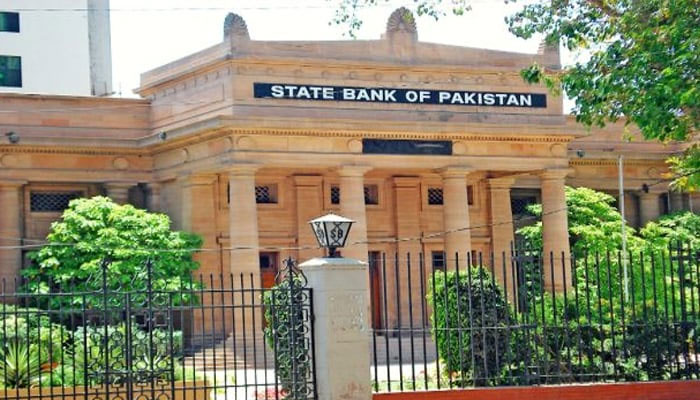

SBP likely to hike interest rate by 200bps this week

Monetary Policy Committee (MPC) meeting preponed to March 2, 2023

KARACHI: The central bank would likely confirm market expectations and raise its benchmark policy rate by 2 percentage points in an off-cycle meeting this week to fulfil the International Monetary Fund (IMF) requirements for a $6.5 billion bailout.

The Monetary Policy Committee (MPC) of the SBP was previously slated to meet on March 16. The central bank said in a statement that the MPC would meet on Thursday, March 2, to unveil the interest rate decision. In January, the SBP hiked its policy rate by 100 basis points (bps) to 17 per cent to curb alarmingly high inflation. The consumer price index (CPI) rose in January, reaching a reading of 27.5 per cent.

The majority of analysts and surveys performed by top brokerage firms suggested that the central bank would significantly raise interest rates at its upcoming review. “We expect the SBP to increase the policy rate by 200 bps to 19 percent in this meeting. In addition to the anchoring of inflationary pressure, this move of increasing policy rate will also help seal the long-awaited and much-needed ninth review with the IMF, post which Pakistan is likely to receive a $1.2 billion tranche,” said Arif Habib Limited, a local brokerage house, in a note.

The majority of the effects of the recent sharp currency depreciation, adjustments to the price of energy and tax measures, according to Fahad Rauf, head of research at Ismail Iqbal Securities, will be felt from March onwards. He estimates February inflation at 29.6 per cent and March at 33.6 per cent. “The market has already incorporated 200 bps, with a three-month T-bill at 19.5 per cent. Targeting core [inflation] seems to be the goal, so if the rural core of 20 per cent is considered, a 300 bps hike is also a possibility,” he said.The secondary market rates, including T-Bill and Karachi interbank offered rates, have increased by almost 200 bps since the last monetary policy meeting. The crisis-struck Pakistan is taking painful steps to secure a $1 billion loan from the IMF, including boosting taxes, eliminating blanket fuel subsidies and removing artificial exchange rate controls.

Dr Khaqan Najeeb, former adviser, Ministry of Finance, said delay in completion of the 9th Review with the IMF has hurt in terms of depletion of SBP forex reserves and severity of external sector challenge. “Pakistan and the IMF also have a trust deficit due to back and forth on the set of reforms agreed in the last few reviews. Pakistan needs to complete the prior actions to reach a staff-level agreement with the IMF,” Najeeb said.

Considering the need to tame high inflationary pressures, tightening of monetary policy is an important part of the discussion between Pakistani authorities and the IMF, according to Najeeb. “It may be prudent to hold an MPC earlier to complete prior actions as well as calm the market. It would be fair to say when a country is in an IMF programme, decisions are made in consultation rather than in a completely autonomous manner, monetary policy decision is no exception,” he added.

-

Bad Bunny Stunned Jennifer Grey So Much She Named Dog After Him

Bad Bunny Stunned Jennifer Grey So Much She Named Dog After Him -

Kim Kardashian's Plans With Lewis Hamilton After Super Bowl Meet-up

Kim Kardashian's Plans With Lewis Hamilton After Super Bowl Meet-up -

Prince William Traumatised By ‘bizarre Image’ Uncle Andrew Has Brought For Royals

Prince William Traumatised By ‘bizarre Image’ Uncle Andrew Has Brought For Royals -

David Thewlis Gets Candid About Remus Lupin Fans In 'Harry Potter'

David Thewlis Gets Candid About Remus Lupin Fans In 'Harry Potter' -

Cardi B And Stefon Diggs Spark Breakup Rumours After Super Bowl LX

Cardi B And Stefon Diggs Spark Breakup Rumours After Super Bowl LX -

Alix Earle And Tom Brady’s Relationship Status Revealed After Cosy Super Bowl 2026 Outing

Alix Earle And Tom Brady’s Relationship Status Revealed After Cosy Super Bowl 2026 Outing -

Why King Charles Has ‘no Choice’ Over Andrew Problem

Why King Charles Has ‘no Choice’ Over Andrew Problem -

Shamed Andrew Wants ‘grand Coffin’ Despite Tainting Nation

Shamed Andrew Wants ‘grand Coffin’ Despite Tainting Nation -

Keke Palmer Reveals How Motherhood Prepared Her For 'The Burbs' Role

Keke Palmer Reveals How Motherhood Prepared Her For 'The Burbs' Role -

King Charles Charms Crowds During Lancashire Tour

King Charles Charms Crowds During Lancashire Tour -

‘Disgraced’ Andrew Still Has Power To Shake King Charles’ Reign: Expert

‘Disgraced’ Andrew Still Has Power To Shake King Charles’ Reign: Expert -

Why Prince William Ground Breaking Saudi Tour Is Important

Why Prince William Ground Breaking Saudi Tour Is Important -

AOC Blasts Jake Paul Over Bad Bunny Slight: 'He Makes You Look Small'

AOC Blasts Jake Paul Over Bad Bunny Slight: 'He Makes You Look Small' -

At Least 53 Dead After Migrant Boat Capsizes Off Libya

At Least 53 Dead After Migrant Boat Capsizes Off Libya -

'God Of War' Announces Casting Major Key Role In Prime Video Show

'God Of War' Announces Casting Major Key Role In Prime Video Show -

Real Reason Prince William, Kate Broke Silence On Andrew Scandal Revealed

Real Reason Prince William, Kate Broke Silence On Andrew Scandal Revealed