reviving carpet exports due to various reasons. They are of the view that the export of handmade carpets from Pakistan experienced a decline due to issues including labour shortages, raw material paucity, high energy costs, an increase in freight fares, rising taxes, hikes in customs clearance costs, and warehouse expenses.

On top of it, and much to the dismay of manufacturers and exporters, the latest taxation measures announced by the federal government have put an extra burden on the export-oriented industry. It is being considered a departure from the tax regime in place since the early 1990s. The taxation policy of the past several decades subjected the export of goods to a final tax regime, which has now been altered to the detriment of exporters.

Under the Finance Act 2024-25, amendments have been made to the regime for direct and indirect exporters. Tax collected from them at the rate of 1.0 per cent will now be treated as the minimum tax. Consequently, such persons will be required to compute their normal taxable income in accordance with applicable provisions. If the 1.0 per cent withholding tax is lower than the tax computed on such taxable income, incremental tax will have to be paid.

As a result of the change in the tax regime, carpet exporters will also be liable to pay under a new provision in Section 147 of Advance Tax, requiring specified withholding agents to collect the 1.0 per cent advance income tax from the exporters of goods at the time of realization of export proceeds.

Instead of providing a competitive edge to local manufacturers, the government is in the process of withdrawing various initiatives aimed at boosting exports. The issue of regionally competitive energy tariffs is a significant concern. In line with the initiatives outlined in the Strategic Trade Policy Framework and Textiles and Apparel Policy for 2020-2025, the government has implemented measures to offer a regionally competitive electricity tariff ranging from US cents 7.5 to 9 per kWh for export-oriented industries, such as handmade carpets.

Nevertheless, the cost of electricity supply to five export-oriented sectors, including carpets, has been raised to US cents 9 per kWh from August to September 2022, and to Rs19.99 from October 2022 to June 2023 per kWh. There is no development regarding the continuation of concessional rates for the industry, despite announcements made by high officials.

Pakistan has the potential to boost exports of handmade carpets in the region. The free trade agreement between China and Pakistan now encompasses handmade carpets, aiming to enhance the export of the domestic carpet industry. The incorporation of

hand-knotted carpets in the China-Pakistan Free Trade Agreement has granted duty-free access to China, potentially opening up new opportunities for carpet exporters. But again, the new tax regime may affect the promising prospects of this initiative too. The hand-woven carpet industry in the country has gained international recognition and serves as one of the country’s trade symbols. Unlike other sectors, the hand-woven carpet industry does not essentially rely on government subsidies or infrastructure, making it a sustainable source of income for millions, particularly women in rural areas. Its significance in providing employment and improving economic conditions at the grassroots level cannot be overstated.

However, due to years of neglect, despite successive attempts made by carpet exporters, the lack of attention from the government left those involved feeling disheartened, causing many to leave the industry. Despite the indifferent attitude of policymakers, key stakeholders still find some motivation, renewed determination, passion, and hope that the government will finally listen to their pleas. The industry has struggled to attract skilled workers due to the absence of support, resulting in a severe shortage of trained artisans.

It is worth mentioning here that Pakistan is known for its production of carpets primarily made from fine wool yarn, giving them a striking resemblance to silk carpets. These varied kinds of hand-knotted carpets are mainly made up of wool while other raw materials include cotton, silk and jute.

The manufacturing of Pakistani carpets is basically concentrated in Lahore, Karachi, and Rawalpindi. These handmade rugs are categorized into Mori and Persian carpets, with 90 per cent of Mori carpets featuring a Bokhara-like pattern and other Turkmenistan patterns.

Ziegler carpets, produced in the country, replicate patterns from traditional designs in the Arak district of Persia. Additionally, carpets inspired by Caucasian designs are also manufactured in Pakistan and marketed as Kazak Fine.

-

'Too Hard To Be Without’: Woman Testifies Against Instagram And YouTube

'Too Hard To Be Without’: Woman Testifies Against Instagram And YouTube -

Kendall Jenner Recalls Being ‘too Stressed’: 'I Want To Focus On Myself'

Kendall Jenner Recalls Being ‘too Stressed’: 'I Want To Focus On Myself' -

Dolly Parton Achieves Major Milestone For Children's Health Advocacy

Dolly Parton Achieves Major Milestone For Children's Health Advocacy -

Oilers Vs Kings: Darcy Kuemper Pulled After Allowing Four Goals In Second Period

Oilers Vs Kings: Darcy Kuemper Pulled After Allowing Four Goals In Second Period -

Calgary Weather Warning As 30cm Snow And 130 Km/h Winds Expected

Calgary Weather Warning As 30cm Snow And 130 Km/h Winds Expected -

Maura Higgins Reveals Why She Wears Wigs On 'The Traitors' And What Her Real Hair Is Like

Maura Higgins Reveals Why She Wears Wigs On 'The Traitors' And What Her Real Hair Is Like -

Brandi Glanville Reveals Shocking Link Of Facial Issues To Leaking Implants, Claims 'no' Support From Ex Eddie Cibrian

Brandi Glanville Reveals Shocking Link Of Facial Issues To Leaking Implants, Claims 'no' Support From Ex Eddie Cibrian -

Who Is Rob Rausch’s Girlfriend? 'The Traitors' Winner Linked To Kansas City Woman

Who Is Rob Rausch’s Girlfriend? 'The Traitors' Winner Linked To Kansas City Woman -

Bobby J. Brown, 'Law & Order' And 'The Wire' Actor, Dies At 62

Bobby J. Brown, 'Law & Order' And 'The Wire' Actor, Dies At 62 -

Netflix Gives In As Paramount Offers Massive Breakup Fee To Step Away From Warner Bros. Discovery Bid

Netflix Gives In As Paramount Offers Massive Breakup Fee To Step Away From Warner Bros. Discovery Bid -

Who Won 'Traitors' Season 4? Rob Rausch Claims $220,800 Grand Prize

Who Won 'Traitors' Season 4? Rob Rausch Claims $220,800 Grand Prize -

Niall Horan Shares Update On New Music On The Way

Niall Horan Shares Update On New Music On The Way -

Backstreet Boys Member Brian Littrell Refiles Trespassing Lawsuit Against Florida Retiree

Backstreet Boys Member Brian Littrell Refiles Trespassing Lawsuit Against Florida Retiree -

Kate Middleton Dubbed ‘conscious Shopper’ By Famous Fashion Expert

Kate Middleton Dubbed ‘conscious Shopper’ By Famous Fashion Expert -

Princess Catherine Joins Volunteers In Newtown During Powys Visit

Princess Catherine Joins Volunteers In Newtown During Powys Visit -

Shamed Andrew Thought BBC Interview Was ‘time To Shine,’ Says Staff

Shamed Andrew Thought BBC Interview Was ‘time To Shine,’ Says Staff