Policy rate

On Monday, central bank announced it was reducing the key interest rate by 150 basis points

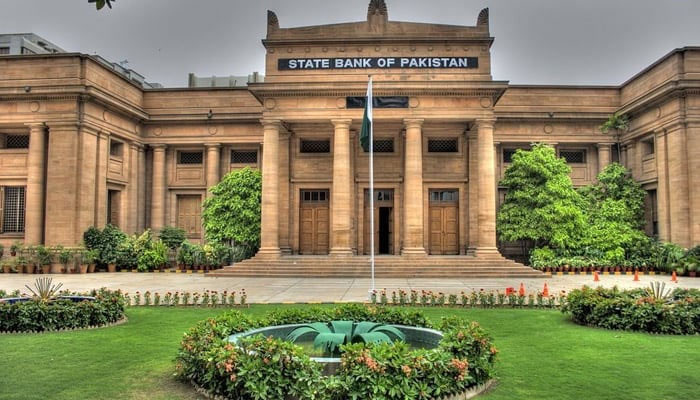

With a reduction in the policy rate by the State Bank of Pakistan (SBP), the economy is likely to get some much-needed boost. On Monday, the central bank announced it was reducing the key interest rate by 150 basis points. As Budget FY24-25 looms, both the timing and margin of this rate are significant – coming on the heels of data showing a noteworthy slowdown in inflation to a 30-month low of 11.8 per cent in May. This improves the overall real interest rate, moving it into deep positive territory. Many would see the rate cut as a sign of a cautiously optimistic outlook on Pakistan’s economic trajectory. The Monetary Policy Committee (MPC) has likely assessed the subsiding inflationary pressures, supported by fiscal consolidation, as foundation enough for the rate cut. While acknowledging the potential risks associated with upcoming budgetary measures and energy price adjustments, the committee seems to be confident in the cumulative impact of earlier monetary tightening to keep inflationary pressures in check.

The rate reduction had been expected, with various surveys predicting a decline and hoping for a shift towards monetary easing. For people, what is important to know is that the SBP’s monetary policy reduction could stimulate economic activity, providing much-needed relief to businesses and consumers alike and offering a favourable environment for investment and borrowing. This reduction in interest rates marks the beginning of a monetary easing cycle in the country, with economists forecasting further cuts in the key rate throughout the year. Such measures are vital for sustaining economic momentum and enhancing fiscal stability, particularly in the face of ongoing negotiations with the IMF for additional financial support. The upcoming budget is poised to introduce stringent fiscal and monetary measures aimed at securing the IMF’s approval for further assistance. The MPC has also said that, given the limited progress in broadening the tax net, the coming budgetary measures will likely be "largely rate-based". It has also noted that in May 2024, worker remittances reached a record high of $3.2 billion, contributing to a reduced current account deficit and bolstering the SBP’s foreign exchange reserves. This, along with increased foreign direct investment (FDI) and the disbursement of a tranche from the SBA in April, facilitated significant debt repayments. According to the MPC, timely financial inflows to meet external financing requirements, strengthen foreign exchange buffers, and support sustainable economic growth, especially in the face of potential external shocks, are important.

Essentially, the decision to reduce the monetary policy rate is a positive sign, a strategic move towards revitalizing the economy – especially as the country prepares to navigate the complexities of the upcoming budget.

-

What You Need To Know About Ischemic Stroke

What You Need To Know About Ischemic Stroke -

Shocking Reason Behind Type 2 Diabetes Revealed By Scientists

Shocking Reason Behind Type 2 Diabetes Revealed By Scientists -

SpaceX Cleared For NASA Crew-12 Launch After Falcon 9 Review

SpaceX Cleared For NASA Crew-12 Launch After Falcon 9 Review -

Meghan Markle Gives Old Hollywood Vibes In New Photos At Glitzy Event

Meghan Markle Gives Old Hollywood Vibes In New Photos At Glitzy Event -

Simple 'finger Test' Unveils Lung Cancer Diagnosis

Simple 'finger Test' Unveils Lung Cancer Diagnosis -

Groundbreaking Treatment For Sepsis Emerges In New Study

Groundbreaking Treatment For Sepsis Emerges In New Study -

Roblox Blocked In Egypt Sparks Debate Over Child Safety And Digital Access

Roblox Blocked In Egypt Sparks Debate Over Child Safety And Digital Access -

Savannah Guthrie Addresses Ransom Demands Made By Her Mother Nancy's Kidnappers

Savannah Guthrie Addresses Ransom Demands Made By Her Mother Nancy's Kidnappers -

OpenAI Reportedly Working On AI-powered Earbuds As First Hardware Product

OpenAI Reportedly Working On AI-powered Earbuds As First Hardware Product -

Andrew, Sarah Ferguson Refuse King Charles Request: 'Raising Eyebrows Inside Palace'

Andrew, Sarah Ferguson Refuse King Charles Request: 'Raising Eyebrows Inside Palace' -

Adam Sandler Reveals How Tom Cruise Introduced Him To Paul Thomas Anderson

Adam Sandler Reveals How Tom Cruise Introduced Him To Paul Thomas Anderson -

Washington Post CEO William Lewis Resigns After Sweeping Layoffs

Washington Post CEO William Lewis Resigns After Sweeping Layoffs -

North Korea To Hold 9th Workers’ Party Congress In Late February

North Korea To Hold 9th Workers’ Party Congress In Late February -

All You Need To Know Guide To Rosacea

All You Need To Know Guide To Rosacea -

Princess Diana's Brother 'handed Over' Althorp House To Marion And Her Family

Princess Diana's Brother 'handed Over' Althorp House To Marion And Her Family -

Trump Mobile T1 Phone Resurfaces With New Specs, Higher Price

Trump Mobile T1 Phone Resurfaces With New Specs, Higher Price