The economy under Nawaz — a review

Backed by a few families that suffered as their businesses were nationalized by Zulfikar Ali Bhutto, Nawaz Sharif was a ray of sunshine for Chiniot and Lahore’s private capital in the 1990s. His first choice for the finance ministry was a Harvard-educated Sartaj Aziz, an experienced private and public sector expert with a unique history of being a part of Muhammad Ali Jinnah’s youth team from Khyber Pakhtunkhwa.

Sartaj’s policies of fiscal conservatism and heavy focus on privatization yielded great results for the country. Infrastructure spending did increase but not at the cost of other key areas of economic significance. Pakistan’s exports increased as a percentage of GDP from 14 per cent to 16 per cent in a matter of a year. A relatively sound exchange rate policy increased from Rs22 per dollar to around Rs29 in Nawaz Sharif’s first tenure. Inflation had increased by around 9-10 per cent in that period but this inflationary pressure was a direct consequence of a global fiscal tightening and a recessionary cycle which had impacted several countries. Overall, Sharif’s first two years as a PM (a whole tenure in the 90s) was a reasonable experience for capital markets and the overall economy. Nawaz Sharif had a complicated battle with the judiciary and had to resign before completing his two years and was replaced by the late Benazir Bhutto.

As Sharif took over for the second time in 1997, he initially chose Sartaj Aziz to run the finance ministry but due to his desire to use Sartaj Aziz in the foreign ministry, he decided to give the flag of the finance ministry to Ishaq Dar who was an MNA from Lahore at the time. Dar’s first stint as a finance minister was short-lived; due to the atomic bomb testing plans, Pakistan was sanctioned for six months and the country defaulted on its Brady and Eurobonds. Due to the Siachen war and civil-military rift, martial law was imposed after which Dar was also imprisoned with the Sharifs and later sent abroad.

During Dar’s tenure, a foreign exchange crisis was created which increased the country’s dollar arrears to $1.5 billion in 1998 from $450 million. Pakistan rescheduled its debts with IFI and the Paris Club. The IMF disbursement was delayed for a while due to concerns around Dar’s new currency policy. Dar became a red flag for international lenders and luck would have it that Pakistan’s foreign policy issues surrounding the nuclear test and the Siachen war overshadowed everything else.

Before moving on to Nawaz Sharif’s third stint, it is noteworthy to mention that despite this turmoil, a great achievement in Dar’s 1999 tenure was the introduction of GST and implementing a market-based investment promotion strategy which paved the way for future foreign investments in infrastructure, agriculture etc. The country was now fully open to foreign capital.

In 2013, Nawaz Sharif came back with great electoral numbers and appointed his now relative Ishaq Dar as the finance minister of the country again. Being an accountant, Dar decided that every economic policymaker in the world was looking at the economy in a completely wrong way and that, instead of managing the supply and demand side using trade, we should use the liquidity of our foreign reserves to appreciate the rupee and it would cut the cost of fuel and imports and reciprocate its impact on inflation as well. This policy required a lot of liquidity and inflows from CPEC loans, global quantitative easing in the aftermath of the 2008 financial crisis, availability of cheap commercial loans and even cheaper oil; and Dar was able to prove the laws of supply and demand wrong.

During these four years, Pakistan had low inflation and the country’s stock market was breaking records. A few sane voices kept warning people of Dar’s new field of public policy called ‘Daronomics’ but Mian Nawaz Sharif only cared about announcing new infrastructure projects and wanted low inflation. During this time, Pakistan’s external debt went from around $60 billion to $90 billion from 2013-2017. Moreover, Pakistan’s imports went from around $40 billion to $56 billion. The most important metric of a country’s economic growth is exports. As other neighbouring countries were taking advantage of low energy costs and low interest rates to build export-oriented manufacturing capabilities, Dar’s Pakistan went from exports of 13 per cent of GDP to around 8.0 per cent between 2013 and 2017. These numbers show that Dar’s subsidized imports had created an artificial reduction in inflation which would need to be paid in the future.

In my opinion, this country has never fully recovered from the 2013-17 policies of Ishaq Dar. Pakistan’s exports and production capabilities were getting worse in 2017 despite a $50+ billion CPEC project and a $16 billion LNG deal. In real terms, Pakistan was selling petrol 30-35 per cent cheaper than our lending countries and countries that were our major suppliers of oil. After the Panama judgment, Dr Miftah Ismail had around five months and his tenure was full of political chaos in Pakistan but he managed to deliver a great tax policy, country’s biggest amnesty scheme, and reversal of the currency measures of Ishaq Dar. In Dar’s tenure, CAD had risen by 149 per cent in a single year and Dr Miftah could not fix in five months the wrongs done over four years.

After the removal of Imran Khan in April 2022, the PDM government decided to give Dr Miftah Ismail a chance and his tenure is considered one of the most significant because it started off with a much-needed import ban and restart of a suspended IMF programme which had been suspended because Imran Khan’s finance minister Shaukat Tarin had wasted Rs862 billion in order to keep petrol prices down amidst a global commodity super cycle. Dr Miftah Ismail presented a budget that was a combination of fiscal conservatism and introduction of new tax laws that would allow the government to collect taxes from retailers.

Maryam Nawaz Sharif, however, started to become a strong critic of Dr Miftah Ismail in private gatherings. Since the then PM Shehbaz Sharif had declined, Maryam decided to start a campaign against her own party’s finance minister and forced him to reverse the tax on the retail sector. According to research and analysis by various independent economists, the retail sector has an untapped tax revenue potential of $5 billion but Dr Miftah Ismail had to reverse a sound economic decision in order to comply with the party leader. Due to a loss in by-elections, Maryam upped the ante on Miftah Ismail and used him as a scapegoat for her failure. The PMLN’s leadership had started openly campaigning for the removal of Miftah Ismail from the finance ministry.

Ishaq Dar was appointed this country’s finance minister for the fourth time (he had once worked as finance minister in 2008 for the PPP government as well for a short-lived PPP-PMLN alliance). Dar’s return was celebrated by the PML-N across Pakistan because he wanted to bring the dollar down from the 230s to the 190s. Dar also started openly criticizing the IMF and global powers for using IMF loans as a bargaining chip for geopolitics in the region. Pakistan did get some support payments during his tenure due to friendly ties with China and Middle Eastern countries but they weren’t enough to provide him the liquidity needed to repeat the 2013-17 saga.

Dar’s recent stint produced the biggest inflationary crisis and currency crisis this country has ever seen with food inflation around 40 per cent. In his September 2022-August 2023 tenure, Pakistan faced another currency crisis; the dollar crossed the 300 rupee barrier and petrol prices went to Rs330. There were three exchange rates and people were hoarding dollars and putting pressure on foreign exchange reserves. In other areas as well, his whole tenure was full of ambiguity around policy decisions. His tax policy was confusing and the budget was also met with scepticism over numbers.

After the government ended, several economists accused Dar of ‘figure fudging’, which was a recurring concern in the 2013-17 budget reactions as well. Post-PDM government, the PML-N’s popularity had taken a hit due to inflation and the party’s supreme leader had to come back from London despite his bad health conditions and legal troubles so he could shift the narrative away from Dar’s failure and help the party win the upcoming election. He delivered an historic speech in his hometown Lahore and promised to control the dollar again and bring back the Pakistan of 2013-2017. If the PML-N does come back to power, it surely means Ishaq Dar is going to become Pakistan’s finance minister again – and this story will continue to be a tale of the same mistakes over and over again.

The writer tweets/posts @FarrukhJAbbasi

-

Andy Cohen Gets Emotional As He Addresses Mary Cosby's Devastating Personal Loss

Andy Cohen Gets Emotional As He Addresses Mary Cosby's Devastating Personal Loss -

Andrew Feeling 'betrayed' By King Charles, Delivers Stark Warning

Andrew Feeling 'betrayed' By King Charles, Delivers Stark Warning -

Andrew Mountbatten's Accuser Comes Up As Hillary Clinton Asked About Daughter's Wedding

Andrew Mountbatten's Accuser Comes Up As Hillary Clinton Asked About Daughter's Wedding -

US Military Accidentally Shoots Down Border Protection Drone With High-energy Laser Near Mexico Border

US Military Accidentally Shoots Down Border Protection Drone With High-energy Laser Near Mexico Border -

'Bridgerton' Season 4 Lead Yerin Ha Details Painful Skin Condition From Filming Steamy Scene

'Bridgerton' Season 4 Lead Yerin Ha Details Painful Skin Condition From Filming Steamy Scene -

Matt Zukowski Reveals What He's Looking For In Life Partner After Divorce

Matt Zukowski Reveals What He's Looking For In Life Partner After Divorce -

Savannah Guthrie All Set To Make 'bravest Move Of All'

Savannah Guthrie All Set To Make 'bravest Move Of All' -

Meghan Markle, Prince Harry Share Details Of Their Meeting With Royals

Meghan Markle, Prince Harry Share Details Of Their Meeting With Royals -

Hillary Clinton's Photo With Jeffrey Epstein, Jay-Z And Diddy Fact-checked

Hillary Clinton's Photo With Jeffrey Epstein, Jay-Z And Diddy Fact-checked -

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

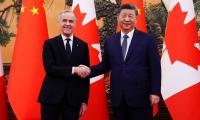

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

Police Arrest A Man Outside Nancy Guthrie’s Residence As New Terrifying Video Emerges

Police Arrest A Man Outside Nancy Guthrie’s Residence As New Terrifying Video Emerges -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training