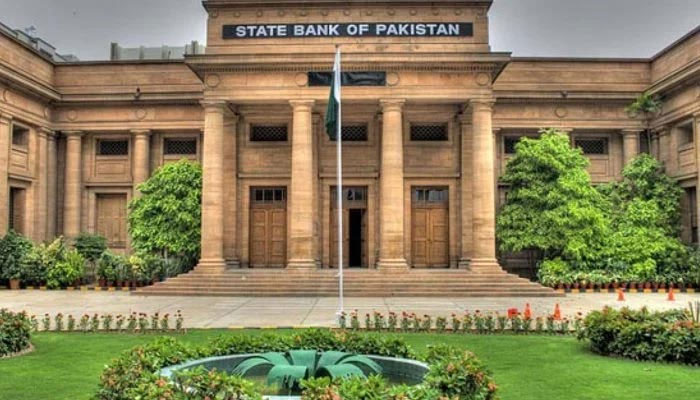

Pakistan central bank likely to delay rate cut until June: Citi

KARACHI: The State Bank of Pakistan is expected to delay a rate cut until June and maintain the current monetary policy rate of 22 percent to gain more clarity on how the budget for fiscal year 2024-2025 (FY25) might impact inflation, Citi Bank said in a report.

"Monetary easing is still underway though timing could be delayed as SBP awaits FY2025 Budget clarity and IMF Fund program," the bank said.It said the more hawkish tone in the March MPC meeting was driven by the need to assess the impact of the administered price adjustments, as well as inflationary implications from the upcoming budget.

Citi Bank projected that the consumer prices are expected to maintain a downward trajectory due to tight monetary policy and an improving agriculture supply. However, the SBP adopted a hawkish tone in March to assess the impact of price adjustments, citing pressure from rising oil prices due to tension in the Middle East.

The bank said Pakistan is expected to opt for the largest loan program with the International Monetary Fund (IMF) soon, and the central bank would need to remain cautious as the government negotiates the terms of a new program with the IMF.

Foreign investors' repatriation of profit and dividends rose 3.37 times year-on-year to $759.2 million, compared to $225.4 million worth of repatriation in the same period last year, the report said. While there is still some backlog of dividends and profit repatriation in the ongoing fiscal year, all backlog pressure is expected to disappear by the end of fiscal year 2024.

The bank said a sharp improvement in the current account deficit has been very supportive, and "the SBP argues this had already reflects relaxation of import controls". "While there is still some backlog of dividend/profit repatriation, about $800 million has already gone out between July to March versus $335 million in the same period last year."

"The SBP estimates that by end of June, this dividend/profit repatriation backlog pressure should disappear."Financing needs in FY25 will be similar to that in FY24, with 50 percent expected to be rollover and the government needing to arrange 50 percent of financing, the bank said.

"As for the remaining external financing needs for FY24, most of the remaining maturities is expected to be rolled over and the government is hoping to negotiate “one of its largest” programs in a couple of months.”

"While the numbers are not yet finalized, their financing needs in FY25 are expected to be similar to FY24, with 50% of the amortizations expected to be rolled over and the other 50% to be arranged." The current account deficit is projected to be 1.5 percent of GDP in FY25, which is anticipated to align with the expected GDP growth of 2-3 percent.

-

Katie Price Drama Escalates As Family Stays In Touch With Ex JJ Slater

Katie Price Drama Escalates As Family Stays In Touch With Ex JJ Slater -

Critics Target Palace Narrative After Andrew's Controversy Refuses To Die

Critics Target Palace Narrative After Andrew's Controversy Refuses To Die -

Sarah Ferguson’s Delusions Take A Turn For The Worse: ‘She’s Been Deserted’

Sarah Ferguson’s Delusions Take A Turn For The Worse: ‘She’s Been Deserted’ -

ICE Agents 'fake Car Trouble' To Arrest Minnesota Man, Family Says

ICE Agents 'fake Car Trouble' To Arrest Minnesota Man, Family Says -

Camila Mendes Reveals How She Prepared For Her Role In 'Idiotka'

Camila Mendes Reveals How She Prepared For Her Role In 'Idiotka' -

China Confirms Visa-free Travel For UK, Canada Nationals

China Confirms Visa-free Travel For UK, Canada Nationals -

Inside Sarah Ferguson, Andrew Windsor's Emotional Collapse After Epstein Fallout

Inside Sarah Ferguson, Andrew Windsor's Emotional Collapse After Epstein Fallout -

Bad Bunny's Star Power Explodes Tourism Searches For His Hometown

Bad Bunny's Star Power Explodes Tourism Searches For His Hometown -

Jennifer Aniston Gives Peek Into Love Life With Cryptic Snap Of Jim Curtis

Jennifer Aniston Gives Peek Into Love Life With Cryptic Snap Of Jim Curtis -

Prince Harry Turns Diana Into Content: ‘It Would Have Appalled Her To Be Repackaged For Profit’

Prince Harry Turns Diana Into Content: ‘It Would Have Appalled Her To Be Repackaged For Profit’ -

Prince William's Love For His Three Children Revealed During Family Crisis

Prince William's Love For His Three Children Revealed During Family Crisis -

Murder Suspect Kills Himself After Woman Found Dead In Missouri

Murder Suspect Kills Himself After Woman Found Dead In Missouri -

Sarah Ferguson's Plea To Jeffrey Epstein Exposed In New Files

Sarah Ferguson's Plea To Jeffrey Epstein Exposed In New Files -

Prince William Prepares For War Against Prince Harry: Nothing Is Off The Table Not Legal Ways Or His Influence

Prince William Prepares For War Against Prince Harry: Nothing Is Off The Table Not Legal Ways Or His Influence -

'How To Get Away With Murder' Star Karla Souza Is Still Friends With THIS Costar

'How To Get Away With Murder' Star Karla Souza Is Still Friends With THIS Costar -

Pal Reveals Prince William’s ‘disorienting’ Turmoil Over Kate’s Cancer: ‘You Saw In His Eyes & The Way He Held Himself’

Pal Reveals Prince William’s ‘disorienting’ Turmoil Over Kate’s Cancer: ‘You Saw In His Eyes & The Way He Held Himself’