Stocks down amid fears of increased taxes

KARACHI: Another day of pressure on stocks saw the benchmark index decline on Thursday due to concerns about higher taxes in the impending FY25 budget and economic uncertainties.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 share Index decreased by 356.51 points or 0.48 per cent to 73,862.93 points against 74,219.44 points recorded in the last session. The highest index of the day remained at 74,593.33 points while the lowest level was recorded at 73,768.40 points.

Analyst Ahsan Mehanti at Arif Habib Corp said, “Stocks closed lower on concerns for economic uncertainty. Investor expectations for cautious SBP policy and subdued growth impacted the sentiments.”

Reports of likely harsh conditions in the new IMF programme for raising power tariffs, tax measures in the Federal Budget FY25 played a catalyst role in the bearish close.The KSE-30 index decreased by 88.08 points or 0.37 per cent to 23,691.27 points against 23,779.35 points.

Traded shares rose by 4 million shares to 352.738 million shares from 348.549 million shares. The trading value dropped to Rs12.312 billion from Rs16.389 billion. Market capital narrowed to Rs9.946 trillion against Rs10.006 trillion. Of 450 companies active in the session, 134 closed in green, 249 in red and 67 remained unchanged.

Maaz Mulla, an analyst at Topline Securities, said equities started the day on a positive note, with the KSE-100 index reaching an intraday high of 74,593 points (+373 points; up 0.50 per cent) in the morning. However, the benchmark index could not sustain the 74,000 level due to a selling spree at the day’s peak. As a result, the KSE-100 index slipped into negative territory, closing at 73,862 points (-356.50 points; down 0.48 percent).

“The selling pressure observed today can be attributed to concerns that the government may raise taxes on dividends, capital gains, and interest income in the upcoming budget,” he said.

Key contributors to the decline included FFC, OGDC, MARI, MCB, and PSO, which collectively subtracted 136 points. On the flip side, BAFL, SYS, LUCK, ENGRO, and MTL added 65 points to the index.

The highest increase was recorded in Hallmark Company Limited shares, which rose by Rs14.98 to Rs435.12 per share, followed by Sapphire Textile Mills Limited, which increased by Rs13.26 to Rs1,292.72 per share. A significant decline was noted in Sazgar Engineering Works Limited, which fell by Rs52.72 to Rs787.49 per share, Serive Industries Limited followed it, which closed lower by Rs45.50 to Rs929.74 per share.

Brokerage Arif Habib Ltd stated KSE-100 Index experienced further declines on Thursday as 74,000 points gave way amid market uncertainty leading up to the upcoming budget announcement.

As the market heads into the final session of the week, the KSE-100 is currently down by 2.66 per cent week-on-week. Analysts anticipate further declines, citing ongoing pressure near the red resistance levels as investors remain cautious ahead of the budget announcement.

The market sentiment remains fragile, with traders closely monitoring the upcoming fiscal policy details for signals on future economic conditions.

WorldCall Telecom remained the volume leader with 17.606 million shares which closed lower by one paisa to Rs1.31 per share. Kohinoor Spining followed it with 14.855 million shares, which closed higher by 18 paisas to Rs4.43 per share.

Other significant turnover stocks included Dewan Motors, Fauji Cement, Ghani Glo Hol, K-Electric Ltd, Fauji Fert Bin, PIA Holding Company, Ghani Chemical and Amtex Limited.In the futures market, 311 companies recorded trading, of which 70 increased, 239 decreased and 2 remained unchanged.

-

Andy Cohen Gets Emotional As He Addresses Mary Cosby's Devastating Personal Loss

Andy Cohen Gets Emotional As He Addresses Mary Cosby's Devastating Personal Loss -

Andrew Feeling 'betrayed' By King Charles, Delivers Stark Warning

Andrew Feeling 'betrayed' By King Charles, Delivers Stark Warning -

Andrew Mountbatten's Accuser Comes Up As Hillary Clinton Asked About Daughter's Wedding

Andrew Mountbatten's Accuser Comes Up As Hillary Clinton Asked About Daughter's Wedding -

US Military Accidentally Shoots Down Border Protection Drone With High-energy Laser Near Mexico Border

US Military Accidentally Shoots Down Border Protection Drone With High-energy Laser Near Mexico Border -

'Bridgerton' Season 4 Lead Yerin Ha Details Painful Skin Condition From Filming Steamy Scene

'Bridgerton' Season 4 Lead Yerin Ha Details Painful Skin Condition From Filming Steamy Scene -

Matt Zukowski Reveals What He's Looking For In Life Partner After Divorce

Matt Zukowski Reveals What He's Looking For In Life Partner After Divorce -

Savannah Guthrie All Set To Make 'bravest Move Of All'

Savannah Guthrie All Set To Make 'bravest Move Of All' -

Meghan Markle, Prince Harry Share Details Of Their Meeting With Royals

Meghan Markle, Prince Harry Share Details Of Their Meeting With Royals -

Hillary Clinton's Photo With Jeffrey Epstein, Jay-Z And Diddy Fact-checked

Hillary Clinton's Photo With Jeffrey Epstein, Jay-Z And Diddy Fact-checked -

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

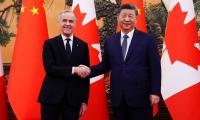

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

Police Arrest A Man Outside Nancy Guthrie’s Residence As New Terrifying Video Emerges

Police Arrest A Man Outside Nancy Guthrie’s Residence As New Terrifying Video Emerges -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training