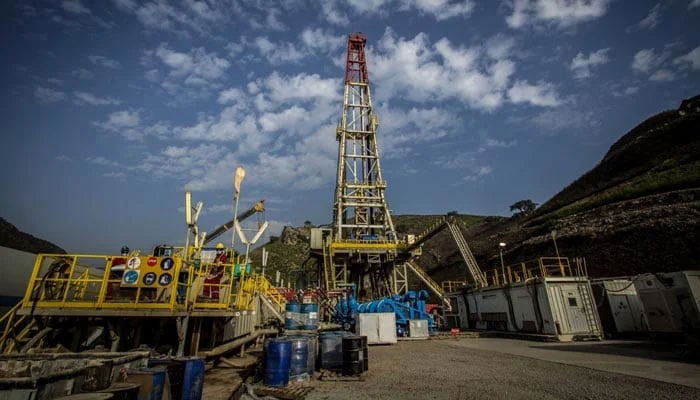

OGDCL quarterly earnings fall 26pc on higher operating costs

KARACHI The Oil and Gas Development Company Limited (OGDCL) on Monday reported a 26 percent drop in quarterly earnings, citing increased operating costs.

In a statement to the Pakistan Stock Exchange, the company reported a net profit of Rs47.807 billion for the quarter that ended March 31, down from Rs64.627 billion during the same quarter last year.

The company also announced an interim cash dividend of Rs2 per share, which is in addition to the interim dividend already paid at Rs4.1 per share. Earnings per share came in at Rs11.12, compared with earnings per share of Rs15.03 during the same period a year ago.

The company said its net sales for the quarter rose to Rs112.788 billion, compared with Rs105.912 billion a year earlier. The company in a statement said its Net sales revenue clocked at Rs348.164 billion translating to profit after tax of Rs171.104 billion and earnings per share of Rs39.78 for the nine-month period ended March 31

During the period under review, the company paid Rs68.497 billion on account of taxation. On the exploration and development side company recorded significant enhancement in seismic efforts and drilling activities."The Board of Directors appreciated the efforts of the management for taking effective steps for the implementation of the company’s aggressive exploration program."

FFC net profit soars 52pc to Rs12.7 billion

Fauji Fertilizer Company (FFC) reported a 52 percent increase in its quarterly earnings on Monday, attributing the growth to a rise in net turnover.

In a statement to the Pakistan Stock Exchange, the company reported a net profit of Rs12.674 billion for the quarter that ended March 31, up from Rs8.332 billion during the same quarter last year.

The company also announced an interim cash dividend for the quarter at Rs5.50 per share. Earnings per share came in at Rs9.96 a share, compared with earnings per share of Rs6.55 a share a year ago.

The company in a statement said Sona Urea production stood at 654,000 tonnes, whereas, sales were recorded at 661,000 tonnes, 5 percent higher than 2023.

The company also marketed 94,000 tonnes urea imported by the government for steady supply of urea to the farmers. Aggregate urea sales of the company thus stood at 755,000 tonnes compared to 631,000 tonnes of same period last year.

"Higher sales volume besides increase in selling prices due to significant escalation in gas prices towards close of last year resulted in higher sales revenue of Rs58.4 billion compared to Rs36.4 billion same period last year."

High cost of imported urea, inflation and higher gas prices caused the cost of sales to increase by 88 percent to Rs41.1 billion. Distribution cost also surged by 70 percent to Rs5.2 billion mainly due to the implementation of Axle Weight Regulation and impact of inflation. The increase in Super tax levy by Finance Act 2023 led to higher effective tax rate of 42 percent compared to 35 percent same period last year.

"The highlight of the performance is record return on investments and dividend income aggregating to Rs 10.3 billion. As a result, net profitability of FFC stood at Rs10.5 billion with earnings per share of Rs8.27 compared to Rs6.08 per share same period last year. Profitability in dollar terms at $38 million, however, remained static at the level of 2021."

NBP Q1 net profit falls 13pc on higher taxes

National Bank of Pakistan (NBP) on Monday reported a 13 percent decline in first-quarter net profit, hurt by a rise in taxes.The bank's net profit fell to Rs9.818 billion in the quarter ended March 31, from Rs11.293 billion in the same period last year.

NBP did not declare a dividend for the quarter.Earnings per share stood at Rs4.56, compared with Rs5.29 in the same quarter last year.

The bank's interest earned income rose 43 percent to Rs275.082 billion, while interest expensed income increased 53 percent to Rs245.954 billion.Tax expenses surged 39 percent to Rs10.608 billion, from Rs7.621 billion in the same quarter last year.

IMC nine-month net profit jumps 61pc on lower costs

Indus Motor Company Limited (IMC), a leading Pakistani automaker, reported a 61 percent surge in nine-month net profit on Monday, driven by a decrease in production costs.

The company reported a net profit of Rs9.406 billion for the nine-month period that ended March 31, up from Rs5.843 billion the previous year.The company also announced an interim cash dividend of Rs34 a share for the quarter that ended March 31, 2023, which is in addition to the already paid interim cash dividend of Rs37.70 a share.

Earnings per share came in at Rs119.67, compared with Rs74.35 last year.The company said its revenue for the year dropped to Rs98.232 billion, compared with Rs135.032 billion a year earlier. The company said its cost of sales remained lower at Rs86.555 billion from Rs134.835 billion during the same period last year. Other income for the period dropped to Rs9.421 billion, compared with Rs11.653 billion the previous year.

For the quarter that ended March 31, the company posted a net profit of Rs4.449 billion from Rs3.216 billion during the corresponding period of 2023.

The EPS for the quarter remained at Rs56.61 against Rs40.92.

The combined sales of Completely Knocked Down (CKD) and Completely Built-up Units (CBU) vehicles for the period decreased by 47 percent to 13,922 units as against 26,055 units sold in the corresponding period last year.

The market share of the company in the overall market stood at approximately 20 percent. The company produced 13,217 vehicles during the period, registering a 51 percent decrease, as compared to 26,848 units produced in the same period last year.

“With plummeting customer demand, it’s been a tough nine months and adding fuel to fire, has been the unabated import of used cars into the country that has wreaked havoc on the auto industry," Ali Asghar Jamali, CEO IMC, said in a statement.

"We request the government to take specific measures that accelerate and sustain auto sector volumes over the future months. Other contributors to the volume drop have been higher duties and taxes along with the deteriorating economic situation. Any further hike in duties and taxes will be detrimental to the auto industry and will also reduce the overall revenue to the Government from this sector."

Mari Petroleum profit falls 14pc as expenses increase

Mari Petroleum Company Limited (MPCL) on Monday reported a 14 percent decrease in its quarterly earnings, due to an increase in operating and exploration expenses.

The company reported a net profit of Rs14.124 billion for the quarter that ended March 31, down from Rs16.429 billion during the same quarter last year. The company skipped any payout for this period.

Earnings per share came in at Rs105.88 a share, compared with earnings per share of Rs123.16 a share a year ago.The company said its gross sales for the quarter rose to Rs54.414 billion, compared with Rs42.467 billion a year earlier.

For the nine-month period ended March 31, the company reported a net profit of Rs51.628 billion against Rs40.291 billion.EPS for the nine-month period was recorded at Rs387.01 a share compared with Rs302.03 a share.

PPL profit falls 15pc on lower other income

Pakistan Petroleum Limited (PPL) on Monday reported a 15 percent decrease in its quarterly earnings, due to a decrease in other income.

The company reported a net profit of Rs27.837 billion for the quarter that ended March 31, down from Rs32.848 billion during the same quarter last year.

The company announced second interim cash dividend of Re1.0 per share on ordinary shares and Re0.50 per share on convertible preference shares for the year ending 30th June 2024. This is in addition to an interim cash dividend of Rs2.50 per share.

Earnings per share came in at Rs10.23, compared with earnings per share of Rs12.07 during the same quarter last year.The company said its turnover for the quarter dropped to Rs75.506 billion, compared with Rs76.919 billion a year earlier.

The company said its other income dropped to Rs3.962 billion from Rs8.251 billion. For the nine-month period ended March 31, the company reported a net profit of Rs97.626 billion against Rs81.347 billion.EPS for the nine-month period was recorded at Rs35.88 a share compared with Rs29.90 a share.

Lucky Cement profit plunges 43pc

Lucky Cement Limited on Monday reported a 43 percent decrease in its quarterly earnings. Last year its profits surged during the quarter due to a part sale of NutriCo Morinaga (Pvt) Ltd.

In a statement to the Pakistan Stock Exchange, the company reported a net profit of Rs17.327 billion for the quarter that ended March 31, down from Rs30.212 billion during the same quarter last year.

The company skipped any payout for this period.

Earnings per share came in at Rs53.20 a share, compared with earnings per share of Rs66.46 a share a year ago.

The company said its revenue for the quarter slightly dropped to Rs119.370 billion, compared with Rs120.537 billion a year earlier. The cost of sales decreased to Rs70.460 billion from Rs74.522 billion.

For the nine-month that ended March 31, the company announced a net profit of Rs55.650 billion, up from Rs48.536 billion during the corresponding period last year. EPS for the nine-month was recorded at Rs170.48 per share against Rs115.24 per share. The company said it had earned Rs8.911 billion on the partial disposal of NutriCo Morinaga (Pvt) Limited and Rs8.239 billion on the remeasurement of interest retained in NutriCo Morinaga (Pvt) Limited during the same period last year, which had increased the profit margins. It had posted 222 percent increase in the quarter last year.

-

Andrew Mountbatten-Windsor Throws King Charles A Diplomatic Crisis

Andrew Mountbatten-Windsor Throws King Charles A Diplomatic Crisis -

Barack Obama Hails Seahawks Super Bowl Win, Calls Defense ‘special’

Barack Obama Hails Seahawks Super Bowl Win, Calls Defense ‘special’ -

Pregnant Women With Depression Likely To Have Kids With Autism

Pregnant Women With Depression Likely To Have Kids With Autism -

$44B Sent By Mistake: South Korea Demands Tougher Crypto Regulations

$44B Sent By Mistake: South Korea Demands Tougher Crypto Regulations -

Lady Gaga Makes Surprising Cameo During Bad Bunny's Super Bowl Performance

Lady Gaga Makes Surprising Cameo During Bad Bunny's Super Bowl Performance -

Paul Brothers Clash Over Bad Bunny's Super Bowl Performance

Paul Brothers Clash Over Bad Bunny's Super Bowl Performance -

South Korea: Two Killed As Military Helicopter Crashes During Training

South Korea: Two Killed As Military Helicopter Crashes During Training -

Elon Musk Unveils SpaceX’s Moon-first Strategy With ‘self Growing Lunar City’

Elon Musk Unveils SpaceX’s Moon-first Strategy With ‘self Growing Lunar City’ -

Donald Trump Slams Bad Bunny's Super Bowl Performance: 'Absolutely Terrible'

Donald Trump Slams Bad Bunny's Super Bowl Performance: 'Absolutely Terrible' -

Jake Paul Criticizes Bad Bunny's Super Bowl LX Halftime Show: 'Fake American'

Jake Paul Criticizes Bad Bunny's Super Bowl LX Halftime Show: 'Fake American' -

Prince William Wants Uncle Andrew In Front Of Police: What To Expect Of Future King

Prince William Wants Uncle Andrew In Front Of Police: What To Expect Of Future King -

Antioxidants Found To Be Protective Agents Against Cognitive Decline

Antioxidants Found To Be Protective Agents Against Cognitive Decline -

Hong Kong Court Sentences Media Tycoon Jimmy Lai To 20-years: Full List Of Charges Explained

Hong Kong Court Sentences Media Tycoon Jimmy Lai To 20-years: Full List Of Charges Explained -

Coffee Reduces Cancer Risk, Research Suggests

Coffee Reduces Cancer Risk, Research Suggests -

Katie Price Defends Marriage To Lee Andrews After Receiving Multiple Warnings

Katie Price Defends Marriage To Lee Andrews After Receiving Multiple Warnings -

Seahawks Super Bowl Victory Parade 2026: Schedule, Route & Seattle Celebration Plans

Seahawks Super Bowl Victory Parade 2026: Schedule, Route & Seattle Celebration Plans