Pakistan working with friendly countries to reprofile, restructure loans: Dar

Dar hopes 9th review would conclude this month

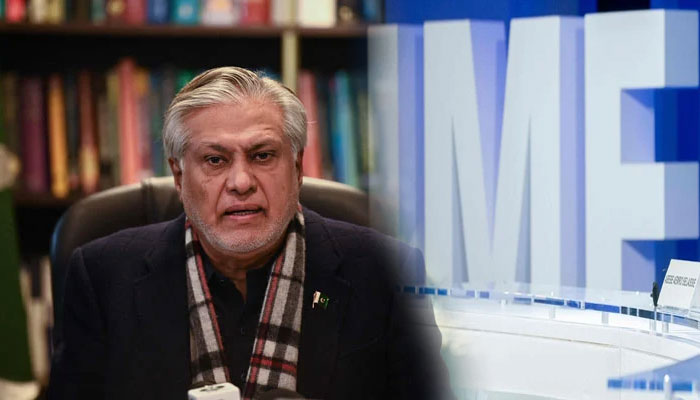

KARACHI: The International Monetary Fund is one of the main contributors to political instability in Pakistan, Federal Finance Minister Ishaq Dar said on Friday.

Speaking on Geo News programme ‘Aaj Shahzeb Khanzada Kay Saath’ after presenting a deficit budget in the National Assembly, he minced no words as he came down hard on the IMF for delaying the 9th review, saying it had been overdue and should have been completed in February.

Dar was visibly upset when he was asked whether the IMF did not trust him personally and that was why it was delaying the 9th review. He said the IMF had been totally unfair to Pakistan. “The IMF is main contributor, one of the main contributors. It is part of political instability.”

When asked what would happen if the 9th review was not finalised, the finance minister said it would be unfair if that happened. However, he expressed the hope that the 9th review would conclude this month. He said the Pakistani media should highlight the unreasonable demands of the IMF. When asked whether the Pakistani media raising this issue would create any impact, he replied that the media should tell the world about what was actually happening.

He said Pakistan had fulfilled the demands of the IMF but it was still not trusting the country because of the last government’s actions that had eroded the trust. He said the last government of the PTI did not act on the commitments it had made to the IMF in 2019 and even reversed whatever little action it had taken.Answering a query if the IMF would believe that Pakistan could achieve its revenue target, Dar stressed that the IMF should trust the country. He said it was not a blind estimate, but based on a scientific formula.Dar asserted that the country had made every payment it owed to the IMF amid talk of its defaulting on its loans. “Our first priority was not to let the country default,” he said, adding that the government had to take extraordinary measures which resulted in a negative impact on imports and large-scale manufacturing.

To a question why any friendly country was not lending Pakistan $2 billion to satisfy the IMF, Dar said the Fund wanted to hold joint talks with countries like Saudi Arabia and the UAE. However, Pakistan responded that it did not need “hand-holding” and the IMF should do its professional work.He said Pakistan would hold bilateral talks with friendly countries itself, but made it clear that the country did not need $2 billion from friendly countries. He added that if the board meeting had taken place in February, Pakistan would have got $2 billion.The finance minister said it seemed that Pakistan was being trapped as part of geo-politics. He said he could not talk more about it on TV.

He said his government had bridged the credibility gap created by the last government and taken measures that undervalued the exchange rate but even then the IMF did not conclude the 9th review, which was unreasonable.When asked if Pakistan should go for reprofiling and restructuring of its debts with the help of friendly countries, as suggested by some economists, Dar said that “frankly speaking we are working on that” and our sovereign deposits which were rolled over every year would continue being rolled over in future.

He said Pakistan was in talks with friendly countries to get its bilateral debts restructured. He said he was against making use of “haircuts” because it was disgraceful to tell someone we cannot give them the Rs100 billion we owe.

“If we have borrowed money, we should return it,” he said, adding that restructuring was not something bad. He said the country would improve its cash flow if it was able to service its interest and stagger the principal repayments.

-

Trump Passes Verdict On Bad Bunny’s Super Bowl Halftime Show

Trump Passes Verdict On Bad Bunny’s Super Bowl Halftime Show -

Super Bowl 2026 Live: Seahawks Defeat Patriots 29-13 To Win Super Bowl LX

Super Bowl 2026 Live: Seahawks Defeat Patriots 29-13 To Win Super Bowl LX -

Kim Kardashian And Lewis Hamilton Make First Public Appearance As A Couple At Super Bowl 2026

Kim Kardashian And Lewis Hamilton Make First Public Appearance As A Couple At Super Bowl 2026 -

Romeo And Cruz Beckham Subtly Roast Brooklyn With New Family Tattoos

Romeo And Cruz Beckham Subtly Roast Brooklyn With New Family Tattoos -

Meghan Markle Called Out For Unturthful Comment About Queen Curtsy

Meghan Markle Called Out For Unturthful Comment About Queen Curtsy -

Bad Bunny Headlines Super Bowl With Hits, Dancers And Celebrity Guests

Bad Bunny Headlines Super Bowl With Hits, Dancers And Celebrity Guests -

Insiders Weigh In On Kim Kardashian And Lewis Hamilton's Relationship

Insiders Weigh In On Kim Kardashian And Lewis Hamilton's Relationship -

Prince William, Kate Middleton Private Time At Posh French Location Laid Bare

Prince William, Kate Middleton Private Time At Posh French Location Laid Bare -

Stefon Diggs Family Explained: How Many Children The Patriots Star Has And With Whom

Stefon Diggs Family Explained: How Many Children The Patriots Star Has And With Whom -

Shamed Andrew ‘mental State’ Under Scrutiny Amid Difficult Time

Shamed Andrew ‘mental State’ Under Scrutiny Amid Difficult Time -

‘Narcissist’ Andrew Still Feels ‘invincible’ After Exile

‘Narcissist’ Andrew Still Feels ‘invincible’ After Exile -

Bad Bunny's Super Bowl Halftime Show: What Time Will He Perform Tonight?

Bad Bunny's Super Bowl Halftime Show: What Time Will He Perform Tonight? -

Where Is Super Bowl 2026 Taking Place? Everything To Know About The NFL Showdown

Where Is Super Bowl 2026 Taking Place? Everything To Know About The NFL Showdown -

Chris Pratt Explains Why He And Katherine Schwarzenegger Did Premarital Counseling

Chris Pratt Explains Why He And Katherine Schwarzenegger Did Premarital Counseling -

Drake 'turns Down' Chance To Hit Back At Kendrick Lamar At Super Bowl

Drake 'turns Down' Chance To Hit Back At Kendrick Lamar At Super Bowl -

Sarah Ferguson Had A ‘psychosexual Network’ With Jeffrey Epstein

Sarah Ferguson Had A ‘psychosexual Network’ With Jeffrey Epstein