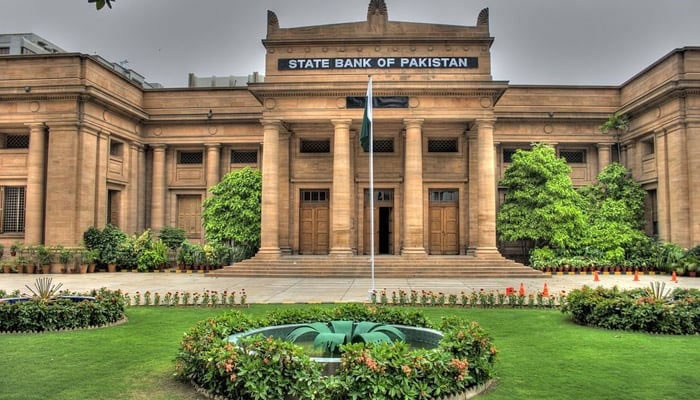

SBP updates guidelines for equity investments abroad

KARACHI: The State Bank of Pakistan updated its guidelines on Thursday regarding residents’ equity investment abroad (EIA) in an attempt to help export-oriented businesses -- especially those in the IT industry -- expand their international presence and boost national exports.

Major revisions in the provisions of the foreign exchange manual include the creation of a new EIA category for export-oriented IT companies and the elimination of the need for exporters to designate their bank in advance to use funds from their export-oriented special foreign currency account for EIAs, a circular said.

The SBP has allowed export-oriented IT companies to acquire an interest (a percentage of shareholding) in foreign entities, as per the updated instructions, it added.Export-oriented IT enterprises are no longer restricted to creating or purchasing a single entity per jurisdiction, it said.

The residents of Pakistan including companies are allowed to make equity-based investment in entities abroad, on repatriable basis, subject to certain terms and conditions, according to the circular.

“Equity investment abroad is allowed only for those countries that allow repatriation of profits, dividends, and capital,” it said.“However, equity investment in India shall be subject to the SBP’s prior approval. The funds proposed for investment should be legitimate and tax paid, the investor should be financially sound, have a clean record of loan repayments, and be on the active taxpayer list.”

To help companies working in the IT sector in increasing exports by extending their enterprises offshore, the formation of subsidiary/branch offices abroad by these companies has been granted.

-

Why Prince William Releases Statement On Epstein Scandal Amid Most 'challenging' Diplomatic Trip?

Why Prince William Releases Statement On Epstein Scandal Amid Most 'challenging' Diplomatic Trip? -

Historic Mental Health Facility Closes Its Doors

Historic Mental Health Facility Closes Its Doors -

Top 5 Easy Hair Fall Remedies For The Winter

Top 5 Easy Hair Fall Remedies For The Winter -

Japan Elections: Stock Surges Record High As PM Sanae Takaichi Secures Historic Victory

Japan Elections: Stock Surges Record High As PM Sanae Takaichi Secures Historic Victory -

Prince William, Kate Middleton Finally Address Epstein Scandal For First Time: 'Deeply Concerned'

Prince William, Kate Middleton Finally Address Epstein Scandal For First Time: 'Deeply Concerned' -

Kim Kardashian Promised THIS To Lewis Hamilton At The 2026 Super Bowl?

Kim Kardashian Promised THIS To Lewis Hamilton At The 2026 Super Bowl? -

Andrew Mountbatten-Windsor Throws King Charles A Diplomatic Crisis

Andrew Mountbatten-Windsor Throws King Charles A Diplomatic Crisis -

Barack Obama Hails Seahawks Super Bowl Win, Calls Defense ‘special’

Barack Obama Hails Seahawks Super Bowl Win, Calls Defense ‘special’ -

Pregnant Women With Depression Likely To Have Kids With Autism

Pregnant Women With Depression Likely To Have Kids With Autism -

$44B Sent By Mistake: South Korea Demands Tougher Crypto Regulations

$44B Sent By Mistake: South Korea Demands Tougher Crypto Regulations -

Lady Gaga Makes Surprising Cameo During Bad Bunny's Super Bowl Performance

Lady Gaga Makes Surprising Cameo During Bad Bunny's Super Bowl Performance -

Paul Brothers Clash Over Bad Bunny's Super Bowl Performance

Paul Brothers Clash Over Bad Bunny's Super Bowl Performance -

South Korea: Two Killed As Military Helicopter Crashes During Training

South Korea: Two Killed As Military Helicopter Crashes During Training -

Elon Musk Unveils SpaceX’s Moon-first Strategy With ‘self Growing Lunar City’

Elon Musk Unveils SpaceX’s Moon-first Strategy With ‘self Growing Lunar City’ -

Donald Trump Slams Bad Bunny's Super Bowl Performance: 'Absolutely Terrible'

Donald Trump Slams Bad Bunny's Super Bowl Performance: 'Absolutely Terrible' -

Jake Paul Criticizes Bad Bunny's Super Bowl LX Halftime Show: 'Fake American'

Jake Paul Criticizes Bad Bunny's Super Bowl LX Halftime Show: 'Fake American'