It is ‘all in’ fiscal account: Part I

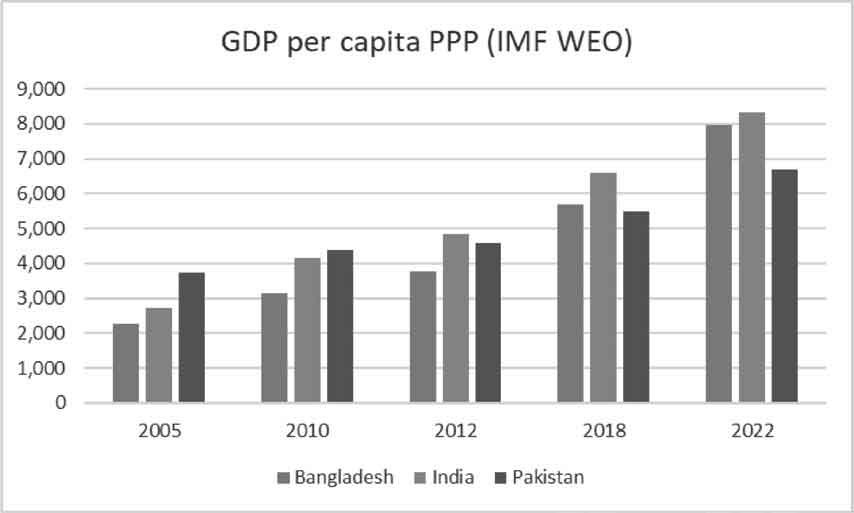

The economic challenges facing Pakistan today are daunting and the roadmap for enhancing wealth and prosperity for the 230+ million citizens needs to be fostered. While the resumption of the IMF program is critical for addressing our immediate financial needs, their standard prescriptions may only address our short-term challenges. What we need is a radical transformation in the way the economy is structured, the way policy is formulated and implemented, and the redistribution of wealth in a more equitable manner. That is the only way forward to escape from the boom & bust cycles that have plagued our economy over the last many decades.

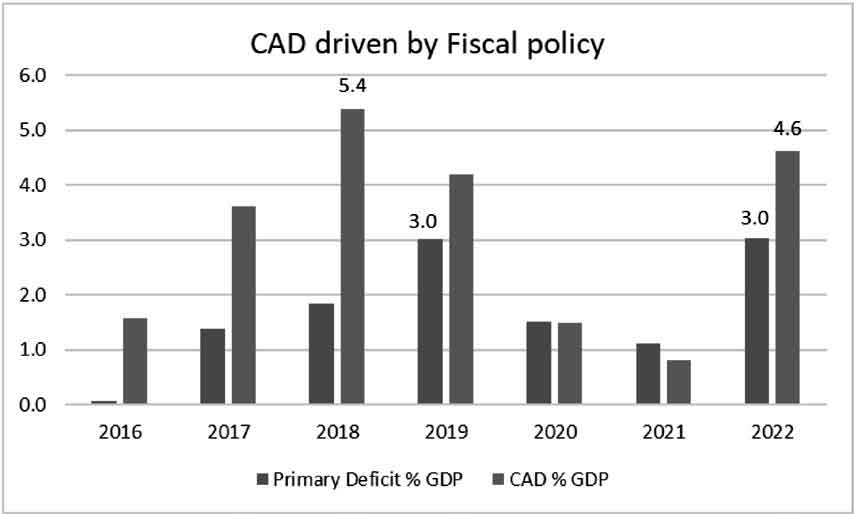

At the outset, we need to figure out the core problem. While the popular notion that ‘we’re confronted with a current account challenge’ is perhaps correct, but it’s the symptom; not the cause of our problem. Current Account Deficit (CAD) is our Achilles heel, but it is driven primarily by fiscal policy, which essentially propel consumption led growth. The balance of payment crisis of 2013, 2018 and 2022 were driven by higher budget deficits. The real problem is our fiscal policy and the mounting government debt. As the solution to all our problems in our formidable years was the “CTRL ALT DEL button”, and this is perhaps the time to it press that button, and review our fiscal policy afresh. We need to resolve to overcome the challenges of low tax collection, rising pension bills, bailouts of loss making State Owned Enterprises (SOEs) and untargeted subsidies.

Presently, the economy is structured in a way that scarce resources are being diverted toward unproductive sectors. The World Bank 2023 report ‘From swimming in the sand to high sustainable growth’ highlights that Pakistan’s growth is stunted by its inability to allocate tight resources to the most productive uses. Underlying that inability are distortions caused by government policies in the form of taxes, subsidies, industrial policies, trade restrictions and gender norms. Distortions create powerful incentives for firms and households to allocate their limited resources in a sub-optimal manner, discouraging innovation and productivity gains.

The center of gravity of most of our problems is the unsustainable government finances. In the current year, the debt servicing is projected to rise to Rs. 5.5trn, which is equivalent to 72% of the tax collection target of Rs. 7.6 trn. Public debt at the current interest rates and a massive devaluation in the last years has become a significant challenge.

A comprehensive consolidation of federal and provincial governments is needed. The government finances can no longer bear the costs of heavy loss-making SOEs. The 2023 Public Expenditure Review report published by the World Bank states that the government is spending Rs. 710bn (1.3% of GDP) on the running of 17 ministries at the federal level that were devolved under the 18th Amendment and financing development projects that fall under the provincial domain. It may be an opportune time for us to review the National Finance Commission (NFC) award and the 18th Amendment to streamline responsibilities and reduce government expenditures.

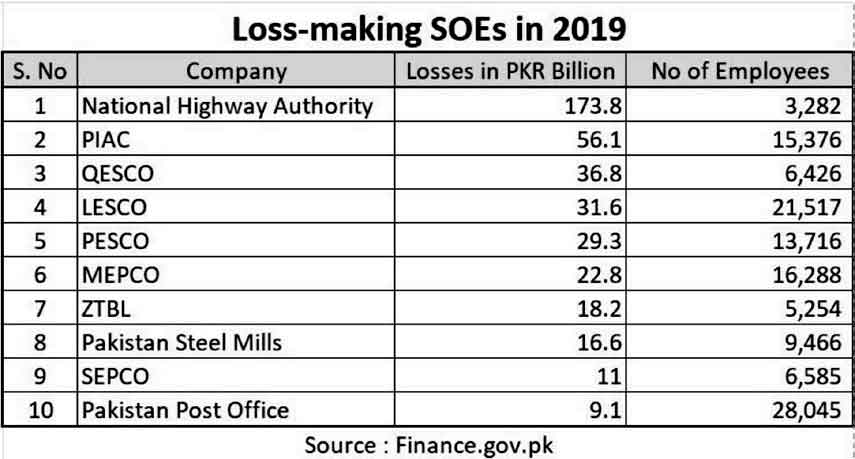

SOEs losses have increased to nearly Rs. 1trn annually. Not only are they bleeding the public exchequer, they are also creating huge inefficiencies in the way the existing resources are being allocated. The biggest challenge is on the power sector. Despite a 50% increase in power tariffs, the losses of the power sector have skyrocketed by Rs. 419bn (0.8% of GDP) in just the last eight months. The rise in circular debt requires a comprehensive policy response, including a reduction of transmission & distribution losses, privatization of DISCOs, and affordable energy for the masses. Price adjustments are not the only solution and are in fact counter-productive in many ways.

In the last one year, a 50% increase in power tariffs has led to a sharp 7.3% reduction in power consumption. The lower the consumption, the higher the marginal cost of production of electricity. The size of the circular debt has ballooned to over Rs. 2.6trn (5% of GDP) and threatens the entire economy.

Privatization of DISCOs, therefore, has become a matter of great urgency. However, privatization on its own will not necessarily solve the problem, and converting public monopolies into monopolies of the private sector will not lead to any efficiency gains. Significant reforms are needed before and after privatization to ensure success. There’s need to strengthen the regulator - NEPRA in case of DISCOs for example - in terms of tariff setting, fostering competition and implementing investment plans.

Slight digression from power sector discussion but since we’re on the topic of independent and powerful regulator, there’s also an urgent need to get the regulator in Oil & Gas Exploration & Production Sector which is important for the replacement of our energy imports and save on our much needed foreign exchange earnings while producing and making energy fuels available at cheaper rates.

A uniform power tariff policy across the country is untenable, with the efficient DISCOs cross-subsidizing inefficient ones. Second, DISCOs need to be broken into smaller distribution companies which will foster more competition and ensure improved bill recovery and customer service.

The starting point to embark upon privatization and an absolute must prerequisite, other than the regulators to be strong and independent, is a tailor-made, comprehensive private investor selection framework in-line with each SOE’s peculiarities and business dynamics. This is in the best interest to protect the public value and the economic impact for the very purpose for which these entities came into being in the first place. With these pre-essentials of privatization in-place, we can immediate offload atleast 8 out of top 10 loss making SOEs - DISCOs, Pakistan Steel and Pakistan Post. The others in the bulge like PIA and NHA could be taken care of through an innovative, out of the box structuring, like “viability gap fund”, etc.

The government needs to move towards elimination of rent-seeking subsidies altogether. The only subsidies that the government should implement are direct subsidies to the poorest households and performance subsidies for targeted sectors. The direct subsidy to the poor and the most vulnerable households is currently being run by the BISP program of cash transfers using the data available through the National Socio-Economic Registry (NSER). A total of 38 million households are covered in the NSER and the government provides cash transfers to around 5mn. This is being scaled up with the budget allocations enhanced to Rs. 400bn to cover additional 3mn households affected by the floods. The government can use this database for targeting households, whether for food or energy subsidies. This formula is very much palatable to the multilaterals as well.

Performance based subsidies to key sectors should be time barred and monitored on export earnings, increase in tax revenue, higher employment and productivity gains for the economy. We must focus our resources towards growth sectors, including technology, agriculture, and value added export industries.

-

Jennifer Garner Reveals Why She Doesn't Like Botox And What She Gets Instead

Jennifer Garner Reveals Why She Doesn't Like Botox And What She Gets Instead -

Instagram To Alert Parents When Teens Search Suicide Or Self-harm Terms

Instagram To Alert Parents When Teens Search Suicide Or Self-harm Terms -

Meghan Markle Feels Kicked In The Teeth With Netflix’s Decision To Close A Door: ‘She Needs Her Family’

Meghan Markle Feels Kicked In The Teeth With Netflix’s Decision To Close A Door: ‘She Needs Her Family’ -

World Economic Forum CEO Borge Brende Steps Down Following Jeffrey Epstein Ties Controversy

World Economic Forum CEO Borge Brende Steps Down Following Jeffrey Epstein Ties Controversy -

Prince Harry's Ex Chelsy Davy Makes Special Announcement

Prince Harry's Ex Chelsy Davy Makes Special Announcement -

Dominic Evans Speaks Out After Being Accused Of Being Involved In Nancy Guthrie Kidnapping

Dominic Evans Speaks Out After Being Accused Of Being Involved In Nancy Guthrie Kidnapping -

AI Doomsday By 2028? New Study Warns Of Global Social, Economic Disruption & ‘ Intelligence Crisis’

AI Doomsday By 2028? New Study Warns Of Global Social, Economic Disruption & ‘ Intelligence Crisis’ -

Do Sophie And Benedict Bridgerton Get Married As Netflix Show Returns For Season 4 Part 2?

Do Sophie And Benedict Bridgerton Get Married As Netflix Show Returns For Season 4 Part 2? -

Prince William Reveals He's 'a Little Biased' Toward One Hollywood Star

Prince William Reveals He's 'a Little Biased' Toward One Hollywood Star -

Meghan Markle, Prince Harry Visit Special Charity On Final Day Of Jordan Trip

Meghan Markle, Prince Harry Visit Special Charity On Final Day Of Jordan Trip -

Natalie Dormer's Reaction To Sarah Ferguson's Epstein Links Resurfaces After 'The Lady' Release

Natalie Dormer's Reaction To Sarah Ferguson's Epstein Links Resurfaces After 'The Lady' Release -

Did You Know Famous Windows 10 Background Was Shot In Real Life? Here's Story

Did You Know Famous Windows 10 Background Was Shot In Real Life? Here's Story -

Pete Davidson's Baby Mommy Elsie Hewitt Reveals Why She 'hated' Being Pregnant

Pete Davidson's Baby Mommy Elsie Hewitt Reveals Why She 'hated' Being Pregnant -

Harry, Meghan Show Royal Family How To Make Impact Without Public Money

Harry, Meghan Show Royal Family How To Make Impact Without Public Money -

Hillary Clinton Set For Deposition Before House Committee Today In Jeffrey Epstein Investigation Case

Hillary Clinton Set For Deposition Before House Committee Today In Jeffrey Epstein Investigation Case -

Samsung Galaxy S26 Ultra Debutes With Display That Blocks Side Viewers

Samsung Galaxy S26 Ultra Debutes With Display That Blocks Side Viewers