FBR may hike tax rates for commercial importers

ISLAMABAD: The Federal Board of Revenue (FBR) is considering increasing rates for commercial imports under the Minimum Tax Regime (MTR) in the upcoming budget for 2023-24 to avoid under-invoicing.

The Revenue and Resource Mobilization Commission (RRMC), in its report, has recommended to the government that the commercial importers are currently subject to MTR at 5.5% to 3.5% (depending upon goods falling under parts III and II of the Twelfth Schedule). These rates reflect net profit margins between 11 and 18% (at an average tax rate of 30%). It is understood that their profit margins are much higher than these estimates. Under-invoicing is also rampant, particularly, in the non-corporate culture which provides these importers a space to make profits and contribute massively towards non- documentation of the economy.

Therefore, it is recommended to increase the rate of tax under Section 148 for commercial imports from 5.5% to 8% and 3.5% to 5.5% in case of commercial imports. The taxpayers should, however, be allowed to adjust excess of minimum tax under Section 148 over their normal tax liability in the next five years irrespective of the taxpayers status.

The carry forward of minimum tax should be subject to certain conditions such as the taxpayer is active under both, income tax and sales tax laws. A taxpayer ensures withholding under Section 236G and 236H on its sales (otherwise, proportionate MTR would apply).

A taxpayer files complete details of his sales to unregistered/non-active buyers (name/CNIC/NTN/address, etc) in his withholding statements/sales tax returns as the case may be; and sale proceeds are received in declared business accounts (compliance similar to Section 73 of STA may be introduced/extended for income tax purposes so that if sales are not received in declared business account, proportionate expenditure be disallowed.

The minimum tax regime should be revamped/withdrawn gradually as it is a distortion in the system. Nonetheless, until the regime exists, the taxpayers should be allowed to adjust excess of minimum over their normal tax liability in the subsequent years subject to certain conditions explained in our detailed comments.

The Final Tax Regime (FTR) of exporters should also be converted into MTR. The tax credit regime may be reduced to lower tax incidence. However, the abolishment of FTR is necessary to improve documentation.

-

Jessie Buckley Utters 'wild' Remarks For 'Hamnet' Co-star Emily Watson At Actor Awards

Jessie Buckley Utters 'wild' Remarks For 'Hamnet' Co-star Emily Watson At Actor Awards -

Who Could Replace Ayatollah Ali Khamenei? Iran’s Top Successor Candidates Explained

Who Could Replace Ayatollah Ali Khamenei? Iran’s Top Successor Candidates Explained -

Oliver 'Power' Grant Cause Of Death Revealed

Oliver 'Power' Grant Cause Of Death Revealed -

Michael B. Jordan Makes Bombshell Confession At Actor Awards After BAFTA Controversy: 'Unbelievable'

Michael B. Jordan Makes Bombshell Confession At Actor Awards After BAFTA Controversy: 'Unbelievable' -

Prince William Willing To Walk Road He ‘loathes’ For ‘horror Show’ Escape: ‘He’s Running Out Of Allies Fast’

Prince William Willing To Walk Road He ‘loathes’ For ‘horror Show’ Escape: ‘He’s Running Out Of Allies Fast’ -

Pentagon Says No Evidence Iran Planned Attack On US, Undercutting Strike Justification

Pentagon Says No Evidence Iran Planned Attack On US, Undercutting Strike Justification -

Prince William’s Changes Priorities With Harry After Kate Middleton’s Remission: ‘It Couldn't Be Worse’

Prince William’s Changes Priorities With Harry After Kate Middleton’s Remission: ‘It Couldn't Be Worse’ -

Justin Bieber Gets Touching Tribute From Mom Pattie Mallette On Turning 32 Amid Limited-edition Birthday Drop

Justin Bieber Gets Touching Tribute From Mom Pattie Mallette On Turning 32 Amid Limited-edition Birthday Drop -

Jada Pinkett Smith Details How Her Memoir Combats 'shame' Around Alopecia

Jada Pinkett Smith Details How Her Memoir Combats 'shame' Around Alopecia -

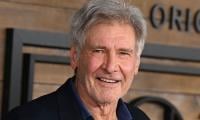

Harrison Ford Reflects On Career As He Receives Life Achievement Award At 2026 Actor Awards

Harrison Ford Reflects On Career As He Receives Life Achievement Award At 2026 Actor Awards -

Timothee Chalamet's Red Carpet Date For Actor Awards Not Kylie Jenner This Year

Timothee Chalamet's Red Carpet Date For Actor Awards Not Kylie Jenner This Year -

Weather Forecast For Tomorrow: Wintry Mix Overnight And Warmer Temps Midweek

Weather Forecast For Tomorrow: Wintry Mix Overnight And Warmer Temps Midweek -

Keith Urban 'solitary' Life Laid Bare After Nicole Kidman Split

Keith Urban 'solitary' Life Laid Bare After Nicole Kidman Split -

SAG Actor Awards 2026 Winners: Complete List

SAG Actor Awards 2026 Winners: Complete List -

UK Asylum System Faces Changes As Refugees Will Get Temporary Protection Only

UK Asylum System Faces Changes As Refugees Will Get Temporary Protection Only -

Meghan Markle Has Realised ‘star Power’ Is Not Enough After Jordan Trip

Meghan Markle Has Realised ‘star Power’ Is Not Enough After Jordan Trip