IMF asks FBR for timeline to bring 3m retailers into tax net

IMF inquired from Pakistan for ascertaining the exact timeframe for unveiling the simplified retailers scheme in order to bring 3 million shopkeepers into the tax net

ISLAMABAD: The International Monetary Fund (IMF) has inquired from the Federal Board of Revenue (FBR) for ascertaining the exact timeframe for unveiling the simplified retailers scheme in order to bring 3 million shopkeepers into the tax net. The FBR replied to the IMF that it would be the decision of the incoming minister for finance, who would take the final decision on this subject. “The retailers scheme is already prepared and will be announced when the government will firm up its decision and grant approval for moving ahead,” top official sources confirmed to The News here on Thursday night.

The IMF team, led by Mission Chief Nathan Porter and FBR high-ups, held a virtual meeting on Thursday night whereby the IMF also inquired about the FBR’s plan for achieving the desired target of Rs9,415 billion on June 30, 2024.

“The IMF also inquired about the FBR’s capability to collect taxes from 3 million retailers,” the sources said and added that the FBR told the IMF team it has deputed 147 district officers all over the country for broadening of tax base. Tackling 3 million potential taxpayers with such a meagre strength of just 147 district revenue officers, who are already burdened with the task of bringing other potential tax dodgers into the tax net, would be a hard nut to crack.

Secondly, the FBR assured the IMF team that they would be able to achieve March 2024 tax collection target of Rs879 billion for the current fiscal year. The FBR had faced a revenue shortfall of Rs33 billion in February 2024 and it would be crucial to achieve the ongoing monthly target in order to avert additional taxes for the remaining period of the current fiscal year. The FBR has already prepared a simplified retailers scheme. PRAL (Pakistan Revenue Authority Limited), a subsidiary of the FBR, has developed the mobile App “Tajir Dost”, which is a national business registry in which all retailers and traders will have to register. Already registered persons will have their names in the Tajir Dost database.

It is proposed that the quantum of indicative income to be determined equal to the annual rental value (determined at 10% of shop valuation) may be accepted as the purpose to document the retail business and ensuring subsequent filing of income tax returns.

The FBR is considering bringing online retailers into the tax net. The working has been underway in consultation with online marketplaces such as Daraz and others; it is yet to be seen how these online retailers will be brought into the tax net.

The scheme does not provide any concessional tax rates to shopkeeper except (i) an early bird discount of 50% tax reduction on filing of tax return for Tax Year 2023 between the date of announcement of scheme and the date of first installment of payment; (ii) a 25% discount of tax if a lumpsum payment for the entire year is made (For current year this will mean the installments of four months between March and June, 2024).

The Tajir Dost App has been designed with user friendly features requiring minimal entry of data and it minimizes the contact between shopkeeper and his tax consultant as well as shopkeeper and tax collector. The App will automatically calculate the monthly tax payment, keep the record and will facilitate the shopkeeper to pay the same. The scheme will cover all shopkeepers providing services or supplies of goods, including professions, etc.

The income tax paid under the scheme will be an advance tax to be treated as minimum tax but adjustable against total income tax payable for FY2024 and similar treatment for next tax years i.e. there will be no refund of income tax paid under this scheme.

The shopkeeper will assess himself for FY2024 (and subsequently) like the any other taxpayer will file his annual income tax return as per the standard income tax return forms and can claim the adjustment or refund of other adjustable advance taxes deducted or collected already in other heads e.g. on purchase of a motor vehicle, etc. The defaulters of monthly payments will face penal consequences like shop sealing or imposition of monetary penalty equal to his monthly instalment due.

The scheme excludes companies that are operating as a unit of national or international chain stores or a firm of professionals with international affiliation and operating in offices in more than one province. The scheme, however, includes all other Tier-I retailers as envisaged under the sales tax as the scheme is being launched under the income tax.

-

Cardi B Hits Back Hard At Critics Of Her Little Miss Drama Tour

Cardi B Hits Back Hard At Critics Of Her Little Miss Drama Tour -

King Charles Sees Andrew Going To Jail As Chance To Protect Monarchy

King Charles Sees Andrew Going To Jail As Chance To Protect Monarchy -

NJ Transit Bus And Train Lines Operating Again On Modified Schedule After Winter Storm

NJ Transit Bus And Train Lines Operating Again On Modified Schedule After Winter Storm -

Peter Mandelson Freed On Bail Following Arrest In Public Office Misconduct Case Linked To Epstein

Peter Mandelson Freed On Bail Following Arrest In Public Office Misconduct Case Linked To Epstein -

Trump Warns Trading Partners: Countries 'playing Games’ After Court Ruling Will Face Even Higher Tariffs

Trump Warns Trading Partners: Countries 'playing Games’ After Court Ruling Will Face Even Higher Tariffs -

Robert Carradine, 'Revenge Of The Nerds' Star, Passes Away At 71 After Decades-long Battle With Bipolar Disorder

Robert Carradine, 'Revenge Of The Nerds' Star, Passes Away At 71 After Decades-long Battle With Bipolar Disorder -

Alex De Minaur Faces Surprise Elimination In Acapulco Thriller By Patrick Kypson

Alex De Minaur Faces Surprise Elimination In Acapulco Thriller By Patrick Kypson -

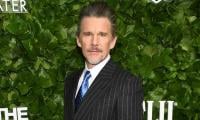

Ethan Hawke Raises Eyebrows With Risque Response To Question About Eating In Bed

Ethan Hawke Raises Eyebrows With Risque Response To Question About Eating In Bed -

Princess Beatrice, Eugenie Enter Crisis Talks As Parents Sins Start Bleeding Onto Them: ‘Help Me Girls!’

Princess Beatrice, Eugenie Enter Crisis Talks As Parents Sins Start Bleeding Onto Them: ‘Help Me Girls!’ -

US Ambassador To France Charles Kushner Barred From Meeting French Government After Missing Meeting

US Ambassador To France Charles Kushner Barred From Meeting French Government After Missing Meeting -

Moby Sings Praises Of Eminem After Calling Rapper 'misogynist, Homophobe, Racist And Antisemite' 25 Years Ago

Moby Sings Praises Of Eminem After Calling Rapper 'misogynist, Homophobe, Racist And Antisemite' 25 Years Ago -

'Tediously Monastic' Moby Reveals How Spiritual Discipline Impacted His Love Life

'Tediously Monastic' Moby Reveals How Spiritual Discipline Impacted His Love Life -

New Zealand PM Christopher Luxon Backs Removing Ex-Prince Andrew From Line Of Succession

New Zealand PM Christopher Luxon Backs Removing Ex-Prince Andrew From Line Of Succession -

Bella Hadid Looks Back On Opportunities She Lost In A Year Amid Lyme Treatment

Bella Hadid Looks Back On Opportunities She Lost In A Year Amid Lyme Treatment -

Meghan Markle’s Family Shares Important News Amid Estrangement

Meghan Markle’s Family Shares Important News Amid Estrangement -

Charley Crockett's Canadian Tour Cancelled After Being Denied Entry Into Canada Over Past Felony Conviction

Charley Crockett's Canadian Tour Cancelled After Being Denied Entry Into Canada Over Past Felony Conviction